Tap Into Your Clients’ Interest in Charitable Planning

Wealth Management

JUNE 9, 2025

Financial advisors should prioritize charitable giving discussions to meet growing client interest and strengthen relationships with younger generations.

Wealth Management

JUNE 9, 2025

Financial advisors should prioritize charitable giving discussions to meet growing client interest and strengthen relationships with younger generations.

Abnormal Returns

JUNE 9, 2025

Podcasts Jess Bost and Mark Newfield talk with Phil Pearlman about the connection between health and executive function. (podcasts.apple.com) Dan Haylett talks with Brendan Frazier about the art of spending money in retirement. (podcasts.apple.com) 14 of the best finance podcasts all investors should listen to including 'The Compound and Friends.' (forbes.com) UHNW The super-rich really are different.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JUNE 9, 2025

Ralph Haberli joins Edelman Financial Engines as president, tasked with improving workplace offerings and expanding the firm's national footprint.

Calculated Risk

JUNE 9, 2025

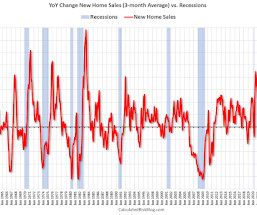

Early in February , I expressed my "increasing concern" about the negative economic impact of "executive / fiscal policy errors", however, I concluded that post by noting that I was not currently on recession watch. In early April, I went on recession watch , but I'm still not yet predicting a recession for several reasons: the U.S. economy is very resilient and was on solid footing at the beginning of the year, the administration might reverse many of the tariffs (we've seen that before), and C

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

JUNE 9, 2025

A former JPMorgan financial advisor is taking legal action against the firm, alleging wrongful termination after her breast cancer diagnosis prevented her return to work.

Nerd's Eye View

JUNE 9, 2025

2025 has had a tumultuous start for most advisory firms, as tariffs-driven market volatility has increased client anxiety and the amount of required hand-holding, forcing advisory firms to manage their own expenses a bit more closely in the face of greater revenue uncertainty. In the meantime, the buzz around AI continues to increase as well, less now about whether the tools will replace financial advisors (they don't), and more about how advisory firms can better leverage the technology to be m

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

JUNE 9, 2025

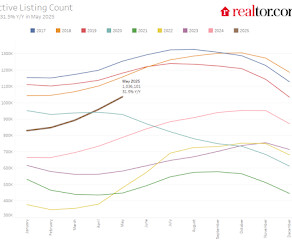

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-June 2025 A brief excerpt: This 2-part overview for mid-June provides a snapshot of the current housing market. First, a quote from Toll Brothers CEO Douglas Yearley Jr.: “The spring selling season, which is really a winter selling season, is when most new homes are sold in this country.

The Big Picture

JUNE 9, 2025

I grew up in the generation of latchkey kids: Both parents worked; you came home from school, fixed yourself a quick bite, then ran off to the playground for some stick- or b-ball. We weren’t wildly overscheduled; we didn’t have 20 hours a week of school events, after-school activities, and projects. We were (mostly) on our own. This led to a generation of parents who recognized the risks all this unsupervised play created.

Calculated Risk

JUNE 9, 2025

The ICE Home Price Index (HPI) is a repeat sales index. ICE reports the median price change of the repeat sales. From ICE (Intercontinental Exchange): • Recent data shows home price growth continued to cool, dropping to an annual growth rate of +1.4%, down from an already low +1.6% mid-month. • On a seasonally adjusted basis, prices fell by -0.01% in the month – the first decline in this metric since 2022. • In fact, if you back out outliers, such as the Fed rate hikes in 2022 and the COVID shut

Wealth Management

JUNE 9, 2025

The minority RIA investor has hired Lara Galloway to lead organic growth strategy and training for partnered firms, and Melinda Brodbeck as head of communications.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Calculated Risk

JUNE 9, 2025

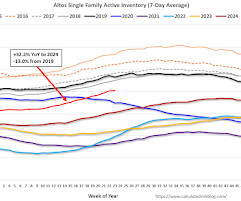

Altos reports that active single-family inventory was up 0.6% week-over-week. Inventory is now up 29.5% from the seasonal bottom in January and is increasing. Usually, inventory is up about 17% from the seasonal low by this week in the year. So, 2025 is seeing a larger than normal pickup in inventory. The first graph shows the seasonal pattern for active single-family inventory since 2015.

Abnormal Returns

JUNE 9, 2025

Strategy Americans have the risk bug. (awealthofcommonsense.com) Who exactly are you listening to and why? (ritholtz.com) Crypto Strategy ($MSTR) keeps attracting copycats. (sherwood.news) The Winkelvoss' Gemini has filed to go public. (theblock.co) Apple The case for the Apple ($AAPL) TV from a privacy perspective. (arstechnica.com) You may not know who Bill Atkinson, but you are likely influenced by his work every day.

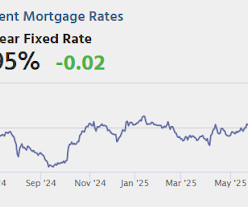

Calculated Risk

JUNE 9, 2025

From Matthew Graham at Mortgage News Daily: Mortgage Rates a Hair Lower to Start The Week As hoped, Friday's big rate spike did not carry additional momentum into the new week. This is occasionally a risk when rates are responding to big surprise in the jobs report, but slightly less of a risk when the other economic data had been weaker. [ 30 year fixed 6.95% ] emphasis added Tuesday: • At 6:00 AM ET, NFIB Small Business Optimism Index for April.

Carson Wealth

JUNE 9, 2025

Inching Closer to New Highs Stocks had some drama last week as the president of the United States and the world’s richest man had a very public falling out, but that did little to slow down the bull market. The S&P 500 is now just a chip shot away from new highs, something that was unfathomable to most this time two months ago. Although US returns have been fairly muted this year after the back-to-back 20% gains the previous two years, what might surprise many US investors is that most globa

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Advisor Perspectives

JUNE 9, 2025

Investors nearing or in retirement who are currently defaulted into TDFs need to stop defaulting and move to safety now.

Trade Brains

JUNE 9, 2025

The stock of the company jumped over 3 percent after major global investors like Goldman Sachs, Morgan Stanley, and Societe Generale, along with others, bought up to 2.86 crore shares. This strong buying interest from top financial institutions boosted investor confidence and drove the stock price higher. Here are the 2 stocks in which promoters offload stakes Azad Engineering Limited With a market capitalization of Rs. 10,894.94 crores, the share of Azad Engineering Limited has reached an intra

A Wealth of Common Sense

JUNE 9, 2025

Today’s Talk Your Book is brought to you by Franklin Templeton: See here for more information on their international strategies On today’s show, we discuss: U.S. outperformance vs international Currency headwinds for international exposure How can international equities see sustained outperformance over the U.S.? The value factor internationally How to find income-focused firms High-performing countries outsi.

Trade Brains

JUNE 9, 2025

When you are preparing for retirement, you should keep in mind both financial strategies and what tax benefits you may gain. Older citizens can get helpful guidance from the Income Tax Department’s special brochure for retirement taxation matters. This document looks at the benefits offered by the Income Tax Act 1961 for those retiring. Target Beneficiaries The tax provisions outlined below apply to individuals who: Have reached or exceeded 60 years of age Have concluded their service in governm

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

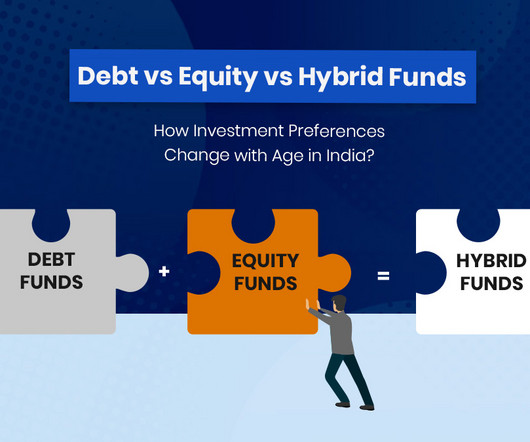

Fintoo

JUNE 9, 2025

When it comes to investing, one size never fits all. In India’s dynamic financial ecosystem, age plays a massive role in shaping how people choose to grow and protect their money. And it’s not just a hunch — it’s backed by data. A joint report by AMFI and Crisil Intelligence offers fascinating insight into how […] The post Debt vs Equity vs Hybrid Funds: How Investment Preferences Change with Age in India appeared first on Fintoo Blog.

Trade Brains

JUNE 9, 2025

In the digital-first era, it is more crucial than ever to protect your online payments. Virtual Credit Cards (VCCs) are a solution many people turn to for secure and hassle-free payments. This article outlines what virtual credit cards are, how they are used, why they are useful, and a few of the most popular virtual credit card companies in India in 2025.

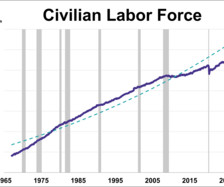

Advisor Perspectives

JUNE 9, 2025

What does the ratio of unemployment claims to the civilian labor force tell us about where we are in the business cycle and recession risk?

Trade Brains

JUNE 9, 2025

Today, thirteen stocks hit their 20 percent daily limit, indicating strong investor interest in small, fast-growing companies. This surge suggests that investors are increasingly willing to take risks and see potential in undervalued sectors. However, such rapid gains can be volatile, so investors should proceed with caution and conduct thorough research before making any decisions.

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Validea

JUNE 9, 2025

The S&P 500 continues to push new highs, driven largely by a concentrated group of mega-cap technology names. Microsoft (MSFT), NVIDIA (NVDA), Apple (AAPL), Amazon (AMZN), Meta Platforms (META), Broadcom (AVGO), and Alphabet (GOOGL) together account for more than a quarter of the index’s total weight. Their dominance has fueled strong index-level returns – but also led to stretched valuation multiples across the broader market.

Don Connelly & Associates

JUNE 9, 2025

Of all the functions financial advisors must perform, generating leads consistently is one of the most critical and challenging. While expertise and service delivery are paramount, business growth stalls, and revenue becomes unpredictable without a steady stream of potential clients. Lead generation for Financial Advisors isn't just about finding clients; it's about implementing a structured, repeatable process that brings in the right prospects over time.

Advisor Perspectives

JUNE 9, 2025

Research trips are an integral component of our active, fundamental investment process. Our investment teams meet with different companies, attend conferences, and travel to new markets around the world, gaining insights for our clients and a deeper understanding of potential investments.

NAIFA Advisor Today

JUNE 9, 2025

Grace Staten is a seasoned marketing executive with over 25 years of experience in the financial services industry. She has led comprehensive initiatives in branding, digital strategy, public relations, and advisor development, significantly enhancing organizational growth and visibility. Grace holds a MBA in finance from San Jose State University, FSCP designation, and multiple FINRA licenses.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Advisor Perspectives

JUNE 9, 2025

Retail traders using sophisticated quantitative strategies are starting to have a surprising and noticeable impact on financial prices.

Trade Brains

JUNE 9, 2025

On June 5 of 2025, Maharashtra witnessed the final milestone of an extraordinary transformative infrastructure project. Opening of the final 76-kilometer section between Thane and Igatpuri. With this project, the Mumbai-Nagpur Samruddhi Mahamarg officially stands complete at 701 kilometers, which slashes the travel time between the two cities from nearly 16 hours to just 8 hours.

Advisor Perspectives

JUNE 9, 2025

Systematic fixed-income investing is attracting increased attention but needs specialist skills and resources. Would your manager have what it takes?

Trade Brains

JUNE 9, 2025

The Reserve Bank of India (RBI) has announced new rules for gold loans, which are easier than what was planned earlier. These rules mainly help people take smaller loans, and Morgan Stanley has picked these two Gold Financing companies as its Top pick. What is the New Gold Loan Update The new rules for gold loans have made borrowing more accessible, especially for smaller borrowers.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Let's personalize your content