AAR: June Rail Carloads and Intermodal Decreased Year-over-year

Calculated Risk

JULY 7, 2023

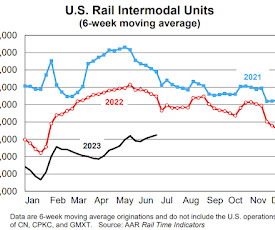

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission. Total originated carloads on U.S. railroads were down 0.2% in June 2023 from June 2022 , their first decline in three months. Total carloads in 2023 through June (5.84 million) were up 0.6% (32,547( carloads) over the same period in 2022 and were the highest since 2019.

Let's personalize your content