WealthManagement.com Recognizes Top Companies, Execs at 2023 Industry Awards

Wealth Management

SEPTEMBER 8, 2023

The ninth-annual event featured 105 awards presented to 84 companies and individuals from a pool of 225 finalists.

Wealth Management

SEPTEMBER 8, 2023

The ninth-annual event featured 105 awards presented to 84 companies and individuals from a pool of 225 finalists.

Calculated Risk

SEPTEMBER 8, 2023

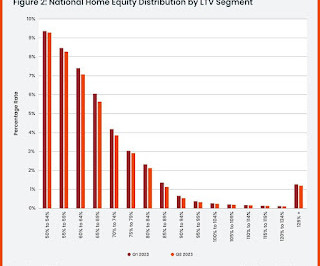

From CoreLogic: CoreLogic: Home Equity Increases From Winter to Spring, Reducing Underwater Properties in Q2 CoreLogic®. today released the Homeowner Equity Report (HER) for the second quarter of 2023. The report shows that U.S. homeowners with mortgages (which account for roughly 63% of all properties) saw home equity decrease by 1.7% year over year, representing a collective loss of $287.6 billion, and an average loss of $8,300 per borrower since the second quarter of 2022.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

SEPTEMBER 8, 2023

The tax deadlines for reallocating capital gains are approaching.

Calculated Risk

SEPTEMBER 8, 2023

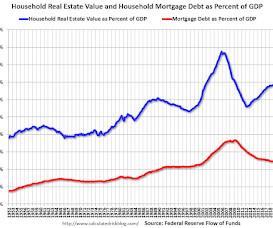

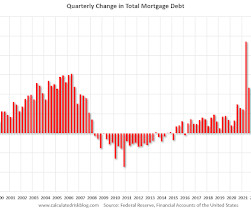

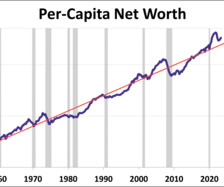

The Federal Reserve released the Q2 2023 Flow of Funds report today: Financial Accounts of the United States. The net worth of households and nonprofits rose to $154.3 trillion during the second quarter of 2023. The value of directly and indirectly held corporate equities increased $2.6 trillion and the value of real estate increased $2.5 trillion. Household debt increased 2.7 percent at an annual rate in the second quarter of 2023.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

SEPTEMBER 8, 2023

RIAs using the platform will be able to create white-label fund strategies including on private credit, equity, real estate, venture capital and infrastructure investments for high-net-worth and ultra-high-net-worth clients.

Calculated Risk

SEPTEMBER 8, 2023

From BofA: Overall, the data flow since our last report pushed our 3Q US GDP tracking up four-tenths to 3.1% q/q saar and 2Q up two-tenths to 2.5%. Next week, August CPI, retail sales, PPI, import and export prices, industrial production and monthly budget statement will affect our GDP tracking [Sept 8th estimate] emphasis added From Goldman: July goods exports were stronger than our previous assumption, and we boosted our Q3 GDP tracking estimate by 0.2pp to +3.1% (qoq ar).

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Abnormal Returns

SEPTEMBER 8, 2023

Strategy Gold is ultimately a bet on global chaos. (morningstar.com) What investors get wrong about the 'Yale Model.' (capitalallocators.com) How much should a fund manager hold in their own strategy? (awealthofcommonsense.com) Retailing Why retail workers are quitting in record numbers. (bloomberg.com) Which helps explain the sorry state of stores.

Wealth Management

SEPTEMBER 8, 2023

A new staff report from the New York Fed makes an old argument for centrally managed capital, but its predictions will rarely hold up in the real world.

Nerd's Eye View

SEPTEMBER 8, 2023

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that the SEC this week issued a risk alert outlining how it selects firms to examine, the areas it focuses on during exams, and how it chooses which firm documents to request, details that could ultimately help firms be better prepared for their next exam and make it a shorter, less painful process!

Wealth Management

SEPTEMBER 8, 2023

The Jack Ma-backed fintech company will use its financial large language model to power two applications known as Zhixiaobao, which answers questions for customers, and Zhixiaozhu, an assistant for financial professionals.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

SEPTEMBER 8, 2023

From Manheim Consulting today: Wholesale Used-Vehicle Prices See Minimal Increase in August Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) increased 0.2% in August from July. The Manheim Used Vehicle Value Index (MUVVI) rose to 212.2, down 7.7% from a year ago. “August brought a stop to wholesale price declines, though it was only a small reversal of the larger magnitude declines so far this spring and early summer,” said Chris Frey, senior manager of Economic a

The Reformed Broker

SEPTEMBER 8, 2023

Welcome to the latest episode of The Compound & Friends. This week, Michael Batnick, Nick Colas, and Downtown Josh Brown discuss Q2 earnings, Moore’s law, interest rates, the future of the automotive market, Steve Cohen, and much more! You can listen to the whole thing below, or find it wherever you like to listen to your favorite pods! Listen here: Apple podcasts Spotify podcasts Google podcasts Everywhere els.

Calculated Risk

SEPTEMBER 8, 2023

Today, in the Real Estate Newsletter: The "Home ATM" Stays Mostly Closed in Q2 Excerpt: During the housing bubble, many homeowners borrowed heavily against their perceived home equity - jokingly calling it the “Home ATM” - and this contributed to the subsequent housing bust, since so many homeowners had negative equity in their homes when house prices declined.

The Big Picture

SEPTEMBER 8, 2023

My end-of-week morning train WFH reads: • How Blackstone Sprinted Ahead of Its Peers in AI : Eight years ago, Stephen Schwarzman decided to go all in on artificial intelligence — and never looked back. ( Institutional Investor ) • Autoworkers Have Good Reason to Demand a Big Raise : Their real wages have fallen 30% over the past two decades. But can the Detroit Three really afford to bring back the old days?

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

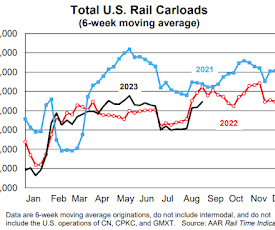

Calculated Risk

SEPTEMBER 8, 2023

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission. U.S. railroads originated 1.13 million total carloads in August 2023, down 2.0% from August 2022 and their third straight year-over-year decline. Total carloads averaged 226,675 per week in August 2023, very close to the weekly averages in March through June 2023.

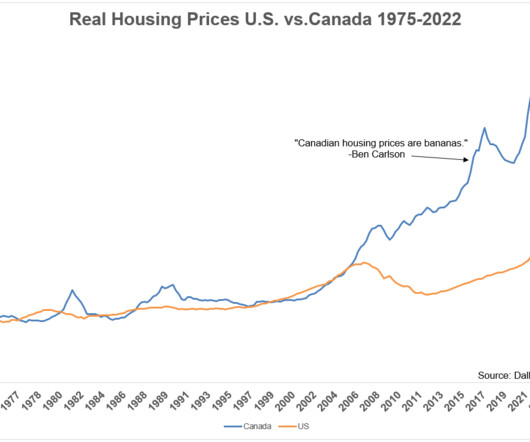

A Wealth of Common Sense

SEPTEMBER 8, 2023

Way back in 2017, I wrote about how bananas Canadian housing prices were. This was the chart I used at the time: Canada basically skipped the housing bust from the Great Financial Crisis. Well, things got even more bananas in the ensuing years. Here’s the updated version: Canadian housing prices can remain irrational longer than you can stay solvent or something like that.

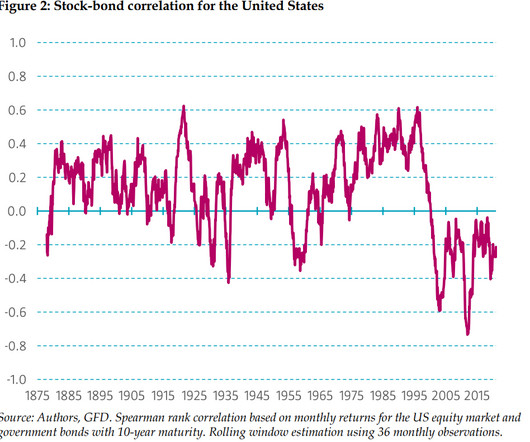

Alpha Architect

SEPTEMBER 8, 2023

The correlation between stocks and bonds should be a critical component of any asset allocation decision, as it impacts not only the overall risk of a diversified multi-asset class portfolio but also the risk premia one should expect to receive for taking risk in different asset classes. The problem for investors is that the correlation between stocks and bonds fluctuates extensively across time and economic regimes.

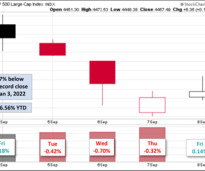

Advisor Perspectives

SEPTEMBER 8, 2023

The S&P 500 finished Friday in the green, snapping its 3-day losing streak. However, despite Friday's gains, the index fell 1.29% from last week. The index is currently up 16.56% year to date and is 7.07% below its record close from January 3, 2022.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

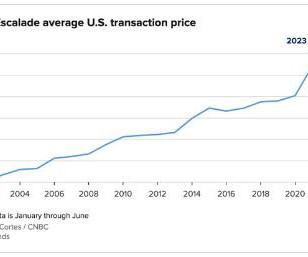

The Irrelevant Investor

SEPTEMBER 8, 2023

On today’s show, we spoke with CarDealershipGuy to discuss the auto market in 2023. See CarDealershipGuys Twitter here On today’s show, we discuss: Ben’s leasing story Today’s average auto loan rate What the money factor is How delinquent car loans can affect the economy The cost of leasing a new car in 2023 The cheapest cars available today Why prices have gotten so high Tesla vs. everyone CarDeal.

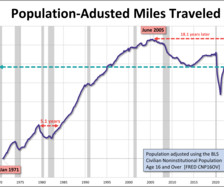

Advisor Perspectives

SEPTEMBER 8, 2023

Travel on all roads and streets increased in July. The 12-month moving average was up 0.3% month-over-month and was up 1.3% year-over-year. If we factor in population growth, the 12-month MA of the civilian population-adjusted data (age 16-and-over) was up 0.2% MoM and up 0.1% YoY.

Integrity Financial Planning

SEPTEMBER 8, 2023

As we age, maintaining cognitive health becomes increasingly important. Playing board games like Scrabble, chess, Monopoly, dominos, and poker can have significant benefits for seniors, helping them stay mentally active and engaged while also providing opportunities for social interaction. [1] Game #1 – Scrabble Scrabble is an excellent game for enhancing linguistic skills and cognitive flexibility.

Advisor Perspectives

SEPTEMBER 8, 2023

Powell’s recent Jackson Hole Summit speech was mainly as expected. Well, except for the part where Powell obfuscated the truth behind the surge in inflation.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Clever Girl Finance

SEPTEMBER 8, 2023

Are you a creative person who wants to start a side hustle or even a full-time business? Are you looking for ideas about what to sell on Etsy? Keep reading to discover popular products that sell and start making extra money! Table of contents How to be successful selling on Etsy What to sell on Etsy: 15 Great Ideas Expert tip: Manage your Etsy business the right way What is the #1 thing to sell on Etsy?

Advisor Perspectives

SEPTEMBER 8, 2023

Pop Quiz! Without recourse to your text, your notes, or a Google search, what line item is the largest asset in Uncle Sam's financial accounts? A) U.S.

Good Financial Cents

SEPTEMBER 8, 2023

Having more than one type of debt is common, and that’s especially true once you graduate from college and start your first “real job.” You may have credit card debt, an auto loan, and a mortgage payment to make once you buy your first home. It’s also common to have other random debts to cover, including student loans. If you’re like many who took out loans during college, you will likely be paying them off after you graduate.

Advisor Perspectives

SEPTEMBER 8, 2023

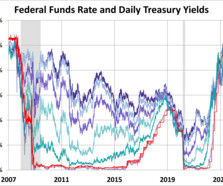

The yield on the 10-year note ended September 8, 2023 at 4.26%, the 2-year note ended at 4.90%, and the 30-year at 4.33%.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Trade Brains

SEPTEMBER 8, 2023

Most Expensive Stocks in the World: In the rapidly moving financial industry of today, a few stocks shine brighter than others, not just for their performance but also for their exorbitant prices. Although most costly shares in the world cost tens or hundreds of dollars, there are some businesses that have stocks priced in thousands. In this article, we will discuss the 10 most expensive stocks in the world.

Advisor Perspectives

SEPTEMBER 8, 2023

As of Q2 2023, the latest Fed balance sheet indicates that household net worth has risen 160% since reaching its 2009 low. However, when adjusted for inflation, household net worth has increased by only 82% since the 2009 trough.

Carson Wealth

SEPTEMBER 8, 2023

September is the worst-performing month for stocks, on average. Dig into the data with Carson Group’s Chief Market Strategist Ryan Detrick and VP, Global Macro Strategist Sonu Varghese. Highlights include: What could be behind the annual September slowdown? What can investors expect for this year? Is the economy slowing down or simply normalizing? Looking for more investment insights and market analysis?

Advisor Perspectives

SEPTEMBER 8, 2023

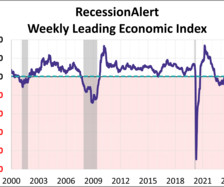

The weekly leading economic index (WLEI) is a composite for the U.S economy that draws from over 20 time-series and groups them into the following six broad categories which are then used to construct an equally weighted average. As of August 25th, the index was at 1.264, up 4.122 from the previous week.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content