Litman Gregory Acquires Private Client Business of Wedgewood Partners

Wealth Management

AUGUST 4, 2023

California-based Litman Gregory has completed its second acquisition under parent company iM Global Partner in a bid to become a national RIA.

Wealth Management

AUGUST 4, 2023

California-based Litman Gregory has completed its second acquisition under parent company iM Global Partner in a bid to become a national RIA.

Nerd's Eye View

AUGUST 4, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that credit ratings agency Fitch on Tuesday downgraded its assessment of the U.S. government's creditworthiness from an AAA rating to AA+. While the downgrade has made headlines and might be startling to advisory clients (particularly those with significant portfolio allocations to U.S.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

AUGUST 4, 2023

Focus Financial co-founders Rajini Kodialam and Lenny Chang are leaving their executive roles at the firm, according to a source, and CEO Rudy Adolf may not be far behind.

Calculated Risk

AUGUST 4, 2023

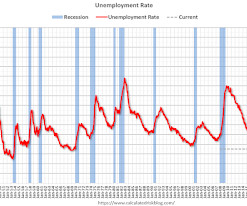

The headline jobs number in the July employment report was slightly below expectations, however, employment for the previous two months was revised down by 49,000, combined. The participation rate was unchanged, and the employment population ratio increased slightly, and the unemployment rate decreased to 3.5%. Leisure and hospitality gained 17 thousand jobs in July.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

AUGUST 4, 2023

Risk management expert Rick Bookstaber and Fabric CEO Govinda Quish discuss how technology is keeping up with risk management.

Abnormal Returns

AUGUST 4, 2023

Audio YouTube is working on being able to dub any language into another. (restofworld.org) Why it's inevitable the streaming services will welcome AI music. (honest-broker.com) Interviewing Russell Sherman talks with Barry Ritholtz about what he has learned through 500 episodes of the 'Masters in Business' podcast. (ritholtz.com) Matt Breitfelder, Partner and Global Head of Human Capital at Apollo, talks with Ted Seides about having better conversations.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Abnormal Returns

AUGUST 4, 2023

Strategy Why you can't hedge inflation in the short run. (whitecoatinvestor.com) A Q&A with William Bernstein author of "The Four Pillars of Investing." (wsj.com) Don't confuse collectibles with investments. (investmentnews.com) Apple Services and wearables are the standouts for Apple ($AAPL). (sixcolors.com) Why Apple ($AAPL) is shifting iPhone production to India.

Wealth Management

AUGUST 4, 2023

OneDigital's Jania Stout provides a primer on what to expect at the upcoming Wealth@Work conference.

The Big Picture

AUGUST 4, 2023

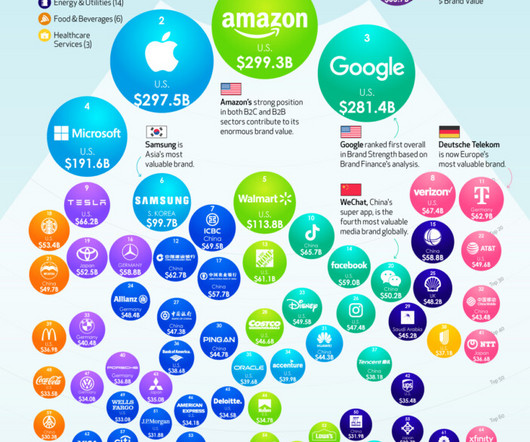

I am a sucker for a good infographic. This depiction of the top 100 brands by Brand Finance (via Visual Capitalist ) is a good example. They examined 5,000+ companies across 38 countries. A brand’s value represents “the allocation of company earnings that are linked to the brand.” By sector, its Tech at #1 (19.4%), Retail at #2 (15.0%), Media at #3 (14%), Banking at 4 (10.2%) and Automobiles at 5 (8.6%) click for original The post 100 Most Valuable Brands appeared first on The Big Pi

Wealth Management

AUGUST 4, 2023

True personalization means taking the time to understand your clients' preferred learning styles and communication preferences to lay the foundation for fruitful dialogue, genuine comprehension of your advice, and ultimately, sound decision-making and action by the client.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

AUGUST 4, 2023

Today, in the Calculated Risk Real Estate Newsletter: The impact of 7% Mortgage Rates A brief excerpt: The following table is from the Freddie Mac’s primary mortgage market survey (PMMS). Existing home sales bottomed in December 2022 and January 2023 on a seasonally adjusted annual rate (SAAR) basis. Those closed sales were for contracts signed mostly in the October through December timeframe when rates were the highest.

The Reformed Broker

AUGUST 4, 2023

Welcome to the latest episode of The Compound & Friends. This week, Michael Batnick, Joe Terranova, Mark Fisher, and Downtown Josh Brown discuss what it takes to be a trader, the energy sector, commodities, the US downgrade, treasuries, and much more! You can listen to the whole thing below, or find it wherever you like to listen to your favorite pods!

Calculated Risk

AUGUST 4, 2023

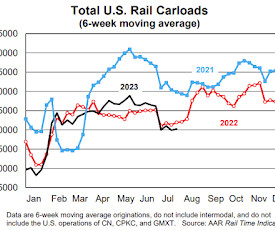

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission. The July 4th holiday complicates an analysis of U.S. rail volumes in July, but there were some encouraging signs. For example, the three non-July 4 weeks in July were the three highest-volume intermodal weeks of the year for U.S. railroads.

Alpha Architect

AUGUST 4, 2023

The empirical evidence demonstrates that returns to the low-beta anomaly are well explained by exposure to other common factors, and it has only justified investment when low-beta stocks were in the value regime, after periods of strong market and small-cap stock performance, and when they excluded high-beta stocks that had low short interest. The Quality Factor and the Low-Beta Anomaly was originally published at Alpha Architect.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Calculated Risk

AUGUST 4, 2023

From the BLS : Total nonfarm payroll employment rose by 187,000 in July, , and the unemployment rate changed little at 3.5 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, social assistance, financial activities, and wholesale trade. The change in total nonfarm payroll employment for May was revised down by 25,000, from +306,000 to +281,000, and the change for June was revised down by 24,000, from +209,000 to +185,000.

Discipline Funds

AUGUST 4, 2023

This has been one of the more fascinating years in economic and market history. The environment is so strange that there’s a narrative for pretty much everyone. For instance: Permabears can argue: Industrial production has slowed to 0%. PMI has been contracting all year. Retail sales have slowed to 0.5%. Housing starts and mortgage applications are down 40-50%.

Your Richest Life

AUGUST 4, 2023

Your Richest Life turns nine this month! I can’t believe we are almost at the ten year mark. When I started this business, I wanted to create financial planning services that were accessible and empowering. I hoped to help my clients reach their financial goals in a way that wasn’t stressful or intimidating, and to show them that their dreams were possible.

Accounting for Good

AUGUST 4, 2023

It's coming up to AGM season for many organisations, including not-for-profits. Here's how to make sure you run a successful AG!

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

FMG

AUGUST 4, 2023

For financial advisors, the process of creating marketing content can be too time-consuming, especially without help from an intern or marketing manager. Sacrifices are often made in terms of content quality or quantity, and the marketing efforts of these advisors often suffer as a result. The solution is to repurpose your content. This does not mean copy-pasting across email, social, etc.

Carson Wealth

AUGUST 4, 2023

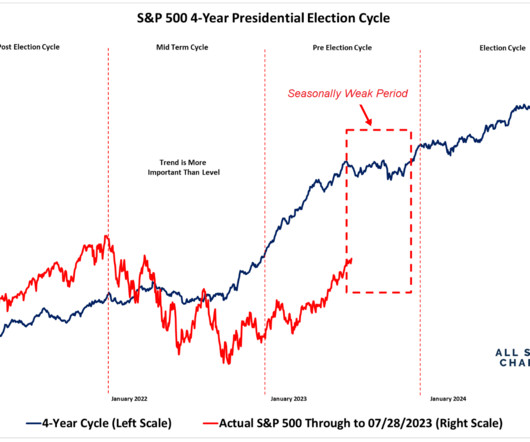

We’ve seen some incredibly strong economic data over the past week! Join Carson Group’s Chief Market Strategist Ryan Detrick and VP, Global Macro Strategist Sonu Varghese as they break down everything from the GDP to the stock market. Highlights include: · GDP grew well above expectations · The Fed raised rates, but they are likely done with hikes · We’re still seeing a bull market, but look for some seasonal weakness to slow growth Looking for more investment insights and market analysis?

Trade Brains

AUGUST 4, 2023

Fundamental Analysis of MRF: We all have memories of Sachin Tendulkar scoring centuries with an MRF bat. We grew older and learnt it is not a sport but a tyre company. Recently, its stock was bustling all over the news as it crossed Rs 1,00,000 per share price (yes, it is the most expensive listed Indian stock). All this pokes investor curiosity in us.

Tobias Financial

AUGUST 4, 2023

Our Wealth Advisor Catalina Franco-Cicero was featured in the recent episode of “Voices of the Goddess” podcast where she shared her inspiring story of becoming a financial advisor. The podcast delved deep into Catalina’s path, from her early years to her passion for the financial industry. Catalina revealed her approach to connecting with clients, her personal growth journey, and her unwavering dedication to professional evolution.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

AUGUST 4, 2023

While Washington continues a seemingly unbridled spending spree under the assumption “more spending” is better, debts and deficits matter. To better understand the impact of debt and deficits on economic growth, we must know where we came from.

Carson Wealth

AUGUST 4, 2023

There’s no question divorce is one of the most stressful and emotionally- charged experiences people may encounter in their adult lives. However, it is possible to get through a divorce with your self-esteem, finances and future intact. The key is careful and deliberate planning. Download Guide The post Divorce Planning appeared first on Carson Wealth.

Advisor Perspectives

AUGUST 4, 2023

The surprise move takes the rating to AA+ from AAA.

Calculated Risk

AUGUST 4, 2023

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Due to changes at the CDC, weekly cases are no longer updated. After the first few weeks, the pandemic low for weekly deaths had been the week of July 7, 2021, at 1,690 deaths (until recently). For COVID hospitalizations, the previous low was 9,821 (until recently). Recently hospitalizations have been increasing from a low of 5,300.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Advisor Perspectives

AUGUST 4, 2023

The Bank of Japan announced changes that could allow its yield curve control program to expire gradually if economic conditions are favorable.

A Wealth of Common Sense

AUGUST 4, 2023

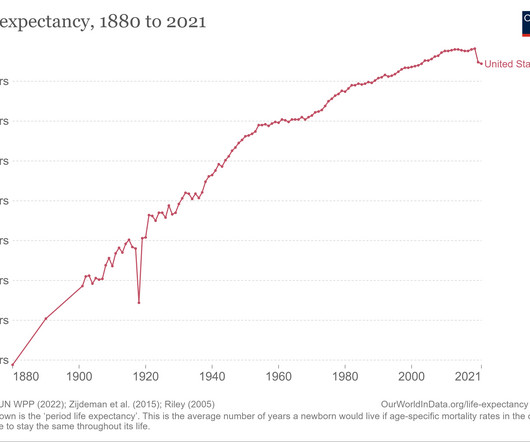

The most popular retirement plan for people in the early-20th century and before was simple — you died. No saving your entire career and moving to Florida or Arizona to golf your days away for the next 2-3 decades. No gold watch ceremonies when you hung it up at the office. Most people simply worked until they dropped dead because a life of leisure in retirement wasn’t a thing for most people.

Advisor Perspectives

AUGUST 4, 2023

Some of the most widely read financial news stories involve projections by Wall Street strategists such as Morgan Stanley’s Michael Wilson, who recently conceded he’d misjudged the direction of US stocks this year.

Advisor Perspectives

AUGUST 4, 2023

No amount of power and prosperity can stop the irritation of getting judged for your borrowing habits, as the world’s biggest economy just experienced.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content