Real Estate Buyers and Sellers Remain Stuck in a Standoff on Asset Pricing

Wealth Management

JULY 31, 2023

The bid-ask gap in the commercial real estate market has created a massive falloff in transaction volume in 2023.

Wealth Management

JULY 31, 2023

The bid-ask gap in the commercial real estate market has created a massive falloff in transaction volume in 2023.

Nerd's Eye View

JULY 31, 2023

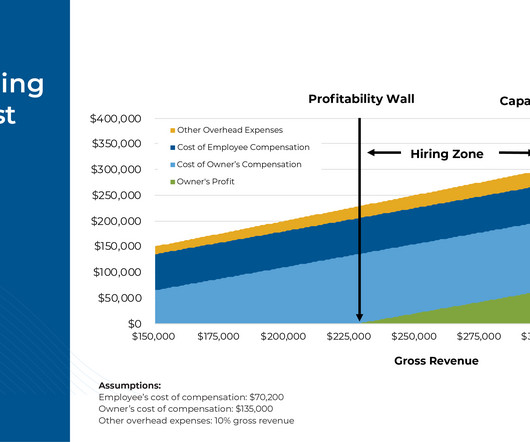

Many financial advisors who launch solo advisory firms do so with the intention of adding more employees once the firm becomes big enough to support them. And while conceptually it makes sense that the firm will be ready to hire its first employee at some point, in practice, there often isn't a lot of clarity about the right time to actually make an initial hire.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JULY 31, 2023

How whole life insurance can help retirees prepare for market downturns.

Calculated Risk

JULY 31, 2023

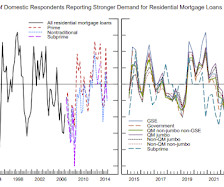

From the Federal Reserve: The July 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices The July 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) addressed changes in the standards and terms on, and demand for, bank loans to businesses and households over the past three months, which generally correspond to the second quarter of 2023.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

JULY 31, 2023

A recent gift tax case involving the founders of Firehouse Subs illustrates both the benefits and risks involved with this technique.

Abnormal Returns

JULY 31, 2023

Markets Every major asset class is up YTD. (capitalspectator.com) The equity risk premium keeps shrinking. (wsj.com) Strategy One year returns are all over the place. Thirty years, not so much. (awealthofcommonsense.com) Don't let news dictate your investing strategy. (dariusforoux.com) Successful investing is ultimately a creative act. (herbgreenberg.substack.com) Finance CME Bitcoin futures volume is growing.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Abnormal Returns

JULY 31, 2023

Podcasts Jason Wenk and Dasarte Yarnway spoke with Justin Castelli of RLS Wealth about finding freedom, independence and growth. (altruist.com) Daniel Crosby talks with Neil Bage who is the co-founder of Shaping Wealth about adviser self-care. (standarddeviationspod.com) Meb Faber talks with JD Gardner who is the CIO & Founder of Aptus Capital Advisors.

Wealth Management

JULY 31, 2023

A lot can be learned listening to clients’ experiences with financial advisors—good and bad. We talked to Andrea Mac, founder of Prequal, a revenue consultancy for salespeople and female company founders based in suburban Chicago.

Calculated Risk

JULY 31, 2023

Altos reports that active single-family inventory was up 1.1% week-over-week. Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of July 28th, inventory was at 485 thousand (7-day average), compared to 479 thousand the prior week. Year-to-date, inventory is down 1.3%. And inventory is up 19.5% from the seasonal bottom 15 weeks ago.

Wealth Management

JULY 31, 2023

Consider taking advantage of current higher exclusions of gifting.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

JULY 31, 2023

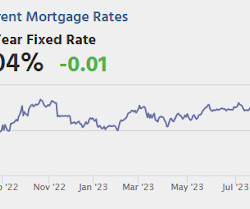

From Matthew Graham at Mortgage News Daily: Mortgage Rates Roughly Unchanged From Friday As the new week begins, mortgage rates are almost perfectly in line with those seen on Friday afternoon. Putting that in context, last Thursday and Friday marked the highest rates in weeks although Friday was quite a bit better. In both cases and again today, the average lender is just over 7% for a top tier conventional 30yr fixed scenario. [ 30 year fixed 7.04% ] emphasis added Tuesday: • At 8:00 AM ET, Co

Wealth Management

JULY 31, 2023

And why the DC industry tends to tend to undervalue them.

Calculated Risk

JULY 31, 2023

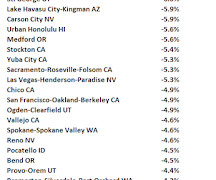

Today, in the Calculated Risk Real Estate Newsletter: Freddie Mac House Price Index Increased in June to New High; Up 1.7% Year-over-year A brief excerpt: On a year-over-year basis, the National FMHPI was up 1.7% in June, from up 0.8% YoY in May. The YoY increase peaked at 19.2% in July 2021. In June, 15 states and D.C. were below their previous peaks, Seasonally Adjusted.

Wealth Management

JULY 31, 2023

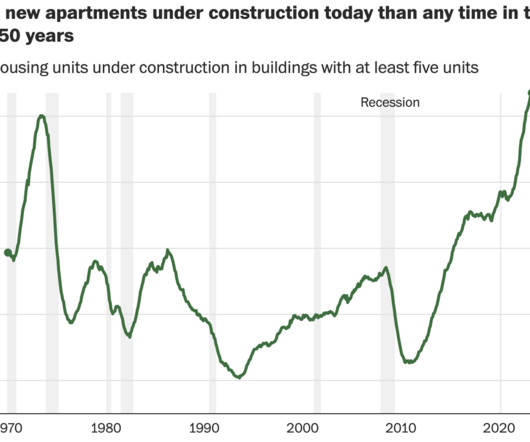

U.S. office space is on track to shrink for the first time on record, according to JLL. The commercial real estate sector has slowed its efforts on DEI initiatives, reports Bisnow. These are among the must reads from around the real estate investment world to end the week.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

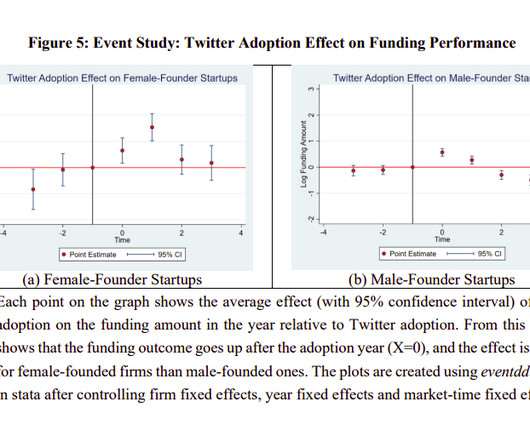

Alpha Architect

JULY 31, 2023

The article aims to examine the role of social media in venture capital financing, its impact on disparities faced by underrepresented groups, and the mechanisms through which social media usage can facilitate venture capital funding. Social Media and Inequality in Venture Capital Funding was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Wealth Management

JULY 31, 2023

According to the latest WealthManagement IQ research, the disappointing performance of equity and fixed-income investments in 2022 only served to heighten advisors’ interest in alts.

Advisor Perspectives

JULY 31, 2023

With the Federal Reserve nearing the end of its most disruptive monetary-tightening campaign in a generation, a softening US dollar is poised to boost profit growth for nearly half of the companies in the S&P 500 Index over the next year.

Wealth Management

JULY 31, 2023

It may be the first year in nearly a decade that the RIA market doesn’t break records, but industry trackers expect it will remain heated as private equity, new players and synergistic opportunities abound.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

A Wealth of Common Sense

JULY 31, 2023

Today’s Talk Your Book is brought to you by Innovator Capital Management We had Co-Founder and CEO Bruce Bond back on the show to discuss their newest innovation in the ETF space! On today’s show, we discuss: Equity Defined Protection ETF product page Equity Defined Protection Investor Guide When Cash Isn’t King Research and Investment Strategy Center The SEC and approving this 100% protec.

Wealth Management

JULY 31, 2023

Proactively address risks that could affect the success of your practice.

Advisor Perspectives

JULY 31, 2023

Starting valuations are the most reliable predictor of equity returns. But they are far from reliable, and investors must use those forecasts cautiously.

Integrity Financial Planning

JULY 31, 2023

The following two types of retirement savings methods may sound similar, but there are a lot of important differences that might be useful for you to know if you’re looking to get a better understanding of what retirement might look like for you. Defined-Benefit Let’s start with a defined-benefit plan. These types of plans commonly come in the form of pension plans. [1] A pension plan guarantees a certain level of retirement benefit based on your salary and how many years you worked for the comp

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

JULY 31, 2023

Valid until the market close on August 31, 2023 The S&P 500 closed July with a monthly gain of 3.11%, after a gain of 6.47% in June. At this point, after close on the last day of the month, one of five Ivy portfolio ETFs — iShares 7-10 Year Treasury Bond ETF (IEF) — is signaling "cash", same as last month's final "cash" signal.

Trade Brains

JULY 31, 2023

Best Debt Free Large Cap Stocks: Many investors prefer investing in large cap stocks because of their steady returns and a long history of profits. The volatility is low making them suitable for risk-averse investors. Furthermore, some investors go a step ahead and pick debt free large cap stocks to protect their downside. In this article, we’ll present you such best debt free large cap stocks which you can add to your watchlists.

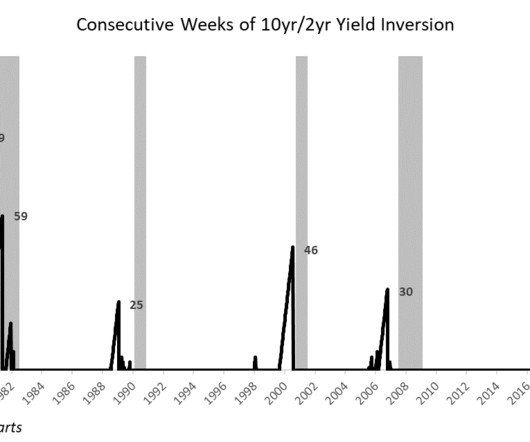

The Irrelevant Investor

JULY 31, 2023

A year ago, the consensus view was that a recession was imminent. However, the situation has taken a complete turn, and now most of the evidence suggests that the economy is thriving. Despite the Fed’s efforts to slow it down, the economy keeps on rolling. The Citi Economic Surprise Index is currently at its highest level in three years, while companies are reporting strong earnings.

Advisor Perspectives

JULY 31, 2023

Many advisors are using longevity assumptions that are less conservative than they think.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Random Roger's Retirement Planning

JULY 31, 2023

First up is another article stating that Gen-X is doomed for retirement. Another article I saw today (sorry no link) said that something like 1/3 of Gen-Xers have less than $10,000 saved for retirement. The article I linked to for this post has various sentiment stats about how few think they will have enough to retire and how many expect to work after they "retire.

Don Connelly & Associates

JULY 31, 2023

Advisors who are in the dark about how their clients view their relationship or feel about the level of service they receive risk losing them to advisors who care about what they think. It's not that you don't care; it's that your clients won't know that you do if you don't periodically ask them for their feedback. Without direct and honest feedback from your clients, you won't know what's working and what's not.

SEI

JULY 31, 2023

Ryan Hicke discusses growth opportunities in today’s macro-environment.

International College of Financial Planning

JULY 31, 2023

Investing is essential to achieving our financial goals, whether saving for retirement, funding our children’s education, or building wealth for the future. However, eliminating the complex world of investments can be challenging, and many individuals fall prey to common investment mistakes that can hinder their financial success. Let’s explore the role of investment advisors in helping individuals avoid these pitfalls and make informed decisions.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content