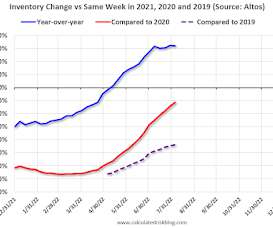

August 8th Update: Housing Inventory Increases Slow

Calculated Risk

AUGUST 8, 2022

Inventory is still increasing, but the inventory build has slowed. Here are the same week inventory changes for the last four years: 2022: 5.0K 2021: 4.5K 2020: -14.0K 2019: -6.4K Inventory bottomed seasonally at the beginning of March 2022 and is now up 126% since then. Altos reports inventory is up 32.1% year-over-year and is now 24.4% above the peak last year.

Let's personalize your content