Research links: persistent investment factors

Abnormal Returns

DECEMBER 19, 2023

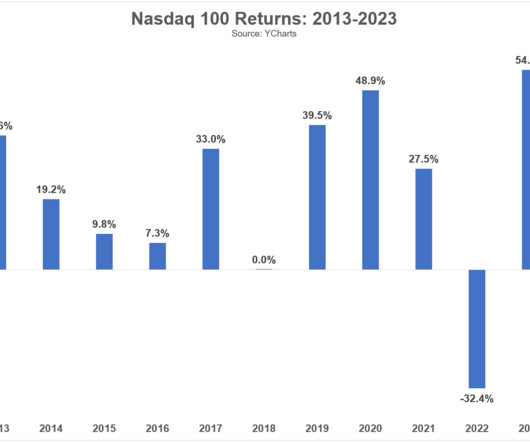

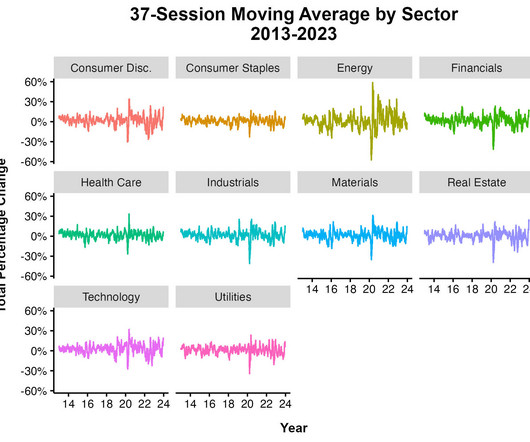

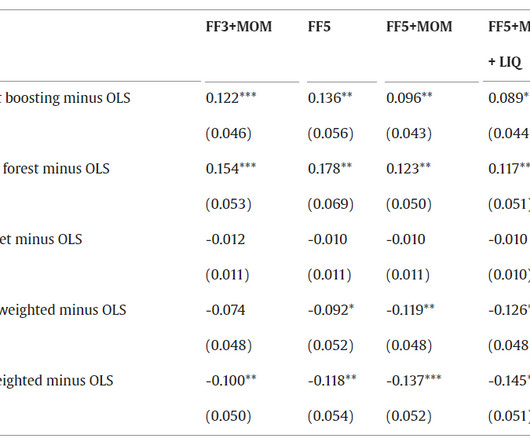

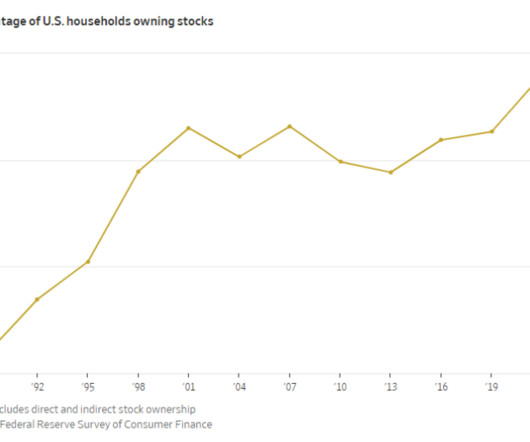

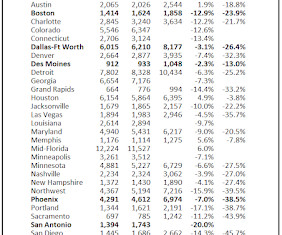

Factors Timing returns factors is tempting, but difficult in practice. (alphaarchitect.com) The high quality anomaly shows up across asset classes. (advisorperspectives.com) A history of quant investing and the state of the factor zoo. (on.ft.com) Corporate finance Stock-based compensation makes a big difference for company valuations. (tdmgrowthpartners.com) Profit margins are high, debt refinancings are coming.

Let's personalize your content