CREXi Data Shows Real Estate Investors Remain Interested in Making Deals

Wealth Management

MAY 18, 2023

But the higher cost of capital and sellers holding on to 2022 prices is preventing some potential transactions from going through.

Wealth Management

MAY 18, 2023

But the higher cost of capital and sellers holding on to 2022 prices is preventing some potential transactions from going through.

Abnormal Returns

MAY 18, 2023

Finance Zero-day options are changing how the stock market operates. (finance.yahoo.com) Managing cash is no longer an afterthought. (institutionalinvestor.com) RIP, once and for all, Libor. (economist.com) Funds Jon Hale looks at the evolution of sustainable investing over the past couple decades. (morningstar.com) ETFs are seeing increased adoption in Europe.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

MAY 18, 2023

Firms using AI tech to generate “customized” suggestions for clients may not realize those recommendations still fall under the best interest rule, warned a senior director at FINRA's annual conference.

Calculated Risk

MAY 18, 2023

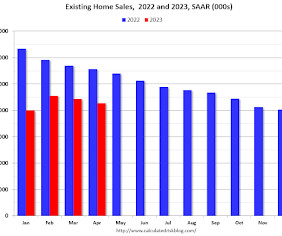

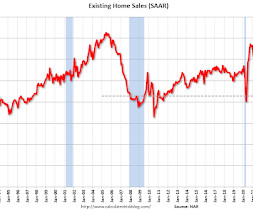

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 4.28 million SAAR in April; Median Prices Declined 1.7% YoY Excerpt: The second graph shows existing home sales by month for 2022 and 2023. Sales declined 23.2% year-over-year compared to April 2022. This was the twentieth consecutive month with sales down year-over-year.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

MAY 18, 2023

Conferences are back. Here’s how advisors can make the most of them.

Nerd's Eye View

MAY 18, 2023

As a solo advisory firm owner grows their practice, they may reach capacity constraints that prompt them to hire an additional employee. While this can be a logical step in scaling their firm, some advisory firm owners may not anticipate the managerial challenges that come with hiring additional staff. And even though some firm owners may have originally thought they were ready to expand and take on an employee, they may later determine that they actually prefer operating on their own as a solo

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

MAY 18, 2023

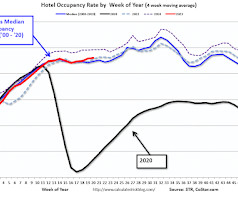

From STR: STR: U.S. hotel results for week ending 13 May U.S. weekly hotel performance produced mixed year-over-year comparisons, according to STR‘s latest data through 13 May. U.S. weekly hotel performance produced mixed year-over-year comparisons, according to STR‘s latest data through 13 May. • Occupancy: 65.1% (-2.0%) • Average daily rate (ADR): US$154.90 (+3.4%) • Revenue per available room (RevPAR): US$100.81 (+1.3%) Worsened comparisons than the week prior were expected and normal given s

Wealth Management

MAY 18, 2023

Little more than a month ahead of its 10th anniversary, Steward Partners brought together hundreds of advisors in Nashville to share best practices, celebrate victories and hand out jerseys.

Calculated Risk

MAY 18, 2023

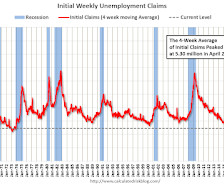

The DOL reported : In the week ending May 13, the advance figure for seasonally adjusted initial claims was 242,000 , a decrease of 22,000 from the previous week's unrevised level of 264,000. The 4-week moving average was 244,250, a decrease of 1,000 from the previous week's unrevised average of 245,250. emphasis added The following graph shows the 4-week moving average of weekly claims since 1971.

Wealth Management

MAY 18, 2023

Vince Giovinazzo and Nick Della Vedova have left NFP to focus on RPAG and flexPATH.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

MAY 18, 2023

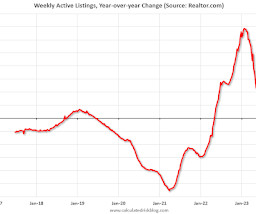

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from chief economist Danielle Hale: Weekly Housing Trends View — Data Week Ending May 13, 2023 • Active inventory was up at a slower pace, with for-sale homes up just 23% above one year ago. The number of homes for sale continues to grow, but at a slower pace compared to one year ago. • New listings–a measure of sellers putting homes up for sale–were down again this week, by 25% from one year ago.

Wealth Management

MAY 18, 2023

What exactly is a high net worth (HNW) investor, and what do these individuals want out of an advisor? And how can advisors attract and retain them more effectively?

Calculated Risk

MAY 18, 2023

From the NAR: Existing-Home Sales Faded 3.4% in April Existing-home sales decreased in April, according to the National Association of REALTORS®. All four major U.S. regions registered month-over-month and year-over-year sales declines. Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – slid 3.4% from March to a seasonally adjusted annual rate of 4.28 million in April.

Wealth Management

MAY 18, 2023

Little more than a month ahead of its 10th anniversary, Steward Partners brought together hundreds of advisors in Nashville to share best practices, celebrate victories and hand out jerseys.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

The Big Picture

MAY 18, 2023

At Barron’s Independent Advisor Conference held in Dallas in March, I got to sit down with Greg Bartalos to discuss the idea of how advisors can use content as a way to enhance their business. The tagline is “ Want to create content, but not sure how to get started? The chairman and CIO of Ritholtz Wealth Management tells all ” but we really spend most of the time explaining why it doesn’t quite work the way people expect, and why it a lot of work, and far less lucrative

Wealth Management

MAY 18, 2023

Jensen Huang's wealth has grown at a faster rate in 2023 than any other US billionaire.

Calculated Risk

MAY 18, 2023

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Friday: • At 10:00 AM ET, State Employment and Unemployment (Monthly) for April 2023 • At 11:00 AM, Discussion, Conversation with Chair Jerome Powell and Ben Bernanke , former Chair of the Board of Governors of the Federal Reserve System At the Thomas Laubach Research Conference, Washington, D.C.

Wealth Management

MAY 18, 2023

Thursday, June 8, 2023 | 2:00 PM ET

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Abnormal Returns

MAY 18, 2023

Books An excerpt from "The Phoenix Economy: Work, Life, and Money in the New Not Normal" by Felix Salmon. (bigthink.com) A Q&A with Henry Grabar author of "Paved Paradise: How Parking Explains the World." (insidehook.com) An excerpt from "SBF: How the FTX Bankruptcy Unwound Crypto’s Very Bad Good Guy" by Brady Dale. (engadget.com) An excerpt from "King: A Life" by Jonathan Eig.

Wealth Management

MAY 18, 2023

Tuesday, June 20, 2023 | 4:15 PM ET

Advisor Perspectives

MAY 18, 2023

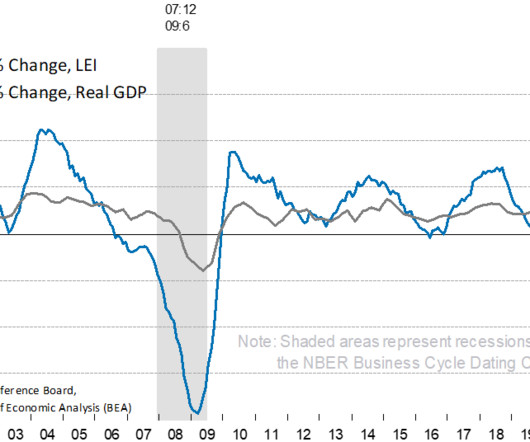

The latest Conference Board Leading Economic Index (LEI) for April dropped to 107.5 from March's revised figure of 108.2. This is the 13th consecutive monthly decline, the longest streak since 2009, and the lowest reading since September 2020. Today's reading represented a 0.6% month-over-month decline, consistent with the forecast.

Wealth Management

MAY 18, 2023

In the first of a 2-part series, Mindy Diamond and Louis Diamond share advice on the threshold questions to ask before taking meetings or calls regarding a transition.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Million Dollar Round Table (MDRT)

MAY 18, 2023

By Matt Pais, MDRT Content Specialist There are always plenty of variables when it comes to insurance, and disability policies are no exception. Ratings, in particular, can add complexity. Without experience, explaining the complicated nature of ratings to clients can be challenging for advisors. Corry Collins, CLU, CH.F.C. , a 20-year MDRT member from Halifax, Nova Scotia, Canada, has specialized in these products for close to 30 years and knows what to do when disability policies are issued wi

A Wealth of Common Sense

MAY 18, 2023

A reader asks: I have recently shifted a substantial portion of the cash portion of my savings into 3-4 month T-bills to take advantage of higher yields and state tax advantages. As of today, they are all set to mature in June and July. I know a US debt default is highly unlikely, but the risk-averse part of me is still a little nervous about what would happen if Congress actually lets the unthinkable happen.

NAIFA Advisor Today

MAY 18, 2023

Errors & Omissions (E&O) insurance can be an essential part of every business' risk management plan. On Thursday, June 1 at 2 pm eastern, Ross Jordan, CPCU , of NAIFA partner CalSurance Associates will outline the current E&O landscape for financial professionals and give you loss prevention tips to help you protect your practice. In this Business Performance Center webinar, explore recent E&O claim trends, learn what other agents are doing to protect their businesses, and what k

Integrity Financial Planning

MAY 18, 2023

The year 1983 saw the release of some of the most iconic and timeless songs in music history. From pop to rock to new wave, this year had something for everyone. If you are headed into retirement and thinking about setting up a playlist of songs from when you were younger to celebrate, this list is for you. Let’s take a look at some of the best songs of 1983. “Every Breath You Take” by The Police This hauntingly beautiful song, written by Sting, topped the charts in 1983 and re

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

The Irrelevant Investor

MAY 18, 2023

Today’s Compound and Friends is brought to you by Kraneshares: Thanks to Kraneshares for sponsoring this episode. See more information here on Kraneshares KLIP ETF. On today’s show, we discuss: About Davis Advisors Shoppers boosted retail sales in April, reversing two months of declines Homebuilder sentiment pulls out of negative territory for the first time in nearly a year Silicon Valley Bank Execs sold before.

MarketWatch

MAY 18, 2023

Shares of Palantir Technologies Inc. PLTR were rallying 13% in afternoon trading after Cathie Wood’s Ark Investment disclosed the purchase of 1.26 million shares Wednesday across several of its funds. The Ark Innovation ETF ARKK added 912,193 shares of Palantir Wednesday, while the Ark Fintech Innovation ETF ARKF added 201,697 shares. The Ark Next Generation Internet ETF ARKW added 149,306 shares.

Random Roger's Retirement Planning

MAY 18, 2023

Bloomberg did a survey and found that Generation-X does not feel like it will be "financially prepared for retirement." We, I am on the older edge of Gen-X, also do not think Social Security will provide all that we were promised. It's due to "run out of money" in 10 or 11 years (kind of a moving target) which might lead to some sort of benefit reduction.

MarketWatch

MAY 18, 2023

Bath & Body Works Inc.’s stock BBWI soared 5% premarket Thursday, after the retailer posted better-than-expected fiscal first-quarter earnings and raised its bottom-line guidance. The company had net income of $81 million, or 35 cents a share, for the quarter to April 29, down from $155 million, or 64 cents a share, in the year-earlier period. Excluding a one-time pretax gain of $7 million related to the early extinguishment of debt, adjusted EPS came to 33 cents, ahead of the 26 cent FactSet co

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content