Nine Book Recommendations From Advisors to Get You to the End of Summer

Wealth Management

AUGUST 11, 2023

Non-fiction about happiness, purpose and the psychology of money, a thriller from David Baldacci and more.

Wealth Management

AUGUST 11, 2023

Non-fiction about happiness, purpose and the psychology of money, a thriller from David Baldacci and more.

Abnormal Returns

AUGUST 11, 2023

Strategy Bonds are showing positive real yield for the first time in a long time. (ft.com) Why Seth Klarman spearheaded a re-write of Graham and Dodd's classic "Security Analysis." (institutionalinvestor.com) Active ETFs are the future. (ft.com) Goldman Sachs Goldman Sachs ($GS) has a morale problem. (nymag.com) Why fingers are being pointed at Goldman Sachs' ($GS) CEO David Solomon could use a friend.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

AUGUST 11, 2023

Utah-based Alpine Securities is challenging the constitutionality of FINRA. Given recent judicial decisions from more conservative courts, some legal scholars think it may succeed.

The Big Picture

AUGUST 11, 2023

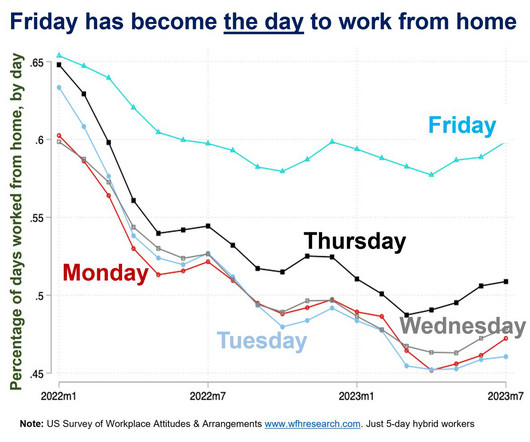

My end-of-week morning train WFH reads: • Seth Klarman on What Makes a Value Investor and Committing ‘Sacrilege’ in New Edition of ‘Security Analysis.’ Klarman edited the classic to remind investors of basic principles — but he questions “how much of this will be read by institutional investors who may think they know it all.” ( Institutional Investor ) • Flying Cars Are Nearly Here—and They’re Electric : Companies like Joby and Archer are about to begin production of electric vertical takeoff a

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

AUGUST 11, 2023

CI Financial revealed Corient’s latest additions during an earnings call this week, Dynamic Advisor Solutions added five new teams in the first half of the year, Integrated added a new Denver affiliate and WEG is staffing up for more growth.

Calculated Risk

AUGUST 11, 2023

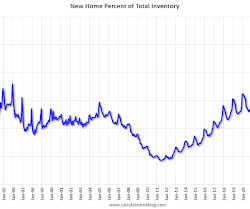

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-August A brief excerpt: Interestingly, new home inventory is close to a record percentage of total inventory. This graph uses Not Seasonally Adjusted (NSA) existing home inventory from the National Association of Realtors® (NAR) and new home inventory from the Census Bureau ( only completed and under construction inventory ).

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

AUGUST 11, 2023

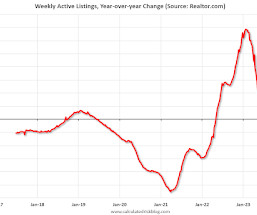

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from Danielle Hale: Weekly Housing Trends View — Data Week Ending Aug 5, 2023 • Active inventory declined, with for-sale homes lagging behind year ago levels by 9%. This week marks a 7th consecutive decline in the number of homes actively for sale compared to the prior year, and the gap is growing. • New listings–a measure of sellers putting homes up for sale–were down again this week, by 14% from on

The Big Picture

AUGUST 11, 2023

I am super jazzed for this year’s Future Proof. Our second go-around is even bigger and better than last year’s! It is nothing like the usual financial conference — it’s totally outdoors, right on the Pacific in Huntington Beach. We took over all 5 hotels for the 3000 attendees, including 1,000 registered advisors and over 500 sponsors.

Wealth Management

AUGUST 11, 2023

The $4 trillion municipal bond market, like other parts of the fixed income universe, is offering elevated yields not seen in years.

Calculated Risk

AUGUST 11, 2023

As usual, there is a wide range of estimates early in the quarter. GDPNow's estimate is probably way too high. From BofA: Next week , we will initiate our 3Q US GDP tracker with the July retail sales data. emphasis added From Goldman: We left our Q3 GDP tracking estimate unchanged at +1.5% (qoq ar) [Aug 8th estimate] And from the Altanta Fed: GDPNow The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2023 is 4.1 percent on August 8, up from 3.9

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Wealth Management

AUGUST 11, 2023

The SEC had until Aug. 13 to say whether it would approve, reject or delay on coming to a decision.

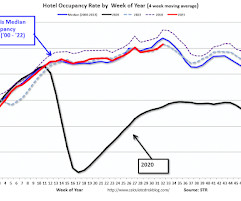

Calculated Risk

AUGUST 11, 2023

From STR: U.S. hotel results for week ending 5 August U.S. hotel performance declined from the previous week and showed lower comparisons year over year, according to CoStar’s latest data through 5 August. 30 July – 5 August 2023 (percentage change from comparable week in 2022): • Occupancy: 68.9% (-1.0%) • Average daily rate (ADR): US$158.10 (+2.2%) • Revenue per available room (RevPAR): US$108.97 (+1.2%) emphasis added The following graph shows the seasonal pattern for the hotel occupancy rate

The Reformed Broker

AUGUST 11, 2023

Welcome to the latest episode of The Compound & Friends. This week, Michael Batnick, Bob Elliott, Ben Carlson, and Downtown Josh Brown discuss Bob’s time running money at Bridgewater, CPI, global macro, the labor market, why hedge funds are typically bearish, and much more! You can listen to the whole thing below, or find it wherever you like to listen to your favorite pods!

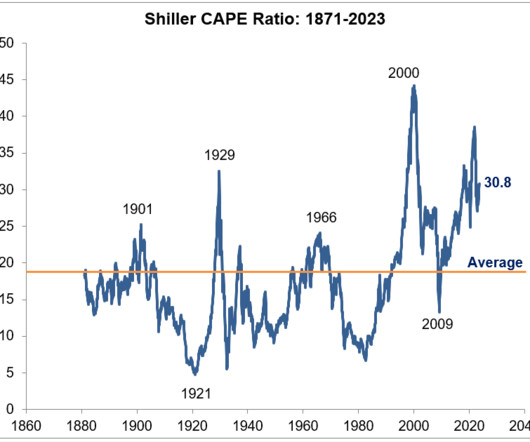

A Wealth of Common Sense

AUGUST 11, 2023

Robert Shiller has a free online database of historical stock market data I’ve been using for years. Going back to 1871, Shiller has data on historical interest rates, dividends, earnings, inflation and valuations. His preferred valuation measure is the cyclically-adjusted price to earnings (CAPE) ratio The average CAPE ratio going back to 1871 is 17.4x the previous 10 years of inflation-adjusted earnings for the U.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Trade Brains

AUGUST 11, 2023

Best Penny Stocks with High Net Profit Margin: From time to time we come across penny stocks which soared 500%, even 1,000% in value making their investors richer. Such companies score better than their peers on key metrics such as return on equity, profit margins, etc. This enables them to earn higher profits than their small peers. Such growth on a small base brings multi-bagger stock returns to investors.

Brown Advisory

AUGUST 11, 2023

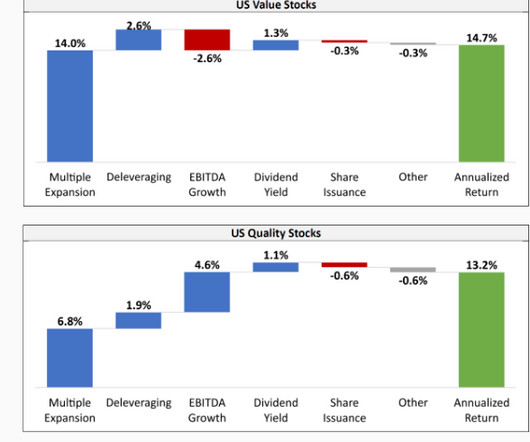

The Equity Beat: Old Economy Stocks Aging Like Fine Wine mhannan Fri, 08/11/2023 - 17:10 Unlike my good friends who frequent Baltimore’s finest dining establishments about as often as the division-leading Orioles win (you know who you are), I would never be confused for a wine connoisseur. Yet through osmosis I’ve learned that aging affords some wines time to become smoother and mellower, developing a fuller flavor as the months and years pass.

Alpha Architect

AUGUST 11, 2023

There are various measures of value and quality, with one being Marx’s gross profits-to-assets. Value and Profitability/Quality: Complementary Factors was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

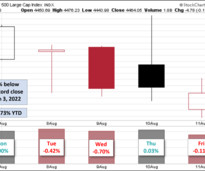

Advisor Perspectives

AUGUST 11, 2023

The S&P 500 posted its lowest close in a month as it finished the week down 0.31% from last Friday. This marks the second consecutive week in the red for the index, something not seen since the first two weeks in May. The index is currently up 16.73% year to date and is 6.93% below its record close from January 3, 2022.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Integrity Financial Planning

AUGUST 11, 2023

Embracing an active lifestyle during the golden years is both rewarding and beneficial for overall health. As the summer season unfolds, it offers retirees an opportunity to engage in a variety of activities that not only keep them physically active but also stimulate their minds and foster social connections. Here are six engaging summer activities that you can enjoy.

Advisor Perspectives

AUGUST 11, 2023

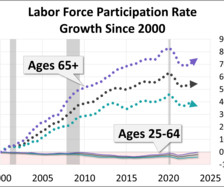

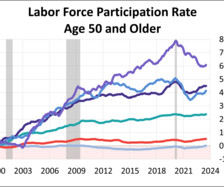

The labor force participation rate (LFPR) is a simple computation: You take the civilian labor force (people aged 16 and over employed or seeking employment) and divide it by the civilian non-institutional population (those 16 and over not in the military and or committed to an institution). As of July, the labor force participation rate is at 62.6%, unchanged from last month and consistent with expectations.

Carson Wealth

AUGUST 11, 2023

You’re downgraded! U.S. debt was downgraded last week by Fitch – from AAA to AA+. This is the second time this has happened in U.S. history. How does this impact investors? Carson Group’s Chief Market Strategist Ryan Detrick and VP, Global Macro Strategist Sonu Varghese break down their thoughts on: · The unlikelihood that your finances will be impacted by the downgrade · Should we have seen the downgrade coming?

Advisor Perspectives

AUGUST 11, 2023

Today, one in three of the 65-69 cohort, nearly one in five of the 70-74 cohort, and nearly one in ten of the 75+ cohort are in the labor force.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Abnormal Returns

AUGUST 11, 2023

AI Patrick O'Shaughnessy talks with Des Traynor is the co-founder and Chief Strategy Officer of Intercom about the practical uses of AI. (joincolossus.com) Russ Roberts talks about the state of AI with Zvi Mowshowitz. (econtalk.org) Business Tyler Cowen talks with Paul Graham about the art of evaluating talent. (conversationswithtyler.com) Shane Parrish talks with Frank Slootman is the Chairman and CEO at Snowflake ($SNOW).

Advisor Perspectives

AUGUST 11, 2023

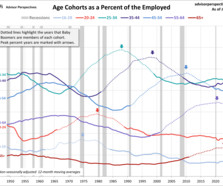

The 20th century Baby Boom was one of the most powerful demographic events in the history of the United States. We've created a series of charts to show seven age cohorts of the employed population from 1948 to the present.

Your Richest Life

AUGUST 11, 2023

Your estate plan is the comprehensive guide to your wealth and property when you pass away or become incapacitated physically or mentally. Whenever you experience big life changes – marriage, divorce, buying a home, death of a loved one, birth of a child, etc. – it’s important that you update your estate plan to reflect those changes. As a physician, there are a few other areas to pay attention to when you’re working on your estate plan.

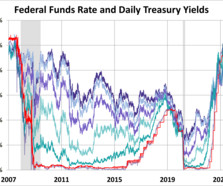

Advisor Perspectives

AUGUST 11, 2023

The yield on the 10-year note ended August 11, 2023 at 4.16%, the 2-year note ended at 4.89%, and the 30-year at 4.24%.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

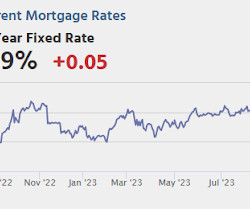

Calculated Risk

AUGUST 11, 2023

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Due to changes at the CDC, weekly cases are no longer updated. After the first few weeks, the pandemic low for weekly deaths had been the week of July 7, 2021, at 1,690 deaths (until recently). Recently hospitalizations have been increasing from a low of 5,146. The last few months have seen a positive trend.

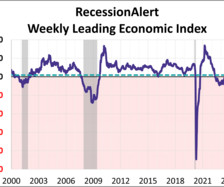

Advisor Perspectives

AUGUST 11, 2023

The weekly leading economic index (WLEI) is a composite for the U.S economy that draws from over 20 time-series and groups them into the following six broad categories which are then used to construct an equally weighted average. As of July 28th, the index was at 5.542, down 0.785 from the previous week.

Random Roger's Retirement Planning

AUGUST 11, 2023

The post earlier this week about a possible 50% cut to Social Security starting in ten years? Yeah that was based on an incomplete, sensationalized article that I tried to convey skepticism over. Barron's cleared things up. The average $17,400 cut is for two earner couples not across the board and so the $10,600 number for lower incomes and the $23,000 number for higher earners was not as it was originally portrayed.

Advisor Perspectives

AUGUST 11, 2023

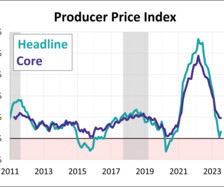

This morning's release of the July Producer Price Index (PPI) for final demand was up 0.3% month-over-month after June's 0.0% change in prices (s.a.). Headline PPI for final demand year-over-year accelerated from 0.2% in June to 0.8% in July, its first pick up in 13 months (n.s.a.).

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content