Farewell, TINA

The Big Picture

SEPTEMBER 29, 2022

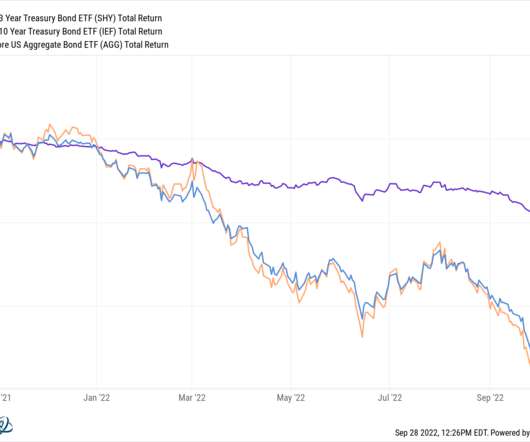

For years, we have heard that “there is no alternative” – TINA – to equities, and that thanks to the Fed, “Cash is trash.”. No longer. The Federal Reserve, in its belated attempt to fight inflation, has cranked up rates to the point where today, there is an alternative to stocks: Bonds. It’s been over two decades since the Fed first began panic cutting interest rates in response to such events as the 1998 Long Term Capital Management implosion, the 2000 dotcom crash (2001-03), the Septembe

Let's personalize your content