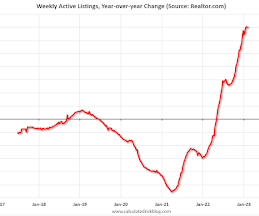

Realtor.com Reports Weekly Active Inventory Up 70% YoY; New Listings Down 13% YoY

Calculated Risk

FEBRUARY 17, 2023

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released today from Chief Economist Danielle Hale: Weekly Housing Trends View — Data Week Ending Feb 11, 2023 • Active inventory growth continued to climb with for-sale homes up 70% above one year ago. Inventories of for-sale homes rose again, on par with the yearly gains we saw last week.

Let's personalize your content