CAIA Charts Challenges for Advisors Interested in Alts

Wealth Management

JUNE 18, 2024

The report shows advisor interest in alternative investments even as some struggle with implementation, according to CAIA Managing Director Aaron Filbeck.

Wealth Management

JUNE 18, 2024

The report shows advisor interest in alternative investments even as some struggle with implementation, according to CAIA Managing Director Aaron Filbeck.

The Big Picture

JUNE 17, 2024

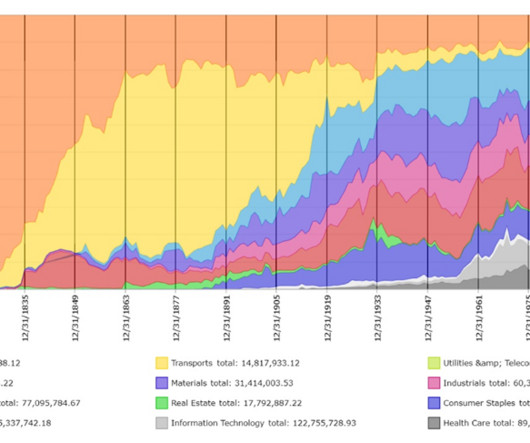

A quick break from book authorship to share a fascinating set of data and charts, via Sam Ro. In his weekly missive, Sam points to some amazing charts from Global Financial Data. They are based on historical data that looks at 200 Years of Market Concentration. You might be surprised at the findings. As the chart above shows, there are long periods of market concentration.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abnormal Returns

JUNE 16, 2024

Also on the site Father time is undefeated: on the impact of cognitive decline on financial outcomes. (abnormalreturns.com) Top clicks this week The S&P 500 is getting three new members. (reuters.com) We are in a 'bear market for diversification.' (thinkadvisor.com) The stock market is increasingly concentrated. Should you be worried? (theirrelevantinvestor.com) More investors are facing up to the problem with illiquid alternatives.

Calculated Risk

JUNE 21, 2024

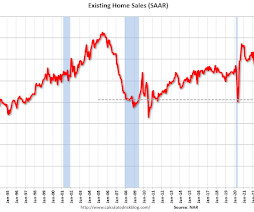

From the NAR: Existing-Home Sales Edged Lower by 0.7% in May as Median Sales Price Reached Record High of $419,300 Existing-home sales slightly declined in May as the median sales price climbed to a record high, according to the National Association of REALTORS®. In the four major U.S. regions, sales slid month-over-month in the South but were unchanged in the Northeast, Midwest and West.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

JUNE 17, 2024

Cox, a former investment analyst at eToro, will be Ritholtz Wealth Management’s first market expert fully dedicated to its advisors.

Nerd's Eye View

JUNE 21, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that affluent Americans believe they need an average of $5.5 million in assets to both retire and pass on a legacy interest (though many have yet to establish an estate plan), according to a recent survey. At the same time, they also overwhelmingly recognize the value of financial advisors , not only for increasing their wealth beyond what they could have achieved on thei

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

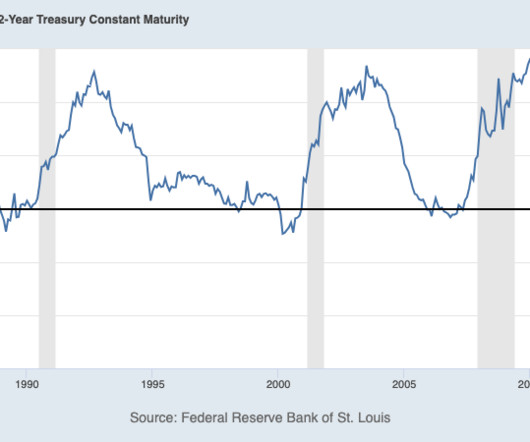

Calculated Risk

JUNE 19, 2024

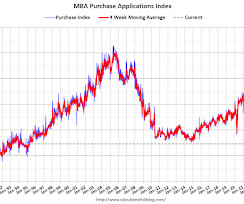

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey Mortgage applications increased 0.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending June 14, 2024. The Market Composite Index, a measure of mortgage loan application volume, increased 0.9 percent on a seasonally adjusted basis from one week earlier.

Wealth Management

JUNE 17, 2024

How an $8,000 marketing investment turned into a $650,000 risk.

Nerd's Eye View

JUNE 17, 2024

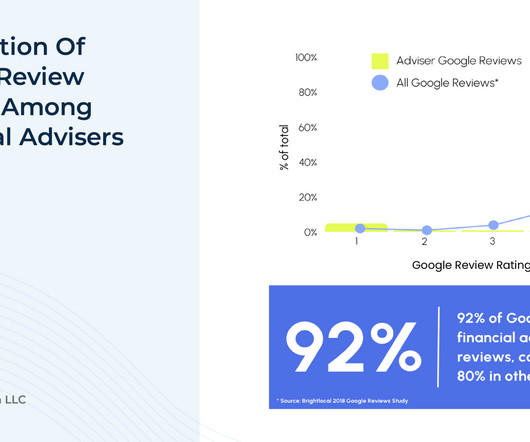

Online reviews are commonly given and used by consumers across many industries, from finding a good restaurant in a new town to reviewing a lawn care service provider. Nonetheless, fewer than 10% of SEC-registered investment advisers report using them, even though the SEC’s updated investment adviser marketing rule allows financial advisors to proactively encourage testimonials (from clients), use endorsements (from non-clients), and highlight their own ratings on various third-party revie

Abnormal Returns

JUNE 21, 2024

Listening The Longform Podcast is calling it quits. (defector.com) A list of some of the most popular (and influential) podcasters. (vulture.com) Economy Scott Galloway talks with Kyla Scanlon author of "In This Economy? How Money & Markets Really Work." (podcasts.apple.com) Joe Weisenthal and Tracy Alloway talk with John Arnold about the roadblocks to building in America.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Calculated Risk

JUNE 18, 2024

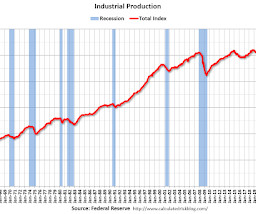

From the Fed: Industrial Production and Capacity Utilization Industrial production rose 0.9 percent in May. Manufacturing output posted a similar gain of 0.9 percent after declining in the previous two months. The index for mining increased 0.3 percent in May, and the index for utilities advanced 1.6 percent. At 103.3 percent of its 2017 average, total industrial production in May was 0.4 percent higher than its year-earlier level.

Wealth Management

JUNE 21, 2024

What wealth advisors need to know about taxing unrealized gains.

The Big Picture

JUNE 20, 2024

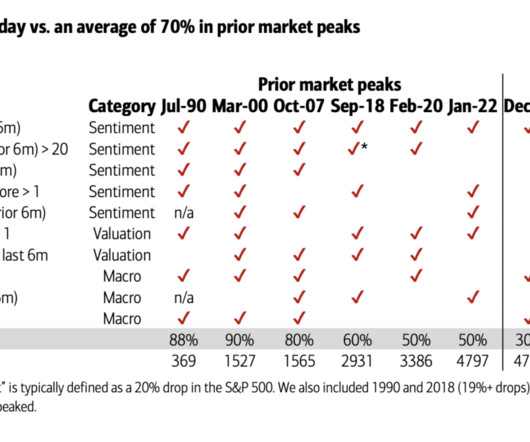

Making good progress on the book, about 60-70% finished (I feel good about it). I wanted to pop out of hiding to share a few charts/tables that should raise your confidence levels that — despite media coverage to the contrary — we are not on the verge of collapse. I want to direct your attention to the latest missive from Savita Subramanian, who runs the Equity and Quant Strategy group at BAML.

Abnormal Returns

JUNE 17, 2024

Markets Big technological transitions are often associated with increase market concentration. (ritholtz.com) Every bull market is different. (bloomberg.com) Strategy Short-termism will crush a stock market investor. (awealthofcommonsense.com) Three things financial charlatans say including 'Here's how to get guaranteed returns.' (dariusforoux.com) Conor Mac, "The longer you invest, the more rocks you turn over, and the more you learn from mistakes, the sharper your perception grows over time. "

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Calculated Risk

JUNE 20, 2024

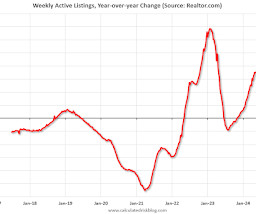

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For April, Realtor.com reported inventory was up 35.2% YoY, but still down almost 34% compared to April 2017 to 2019 levels. Now - on a weekly basis - inventory is up 36.0% YoY. Realtor.com has monthly and weekly data on the existing home market.

Wealth Management

JUNE 21, 2024

PhilanthPro's Nicholas Palahnuk discusses how clients' growing interest in philanthropy demands a more integrated approach, where giving is strategically aligned with overall financial goals.

Nerd's Eye View

JUNE 19, 2024

The role of estate planning is most commonly considered to be about transferring assets from one generation to the next in the most efficient manner possible (e.g., how to minimize the burden of estate taxes and avoid the public spectacle of the probate process). And yet, looking at estate planning solely through the lens of assets on a balance sheet can make it easy to overlook the reality that people often have other, intangible assets that they wish to pass on to the next generation, such as

Abnormal Returns

JUNE 17, 2024

Podcasts Matt Zeigler talks with Daniel Crosby about his new book "The Soul of Wealth" and much more. (epsilontheory.com) Michael Kitces talks with Mark Berg, Founder of Timothy Financial Counsel, about using an hourly fee model. (kitces.com) Amy Arnott and Christine Benz talk with Andrew Blake who is associate director of wealth management for Cerulli Associates about the upcoming wave of adviser retirements.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

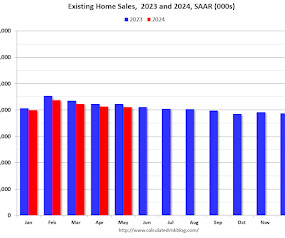

Calculated Risk

JUNE 21, 2024

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 4.11 million SAAR in May Excerpt: Sales Year-over-Year and Not Seasonally Adjusted (NSA) The fourth graph shows existing home sales by month for 2023 and 2024. Sales declined 2.8% year-over-year compared to May 2023. This was the thirty-third consecutive month with sales down year-over-year.

Wealth Management

JUNE 18, 2024

Does the wisdom of age outweigh the other limitations it can impose?

Nerd's Eye View

JUNE 19, 2024

The role of estate planning is most commonly considered to be about transferring assets from one generation to the next in the most efficient manner possible (e.g., how to minimize the burden of estate taxes and avoid the public spectacle of the probate process). And yet, looking at estate planning solely through the lens of assets on a balance sheet can make it easy to overlook the reality that people often have other, intangible assets that they wish to pass on to the next generation, such as

Abnormal Returns

JUNE 20, 2024

Markets What's different about the Magnificent Seven stocks. (awealthofcommonsense.com) Don't look now but Taiwan Semi ($TSM) is nearly a $1 trillion company. (bnnbloomberg.ca) The case for swapping large caps for small caps. (blogs.cfainstitute.org) Strategy There's no such thing as certainty. (tonyisola.com) Lessons from Robert Hagstrom’s 1994 book "The Warren Buffett Way.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

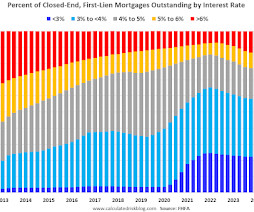

Calculated Risk

JUNE 15, 2024

At the Calculated Risk Real Estate Newsletter this week: Click on graph for larger image. • Q1 Update: Delinquencies, Foreclosures and REO • Part 1: Current State of the Housing Market; Overview for mid-June 2024 • Part 2: Current State of the Housing Market; Overview for mid-June 2024 • 3rd Look at Local Housing Markets in May • 2nd Look at Local Housing Markets in May This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Wealth Management

JUNE 18, 2024

James McDonald was taken into custody in Port Orchard, Wash. and will face federal charges in Los Angeles. He is accused of losing millions in client funds and fled an SEC subpoena in 2021.

The Big Picture

JUNE 19, 2024

At the Money: Smart Spending vs. Not Spending (June 18, 2024) Spending Scolds will tell you that a sailboat, a sports car, or even a latte will be your financial ruin. Is this accurate? Focusing on the cost without considering whether you can afford the items and what memories they create is the wrong calculus. In today’s ATM, we discuss how to spend intelligently, within your budget, on the things that hep create lasting memories.

Abnormal Returns

JUNE 18, 2024

AlphaSense AlphaSense is buying Tegus. (bloomberg.com) What next for AlphaSense? (mattober.co) Private equity As alts go, so go pension fund returns. (papers.ssrn.com) Comparing the (real) volatility of private equity and private credit. (alphaarchitect.com) Secondary PE investments are a necessary part of the system. (caia.org) How much in taxes have private equity fund managers avoided through carried interest?

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

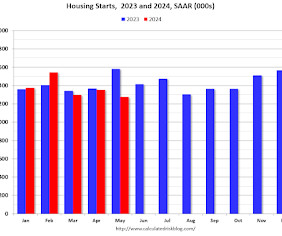

Calculated Risk

JUNE 20, 2024

Today, in the Calculated Risk Real Estate Newsletter: Single Family Starts Down Slightly Year-over-year in May; Multi-Family Starts Down 50% A brief excerpt: Total housing starts in May were below expectations, however, starts in March and April were revised up slightly, combined. The third graph shows the month-to-month comparison for total starts between 2023 (blue) and 2024 (red).

Wealth Management

JUNE 18, 2024

Blackrock’s Chief Investment Officer reported that while hedge funds and brokerages have dipped into spot bitcoin ETFs, RIAs have been slower to embrace them. Morgan Stanley is adding more manager-traded SMAs to its UMA platform, reports FundFire. These are among the investment must reads we found this week for wealth advisors.

A Wealth of Common Sense

JUNE 16, 2024

Roger Federer delivered an excellent commencement address at Dartmouth’s graduation recently. This part floored me: In tennis, perfection is impossible… In the 1,526 singles matches I played in my career, I won almost 80% of those matches… Now, I have a question for all of you… what percentage of the POINTS do you think I won in those matches?

Abnormal Returns

JUNE 19, 2024

Podcasts Barry Ritholtz talks with Jan van Eck about thematic investing. (ritholtz.com) Bogumil Baranowski talks money and purpose with Morgan Ranstrom of Trailhead Planners. (talkingbillions.co) Thomas Kopelman and Jacob Turner talk about the legitimate uses of life insurance. (podcasts.apple.com) Khe Hy talks with Geraldine DeRuiter about getting off the hedonic treadmill.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Let's personalize your content