HNW Investors Continue to Favor Multifamily, Industrial Real Estate Segments

Wealth Management

AUGUST 1, 2023

HNWIs are also showing some interest in newer property segments, such as data centers and SFRs.

Wealth Management

AUGUST 1, 2023

HNWIs are also showing some interest in newer property segments, such as data centers and SFRs.

The Big Picture

AUGUST 1, 2023

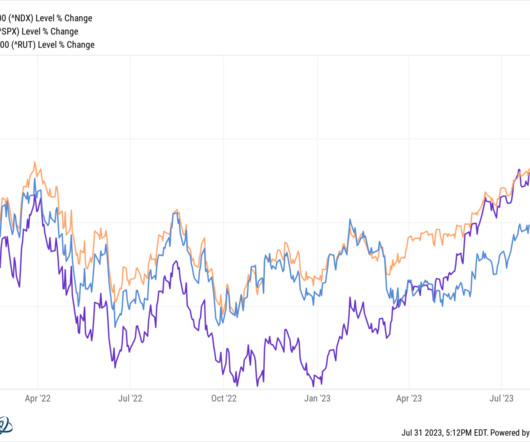

After a monstrous 68% recovery from the March 2020 pandemic low, and another nearly 30% gain in 2021, markets decided to have one of their all-too-regular spasms. Blame whatever you want – Too far, too fast? End of ZIRP? Too rapid rate increases? – but the giveback off the highs was substantial: S&P 500 was down ~23%, Russell 2000 was off 27%, and the Nasdaq 100 came down 32%.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

AUGUST 1, 2023

A large body of evidence demonstrates that market forecasts from 'gurus' have no value in terms of adding alpha.

Abnormal Returns

AUGUST 1, 2023

July 2023 How major asset classes performed in July 2023. (capitalspectator.com) The U.S. stock market is on a five-month winning streak. (ft.com) Markets What investors got wrong about the stock market's rally year-to-date. (ritholtz.com) The yield curve has been inverted for over a year now. (theirrelevantinvestor.com) Meme stock traders just can't quit bankrupt stocks.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

AUGUST 1, 2023

Construction starts for apartment buildings with five or more units fell by 11.2% in June, a new report shows. KKR has opened its first office in Los Angeles in its drive to capitalize on real estate investment opportunities, Bloomberg reported. These are among today’s must reads from around the commercial real estate industry.

Abnormal Returns

AUGUST 1, 2023

Quant stuff Quant investing is all about combating behavioral biases. (mrzepczynski.blogspot.com) A round-up of the past month's best research papers including 'Before Index Funds: How Much of the Market Return Could Investors Have Got?' (bpsandpieces.com) Global Two trends that could help unlock value in Japan's stock market. (mailchi.mp) A review of country risk premia from Aswath Damodaran.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

AUGUST 1, 2023

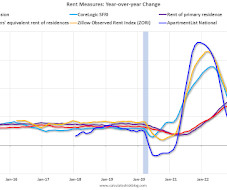

Today, in the Calculated Risk Real Estate Newsletter: Asking Rents Negative Year-over-year A brief excerpt: Tracking rents is important for understanding the dynamics of the housing market. For example, the sharp increase in rents helped me deduce that there was a surge in household formation in 2021 (See from September 2021: Household Formation Drives Housing Demand ).

Wealth Management

AUGUST 1, 2023

Burney Company, a Virginia-based RIA with $2.4 billion in assets, has added Goldman Sachs Advisor Solutions’ custodial service to expand access to alternative investments.

Calculated Risk

AUGUST 1, 2023

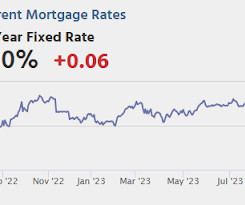

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. • At 8:15 AM: The ADP Employment Report for July. This report is for private payrolls only (no government). The consensus is for 185,000 payroll jobs added in July, down from 497,000 in June. • At 10:00 AM, the Q2 2023 Housing Vacancies and Homeownership from the Census Bureau.

Wealth Management

AUGUST 1, 2023

By making the right capital improvements, property managers can increase the value of their properties and create a more attractive environment for tenants.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

AUGUST 1, 2023

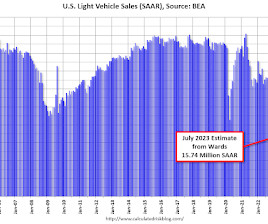

Wards Auto released their estimate of light vehicle sales for July: U.S. Light-Vehicle Sales Post 11th Straight Increase in July (pay site). Assuming no shocks to the economy, sales appear easily on their way to reaching the 15.4 million units forecast for the year. Battery-electric-vehicle deliveries increased 51% year-over-year, accounting for a record-high 7.5% of the market.

Wealth Management

AUGUST 1, 2023

Tuesday, August 22, 2023 | 2:00 PM ET

Calculated Risk

AUGUST 1, 2023

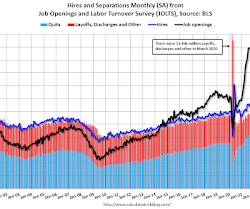

From the BLS: Job Openings and Labor Turnover Summary The number of job openings was little changed at 9.6 million on the last business day of June , the U.S. Bureau of Labor Statistics reported today. Over the month, the number of hires and total separations decreased to 5.9 million and 5.6 million, respectively. Within separations, quits (3.8 million) decreased, while layoffs and discharges (1.5 million) changed little. emphasis added The following graph shows job openings (black line), hires

Wealth Management

AUGUST 1, 2023

All of CI Private Wealth's offices will now operate as Corient, the brand of one of its acquired firms. CI wants to integrate all of its acquisitions into one RIA.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Calculated Risk

AUGUST 1, 2023

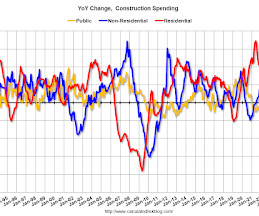

From the Census Bureau reported that overall construction spending increased: Construction spending during June 2023 was estimated at a seasonally adjusted annual rate of $1,938.4 billion, 0.5 percent above the revised May estimate of $1,929.6 billion. The June figure is 3.5 percent above the June 2022 estimate of $1,873.2 billion. emphasis added Both private and public spending increased: Spending on private construction was at a seasonally adjusted annual rate of $1,516.9 billion, 0.5 percent

Wealth Management

AUGUST 1, 2023

John Woods already pleaded guilty to federal charges that he raised more than $110 million in a Ponzi scheme. Plaintiffs in a suit against Oppenheimer & Co. claim the firm failed to protect his clients.

The Reformed Broker

AUGUST 1, 2023

Final Trades: McDonald’s, Qualcomm & more from CNBC. The post Clips From Today’s Halftime Report appeared first on The Reformed Broker.

Wealth Management

AUGUST 1, 2023

About 6.4 million borrowers, including some who left school during the pause, still lack a repayment plan.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Calculated Risk

AUGUST 1, 2023

Notes: This CoreLogic House Price Index report is for June. The recent Case-Shiller index release was for May. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA). From CoreLogic: US Annual Home Price Growth Inches Up in June • U.S. home prices continued to reach new highs in June and are 41% above pre-pandemic levels. • Annual U.S. single-family home price growth was up by 1.6% in June after increasing by 1.5% in May, marking the 137th straight month of year

Wealth Management

AUGUST 1, 2023

Unless 3.6% unemployment is the new normal, the central bank has more tightening to do.

Nerd's Eye View

AUGUST 1, 2023

Welcome back to the 344th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Brad Barrett. Brad is the Managing Director and Partner of One Capital Management, an independent RIA based in Westlake Village, California, with locations across the country, that oversees $5.3 billion in assets under management for more than 2,000 client households.

Wealth Management

AUGUST 1, 2023

The ICE risk matching auction, which matches buyers and sellers of the same corporate bond or list of bonds to determine the best price for the transaction, was reworked and went live in recent months after years of being dormant.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

AUGUST 1, 2023

(Posted with permission). The ISM manufacturing index indicated contraction. The PMI® was at 46.4% in July, up from 46.0% in June. The employment index was at 44.4%, down from 48.1% the previous month, and the new orders index was at 47.3%, up from 45.6%. From ISM: Manufacturing PMI® at 46.4% July 2023 Manufacturing ISM® Report On Business® Economic activity in the manufacturing sector contracted in July for the ninth consecutive month following a 28-month period of growth, say the nation's supp

Fintoo

AUGUST 1, 2023

Highlights Issue Size – 179-189 mn shares Issue Open/Close – Aug 3/Aug 7, 2023 Price Band (Rs) 54-57 Issue Size- Rs 10.25 bn Face Value (Rs) 10 Lot Size (shares) 260 SBFC Finance Ltd. was Started in 2017 and it is a systemically important, non-deposit taking Non-Banking Finance Company (NBFC) that provides Secured MSME loans […] The post SBFC Finance Ltd IPO (Subscribe) appeared first on Fintoo Blog.

Gen Y Planning

AUGUST 1, 2023

Every day, you’re inundated with information. From social media to texts, phone calls, emails, and news alerts—it’s incredible how much information we process regularly. So when it comes to handling your finances, it’s natural to think that the information you hear repeatedly is the best advice to follow. Right? Well, not quite. Here are five pieces of popular personal finance advice we can almost guarantee you’ve heard before and why you shouldn’t necessarily take it.

NAIFA Advisor Today

AUGUST 1, 2023

Today is the day it all begins. Every August, Congress recesses, allowing Senators and Representatives to spend a few weeks working from their home states and districts. Things slow to a crawl in our nation’s capital but they really heat up in Congressional districts across the country. It’s an opportunity NAIFA does not pass up.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

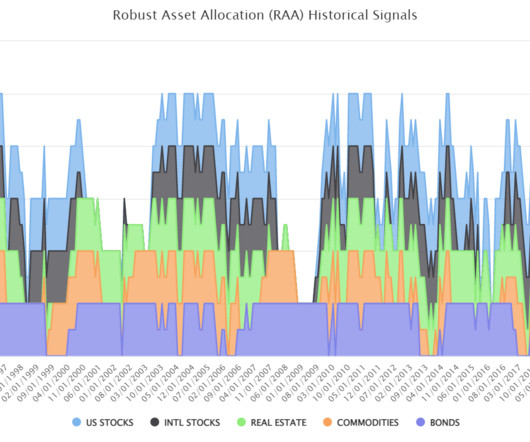

Alpha Architect

AUGUST 1, 2023

Full exposure to domestic equities. Full exposure to international equities. Partial exposure to REITs. Partial exposure to commodities. No exposure to intermediate-term bonds. DIY Trend-Following Allocations: August 2023 was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

NAIFA Advisor Today

AUGUST 1, 2023

In the rapidly evolving health insurance sales landscape, efficient process management poses significant challenges for Field Marketing Organizations (FMOs) and Brokerage General Agencies (BGAs). Enrollment, quoting, customer management and engagement, and commissions are handled by disparate platforms that lack communication and may not be tailored to the industry's specific needs.

Advisor Perspectives

AUGUST 1, 2023

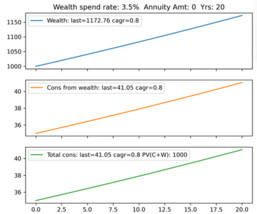

Advisors and investors wonder what role annuities should play in retirement planning. Here are the pros and cons of a common annuity product versus consuming out of invested wealth.

Million Dollar Round Table (MDRT)

AUGUST 1, 2023

By Bryce Sanders Making friends within the high-net-worth (HNW) community isn’t as easy as making friends at the school playground. It gets more complex as we get older, but it’s not impossible. You need to learn to play by their rules though. Before we look at the unwritten rules, be aware that everyone in sales considers everyone with money a potential prospect.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content