Impact of New $15M 'Permanent' Estate/Gift Tax Exemption

Wealth Management

JULY 7, 2025

Explore how the new $15 million federal estate tax exemption affects lifetime transfer planning and strategies for high-net-worth clients.

Wealth Management

JULY 7, 2025

Explore how the new $15 million federal estate tax exemption affects lifetime transfer planning and strategies for high-net-worth clients.

Abnormal Returns

JULY 7, 2025

Podcasts Michael Batnick talks with Jason Wenk, CEO of Altruist, about the changing custody landscape. (youtube.com) Jeff Bernier talks with Larry Swedroe about the the evolving role of alternative assets like private credit and reinsurance in modern portfolios. (youtube.com) Barry Ritholtz talks with Kate Moore, chief investment officer at Citi Wealth.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JULY 7, 2025

Bill Ramsay, the founder of Financial Symmetry, grew his RIA Edge 100 RIA firm organically with shared employee ownership and an internship program that has led to a young, invested team.

Advisor Perspectives

JULY 7, 2025

U.S. stocks are no longer the best-performing asset class this year. Gold and foreign stocks are the best performers.

Advertisement

The office of the CFO is rapidly evolving, with more and more demands being placed upon the finance and accounting team each year. Join us in this webinar, where we share 8 things to NOT do when it comes to helping the CFO office advance in supporting the business. Learning Objectives: This course objective is to understand how best to support an organization's finance leadership.

Wealth Management

JULY 7, 2025

Zephyr's Ryan Nauman and FolioBeyond's Dean Smith cover the changing landscape of fixed income investing, the impact of tariffs, the importance of managing drawdown risk, and adapting investment strategies to modern market conditions.

Nerd's Eye View

JULY 7, 2025

Welcome to the July 2025 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors! This month's edition kicks off with the news that CRM provider Wealthbox has sold a majority stake in itself to PE firm Sixth Street, marking a new phase in its growth from having a customer base primarily concentrated among small and midsize RIA firms

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Alpha Architect

JULY 7, 2025

This paper explores how value, momentum, low-risk, and size factors explain differences in corporate bond returns across firms and over time. What Factors Drive Corporate Bond Returns? was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Diamond Consultants

JULY 7, 2025

Part two of the series “UBS at a Crossroads” explores the possible outcomes and implications for UBS advisors and their businesses. When a firm as globally powerful as UBS begins to show cracks in the foundation, the result is not chaos, but quiet unrest. Advisors don’t panic. They observe. They listen. They assess. And then they begin to consider their options.

Validea

JULY 7, 2025

In investing, it’s often not just the news that matters — it’s how investors react to it. One of the most underappreciated signals in the market is when analysts raise their earnings forecasts. Research shows that the market tends to underreact to this kind of good news, creating a window of opportunity for those paying attention. That’s the premise behind the Earnings Revision Investor strategy developed by Wayne Thorp and implemented by Validea.

Don Connelly & Associates

JULY 7, 2025

If you’re a financial advisor with ambitions for sustainable success, you know the quest for new clients must be constant but what about optimizing your lead generation? You pour time and resources into various lead generation activities, from networking events to online marketing. But how do you truly know if your efforts are paying off? Are you simply generating a high volume of names, or are you attracting the right individuals likely to become valued clients?

Speaker: Dylan Secrest, Founder of Alamo Innovation and Construction Digital Transformation Consultant

Construction payment workflows are notoriously complex when you consider juggling multiple stakeholders, compliance requirements, and evolving project scopes. Delays in approvals or misaligned data between budgets, lien waivers, and pay applications can grind progress to a halt. The good news? It doesn't have to be this way! Join expert Dylan Secrest to discover how leading contractors are turning payment chaos into clarity using digital workflows, integrated systems, and automation strategies.

Wealth Management

JULY 7, 2025

As 401(k) plan formation explodes, banks may step in to serve the market. JPMorgan's success offers a model, but challenges remain for new entrants.

Trade Brains

JULY 7, 2025

A weekend promise of instant residency through cryptocurrency has crumbled. United Arab Emirates authorities forcefully rejected claims linking Toncoin staking to its prized Golden Visa program. This swift denial followed a misleading announcement that briefly sent Toncoin prices soaring. Major government bodies united to set the record straight. The Federal Authority for Identity, Citizenship, Customs and Port Security (ICP) took the lead.

Wealth Management

JULY 7, 2025

Merit Financial Advisors, with $19.94B in assets, agrees to sell a minority stake to Constellation Wealth Capital as it prepares for future growth.

Carson Wealth

JULY 7, 2025

What a first half it was, as the S&P 500 was down close to 20% at the April lows and incredibly have come back to new highs already, one of the fastest recoveries ever. We’ve discussed why this market may be like a slingshot and here’s another way to show why the shakeout and recovery in the first half could be a good sign for the bulls for the rest of 2025.

Advertisement

You wouldn’t keep using a 2009 flip phone - so why settle for outdated close processes? It’s time for an upgrade. SkyStem's Guide to Month-End Close Software walks you through what today’s best tools can do (and what your team shouldn’t have to deal with anymore). Get smart, fast, and a whole lot less stressed when it’s time to close the books.

Trade Brains

JULY 7, 2025

The following is a list of four stocks that witnessed notable price movements during Monday’s trading session, following significant bulk deal transactions executed on the stock exchanges on 4th July. These fluctuations reflect investor sentiment and market reactions to the large-scale buying or selling activities observed during the period. Dreamfolks Services Limited With a market cap of Rs. 963 crores, the stock moved down by nearly 7 percent on BSE, falling to Rs. 177.6 on Monday.

Advisor Perspectives

JULY 7, 2025

A pre-summer frenzy in junk loans is seeing the market start to overheat, prompting investors to get a bit more picky about deals after spreads reached the tightest levels in years.

Trade Brains

JULY 7, 2025

The Shares of a power company jumped over 18% after reports said the Adani Group is likely to buy its parent firm for Rs 12,500 crore. Investors expect the deal to benefit the company, as the parent holds a big stake and the businesses fit well with Adani’s plans. With a market capitalization of Rs 15,208 Crores, the share price of Jaiprakash Power Venture Limited was trading over 18% up to hit an intraday high of Rs 22.25 per share from its previous closing price of Rs 18.95 per share.

WiserAdvisor

JULY 7, 2025

Are you thinking about cashing in on your Roth Individual Retirement Account (IRA) early? Before you make the move, it is important to understand what you are really signing up for and how this one decision affects multiple things. First off, let’s clear up some confusion. There are several types of IRAs, such as Traditional, Roth, Simplified Employee Pension (SEP), and Savings Incentive Match Plan for Employees (SIMPLE).

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Walkner Condon Financial Advisors

JULY 7, 2025

Keith Poniewaz, Partner at Walkner Condon, provides the Q2 investment summary, covering market growth, U.S. dollar weakness, and global market performance.

Hubly

JULY 7, 2025

In this article, we will explore practical ways advisors can stay ahead of new technology and refine their processes to deliver the kind of service that no self-service app can match.

Advisor Perspectives

JULY 7, 2025

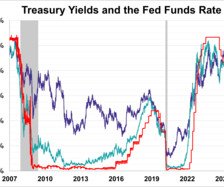

The yield on the 10-year note ended July 3, 2025 at 4.35%. Meanwhile, the 2-year note ended at 3.88% and the 30-year note ended at 4.86%.

Getting Your Financial Ducks In A Row

JULY 7, 2025

Photo credit: jb We’ve discussed here in the past about how it is a perfectly legal maneuver to make a non-deductible contribution to a traditional IRA and then at some point later convert the same contribution to your Roth IRA (see Is it Really Allowed? for more). If you have no other IRA accounts, this conversion to Roth can be a tax-free event, especially if there has been no growth or gains on the investments in the account.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Fintoo

JULY 7, 2025

Market Commentary Global markets – US indices closed higher on Thursday over stronger dollar supported by Jobs data. Dow Jones closed green by 0.8 pct. While Nasdaq jumped 1 pct. Global Indices % Change Last Close 1 day YTD Dow Jones 44,828 0.8 5.4 Nasdaq 20,601 1.0 6.7 Hang Seng 23,810 -0.4 18.7 […] The post Market Morning Notes For 8th July 2025 appeared first on Fintoo Blog.

Advisor Perspectives

JULY 7, 2025

Goldman Sachs Group Inc. is leading a potential transaction for Gray Media Inc. to help the company refinance some of its existing debt, according to people with knowledge of the matter.

Carson Wealth

JULY 7, 2025

Carson Wealth’s Jon Read, CFP®️, ChFC®️, AIF®️, Partner, Wealth Advisor and Justin Schultes, CFP®️, AIF®️, MBA, Partner, Wealth Advisor with some discussion around the importance to stay in the market. The post Missing the 10 Best Days Can Crush Returns appeared first on Carson Wealth.

Random Roger's Retirement Planning

JULY 7, 2025

How miserable would the following three years be? The portfolio on the left was up a little in 2012 but lagged VBAIX, on the right, that year by almost 400 basis points. But the long term result in meaningfully better and less volatile than VBAIX. Admittedly, enduring that long of a period with a meaningful lag like that would be very difficult to do but if you don't think you could sit through that, maybe your portfolio could be constructed in such a way that when it does lag, I promise you any

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Trade Brains

JULY 7, 2025

Synopsis: Jio BlackRock has successfully raised Rs. 17,800 crore through its first New Fund Offering (NFO), comprising three short-term debt mutual funds which are the Overnight Fund, Liquid Fund, and Money Market Fund. In a landmark debut, Jio BlackRock Asset Management has entered India’s mutual fund industry with remarkable momentum, leveraging the combined strength of Reliance’s financial reach and BlackRock’s global investment expertise.

Norman Marks

JULY 7, 2025

Politicians in the US (at least on one side of the aisle) love to talk about “waste, fraud, and abuse”. How big is it? Google AI tells us: Estimates of the financial impact of waste, fraud, and abuse within the United States government and in specific sectors like healthcare reveal a significant drain on resources.

Calculated Risk

JULY 7, 2025

From Matthew Graham at Mortgage News Daily: Mortgage Rates Continue Higher For Third Straight Day For the entire 2nd half of June, it was easy to be spoiled by the absence of volatility in mortgage rates. During that time, rates were either lower or unchanged every single day. The past few business days have been a different story. [ 30 year fixed 6.79% ] emphasis added Tuesday: • At 6:00 AM ET, NFIB Small Business Optimism Index for June.

Advisor Perspectives

JULY 7, 2025

Investors looking for cash flow from commercial real estate may want to check out the debt side.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Let's personalize your content