Wrongfully Detained Americans Welcomed Back with IRS Penalties

Wealth Management

AUGUST 14, 2024

The agency doesn’t have the authority to fully forgive fines and interest.

Wealth Management

AUGUST 14, 2024

The agency doesn’t have the authority to fully forgive fines and interest.

Calculated Risk

AUGUST 14, 2024

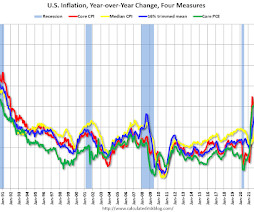

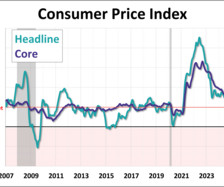

Here are a few measures of inflation: The first graph is the one Fed Chair Powell had mentioned when services less rent of shelter was up around 8% year-over-year. This declined and is now up 4.6% YoY. Click on graph for larger image. This graph shows the YoY price change for Services and Services less rent of shelter through July 2024. Services were up 4.9% YoY as of July 2024, down from 5.0% YoY in June.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

AUGUST 14, 2024

More than two dozen broker/dealers and RIAs agreed to pay a combined $392.75 million in penalties, including Raymond James, LPL, Edward Jones and Osaic, among others.

Calculated Risk

AUGUST 14, 2024

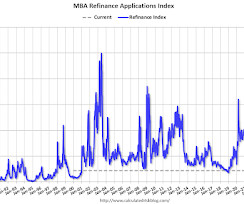

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey Mortgage applications increased 16.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending August 9, 2024. The Market Composite Index, a measure of mortgage loan application volume, increased 16.8 percent on a seasonally adjusted basis from one week earlier.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

AUGUST 14, 2024

According to the commission, Russell Todd Burkhalter, the CEO of Drive Planning, allegedly used new funds to pay existing investors’ returns and personal expenses, including yacht and private jet payments.

Abnormal Returns

AUGUST 14, 2024

Companies Mars Inc. is buying Cheez-It maker Kellanova ($K). (wsj.com) Tilray Brands ($TLRY) has acquired four craft breweries from Molson Coors ($TAP). (finance.yahoo.com) Finance How much of the work of a junior analyst can be done by AI? (ft.com) Reverse stock splits are usually a last ditch effort. (sherwood.news) Fund management Ten questions for Vanguard's new CEO Salim Ramji.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

AUGUST 14, 2024

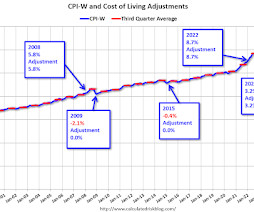

The BLS reported this morning: The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 2.9 percent over the last 12 months to an index level of 308.501 (1982-84=100). For the month, the index increased 0.1 percent prior to seasonal adjustment. CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA).

Wealth Management

AUGUST 14, 2024

Our speakers will cover the basics of private foundations, including what they are, the basic requirements for creating and maintaining them, which clients will benefit from creating them, their tax implications and how they differ from donor-advised

Calculated Risk

AUGUST 14, 2024

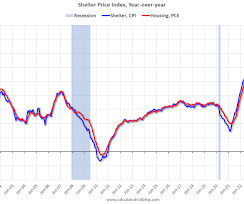

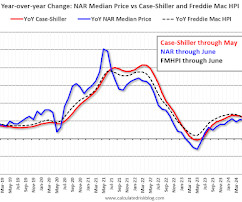

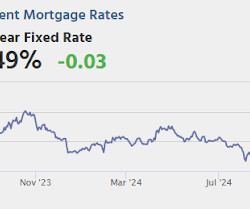

Today, in the Calculated Risk Real Estate Newsletter: Part 2: Current State of the Housing Market; Overview for mid-August 2024 A brief excerpt: Yesterday, in Part 1: Current State of the Housing Market; Overview for mid-August 2024 I reviewed home inventory, housing starts and sales. In Part 2, I will look at house prices, mortgage rates, rents and more.

Wealth Management

AUGUST 14, 2024

In the newly created role as CMO, Samantha Schwimmer will help Advyzon move into new market segments.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Calculated Risk

AUGUST 14, 2024

From the BLS : The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent on a seasonally adjusted basis , after declining 0.1 percent in June, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.9 percent before seasonal adjustment. The index for shelter rose 0.4 percent in July, accounting for nearly 90 percent of the monthly increase in the all items index.

Wealth Management

AUGUST 14, 2024

The Securities Industry and Financial Markets Association filed a lawsuit against the regulation that took effect last year, saying there was “no precedent for it in the securities laws.

Calculated Risk

AUGUST 14, 2024

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Thursday: • At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 238 thousand initial claims, up from 233 thousand last week. • Also at 8:30 AM, Retail sales for July is scheduled to be released. The consensus is for 0.3% increase in retail sales. • Also at 8:30 AM, The New York Fed Empire State manufacturing survey for August.

Wealth Management

AUGUST 14, 2024

For years, RBC executive Shareen Luze struggled with anxiety. But the more she was vulnerable and shared her story in the workplace, the more she connected with people. Today, she brings a unique perspective on the role a sense of belonging plays within corporate mental health strategies.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Calculated Risk

AUGUST 14, 2024

The Cleveland Fed released the median CPI and the trimmed-mean CPI. According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% in July. The 16% trimmed-mean Consumer Price Index increased 0.2%. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Wealth Management

AUGUST 14, 2024

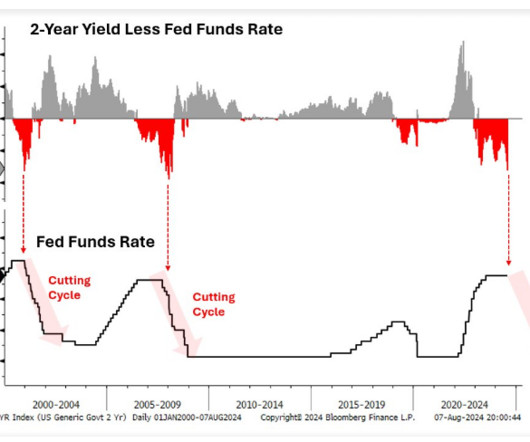

Ask "why is the Fed cutting rates?” rather than just focusing on the cuts themselves.

Advisor Perspectives

AUGUST 14, 2024

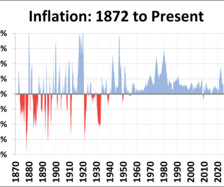

The Consumer Price Index for Urban Consumers (CPI-U) released for July puts the year-over-year inflation rate at 2.89%. The latest reading keeps inflation below the 3.74% average since the end of the Second World War for the 14th straight month. However, inflation remains above the 10-year moving average which is now at 2.83%.

Wealth Management

AUGUST 14, 2024

Open, honest and candid discussion about lawsuits against TIAA and Morningstar, CITs bigger than mutual funds in TDFs, private equity in retirement plans and more.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Advisor Perspectives

AUGUST 14, 2024

Here are some lessons from interviewing financial advisors and insights into the traits that lead to a recommendation.

A Wealth of Common Sense

AUGUST 14, 2024

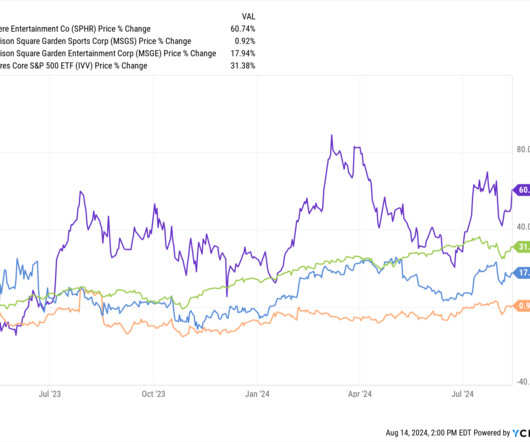

Today’s Animal Spirits is brought to you by YCharts and Fabric: See here for 20% off your initial YCharts professional subscription Go to meetfabric.com/spirits for more information on life insurance from Fabric by Gerber Life On today’s show, we discuss: Campbell Harvey on the soft landing Has the U.S. Economy Reached a Tipping Point? Flights, Hotels and Parks Are All Flashing Travel Warning Signs Rece.

Steve Sanduski

AUGUST 14, 2024

Guest: Erin Scannell , Chief Executive Officer of Heritage Wealth Advisors. In a Nutshell: When I talked to Erin Scannell in 2020, he was directing 50 team members, 18 advisors, and about $2 billion in AUM. Four years later, Heritage has doubled to $4 billion in AUM, and Erin is in charge of over 80 team members, including 20 advisors and a robust support team.

Wealthfront

AUGUST 14, 2024

Welcome to our Ask Wealthfront series, where we tackle your questions about personal finance and investing. Want to see your question answered here? Reach out to us on social media and we’ll try to address it in a future column. I’m saving for a house. Should I invest my down payment or keep it in […] The post Ask Wealthfront: Should I Invest My Down Payment?

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Advisor Perspectives

AUGUST 14, 2024

Criticism is a gift when it is used to push people to greatness and watch them develop into their potential.

Random Roger's Retirement Planning

AUGUST 14, 2024

The Bridges Tactical ETF (BGDS) is a new to me ETF that I stumbled into. It is actively managed and allocates to equities and or cash based on a process that I'll get into a little bit below. At a high level it is trying to provide equity upside with less risk. There are of course many different ways that funds try to deliver that result. Narrowing in slightly, the fund uses a three step approach that I'd describe as top down to determine risk on or risk off.

Financial Symmetry

AUGUST 14, 2024

How do you begin to save for your children to go to college? With the rising costs of college education, is it worth the monetary commitment? Including tuition & fees, room & board, books & supplies, etc. the average cost … Continued The post How to Pay for College in 3 Phases, Ep #222 appeared first on Financial Symmetry, Inc.

Advisor Perspectives

AUGUST 14, 2024

Regulators and investors have always had a keen interest in the trades that corporates executives and board members make in their companies’ own shares. The government has to look out for the integrity of financial markets, of course, while investors are eager to ride insiders’ coattails. Unfortunately, it’s never been easy to read the insider tea leaves.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

SEI

AUGUST 14, 2024

Investors remain nervous in the aftermath of the recent market decline.

Advisor Perspectives

AUGUST 14, 2024

Inflation cooled for a fourth straight month in July, dropping to its lowest level since March 2021. According to the Bureau of Labor Statistics, the headline figure for the Consumer Price Index fell to 2.9% year-over-year, lower than the expected 3.0% growth. Additionally, core CPI cooled to 3.2% as expected.

Midstream Marketing

AUGUST 14, 2024

Key Highlights Search for ways to get new clients and grow your financial advisor business. Try different strategies like using LinkedIn for networking, hosting webinars, sending email campaigns, and creating great content. Learn how to use Google Ads, set up referral programs, and engage with your community to reach more people. Understand why social media marketing is important on sites like Facebook and Instagram.

NAIFA Advisor Today

AUGUST 14, 2024

Financial Clarity by Design in Spencer, Wisconsin is a NAIFA 100% Agency The National Association of Insurance and Financial Advisors (NAIFA) is pleased to announce that Financial Clarity by Design in Spencer, Wisconsin has become a NAIFA 100% Agency. Under the membership program, Financial Clarity by Design has enrolled all its advisors as NAIFA members, enrolled them in NAIFA’s grassroots advocacy programs, and encourages them to participate in NAIFA as a group.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Let's personalize your content