Don’t Be Tempted By Pop-Up Estate Planning Schemes

Wealth Management

AUGUST 22, 2024

Stick with the basics when preparing for the high exemption sunset.

Wealth Management

AUGUST 22, 2024

Stick with the basics when preparing for the high exemption sunset.

Abnormal Returns

AUGUST 22, 2024

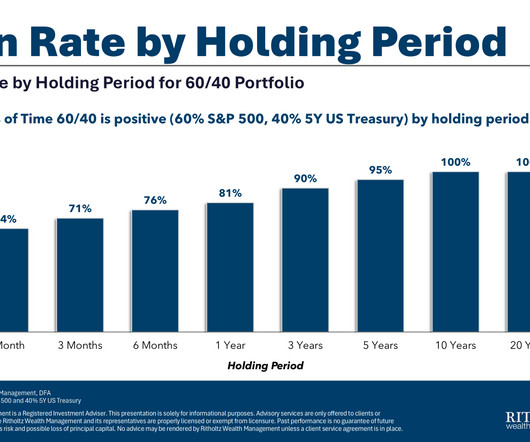

Strategy Successful investors have a long time horizon. (awealthofcommonsense.com) An example of overconfidence and leverage. (novelinvestor.com) Finance The VC boom of the early 2020s is showing up in historically bad performance. (sherwood.news) Credit card companies are adding additional perks like lounges at concert venues. (wsj.com) The popularity of sports gambling as a market failure.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

AUGUST 22, 2024

The nine-person Paradigm Group will open RBC’s first branch in Cincinnati.

The Big Picture

AUGUST 22, 2024

My keynote at the Greater Kansas City FPA Symposium 2024 is above. They are a great group of people, and very motivated to serve their clients. The deck is an updated version of last year’s presentation to investors at the Orlando Money Show. It has evolved into a few chapters in my upcoming book (more on that to come later). The folks attending the FPA event are all CFPs and advisors, and so I tailored the presentation to ideas they can use to better serve their clients.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

AUGUST 22, 2024

The segment is just ahead of interval funds among limited liquidity vehicles, according to Robert A. Stanger & Co.

A Wealth of Common Sense

AUGUST 22, 2024

Callie Cox, our new Chief Market Strategist at Ritholtz Wealth, joined me on the show this week to discuss questions about the potential for a recession, what the Fed should do now, going all in on the Nasdaq 100 in your retirement accounts and how markets move in off hours. Further Reading: What’s the Worst Long-Term Return For U.S. Stocks? 1Taxes and fees are excluded as well, of course.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Advisor Perspectives

AUGUST 22, 2024

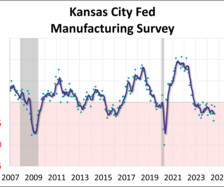

The latest Kansas City Fed Manufacturing Survey composite index did not decline as much in August following a sharper decline last month. The composite index came in at -3, up from -13 in July. Meanwhile, the future outlook increased to 8.

Wealth Management

AUGUST 22, 2024

The six-year-old company, led by former LPL exec Bill Dwyer, will integrate its AI capabilities into Anchor's sales enablement platform.

Nerd's Eye View

AUGUST 22, 2024

As advisory firm websites have become crucial to the prospecting pipeline, displaying fees can present a delicate challenge for advisors. On the one hand, displaying fees can help a client determine whether an advisor will fit into their budget and may build trust when an advisor demonstrates transparency by explaining how their fee applies to their value proposition; on the other hand, even with a clear explanation, prospects may find it difficult to understand exactly how the value of an advic

Wealth Management

AUGUST 22, 2024

Jason Andrews and Ross Bauer of Merritt Point Wealth Advisors demonstrate how their transition from Wells Fargo PCG to FiNet resulted in new growth opportunities.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

NAIFA Advisor Today

AUGUST 22, 2024

David Wood’s journey in the financial services industry is a testament to dedication, vision, and an unwavering commitment to growth. Based in Marlborough, CT, Wood has been a loyal member of the National Association of Insurance and Financial Advisors (NAIFA) since 2024, though his connection to the field dates back to the 1990s. As the founder and principal of Gateway Financial Partners, Wood’s career is a blend of pioneering spirit and deep-rooted advocacy.

Wealth Management

AUGUST 22, 2024

A consortium led by Peter Nobel investing as much as $25 million in Cardea, which is rebranding to Fourcore Capital.

Advisor Perspectives

AUGUST 22, 2024

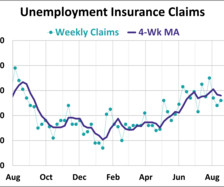

In the week ending August 17th, initial jobless claims were at a seasonally adjusted level of 232,000. This represents an increase of 4,000 from the previous week's figure and is right in line with economist forecasts.

Wealth Management

AUGUST 22, 2024

The lawsuits filed in Minnesota and California federal courts come as a New York-based law firm announced a new task force looking into the controversial practice, assisted by former SEC Commissioner Robert Jackson, Jr.

Speaker: Kim Beynon, CPA, CGMA, PMP

Advisor Perspectives

AUGUST 22, 2024

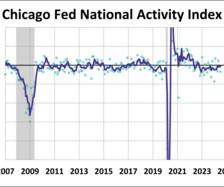

The Chicago Fed National Activity Index (CFNAI) fell to -0.34 in July from -0.09 in June. Two of the four broad categories of indicators used to construct the index decreased from June and three categories made negative contributions in July. The index's three-month moving average, CFNAI-MA3, was unchanged at -0.06 in July.

Wealth Management

AUGUST 22, 2024

Ken Leech is taking a leave of absence as co-chief investment officer after receiving a so-called Wells notice from the SEC, a warning that regulators may recommend enforcement.

Advisor Perspectives

AUGUST 22, 2024

Call me Ishmael. The biggest question about an investment banking client like Elon Musk is whether he turns out to be a Moby Dick.

Trade Brains

AUGUST 22, 2024

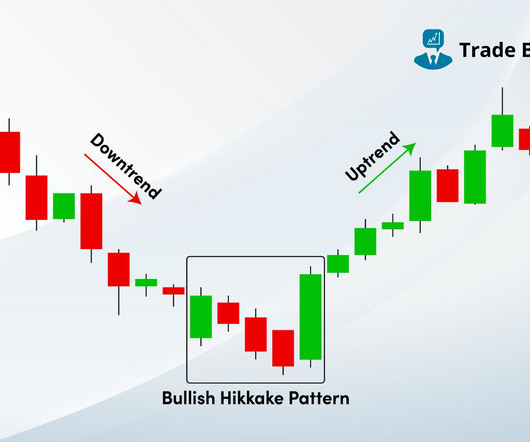

Candlestick patterns are essential tools in technical analysis, offering insights into potential market reversals and continuations. Among the less common but highly significant patterns is the “Bullish Hikkake” candlestick pattern. In this article, we shall explore the meaning, psychology, formation, and trading strategies of the Bullish Hikkake Candlestick pattern.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Advisor Perspectives

AUGUST 22, 2024

Since the end of the financial crisis, economists, analysts, and the Federal Reserve have continued to predict a return to higher levels of economic growth. The hope remains that the Trillions of dollars spent during the pandemic-driven economic shutdown will turn into lasting organic economic growth.

Walkner Condon Financial Advisors

AUGUST 22, 2024

With the expiration of the Tax Cuts and Jobs Act (TCJA) on the horizon at the end of 2025, we have had an uptick in the number of clients asking about doing Roth conversions. If you’re like “wtf is a Roth conversion?” don’t worry, I got you, keep reading.

Random Roger's Retirement Planning

AUGUST 22, 2024

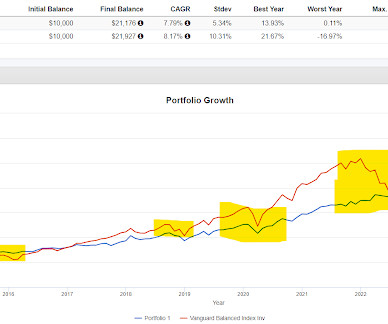

Bob Elliott who manages the Unlimited Hedge Fund ETF (HFND) had a blog post that took a dim view of the defined outcome funds, also known as buffer funds. Read the post but the following graphic stood out to me. WRT to buffer funds, Bob did the work to show whatever you're trying to achieve with a buffer fund can be done in a better way. We've made that point here quite a few times.

Meb Faber Research

AUGUST 22, 2024

Excited news to share… After almost 550 episodes, the podcast has its own website! You may have noticed we stopped posting podcast episodes here on the blog. Going forward, all episode show notes will be on the new website. Be sure to subscribe on Apple, Spotify, or YouTube! The post Podcast Update! appeared first on Meb Faber Research - Stock Market and Investing Blog.

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Advisor Perspectives

AUGUST 22, 2024

Robust U.S. stock momentum hit a slowdown in the third quarter, even as strong company earnings results rolled in. Fundamental Equities’ U.S. and Developed Markets CIO Carrie King weighs in on the incongruence with three reflections from Q2 earnings season.

Indigo Marketing Agency

AUGUST 22, 2024

5 Steps to Client Retention for Financial Advisors As a marketing agency for financial advisors, we post a lot about growing your business and attracting new clients. But all too often we see financial advisors ignore marketing when it comes to how to retain clients once they’ve signed. The truth is a strong, consistent marketing strategy is also a great client retention strategy.

Advisor Perspectives

AUGUST 22, 2024

The euro’s August gains have been relentless, taking it to a one year high against the dollar on Wednesday, but a cautious tone from Federal Reserve Chair Jerome Powell on Friday could turn that momentum around.

Abnormal Returns

AUGUST 22, 2024

Books An excerpt from Brooke Harrington’s forthcoming book, "Offshore: Stealth Wealth and the New Colonialism." (theatlantic.com) An excerpt from “Gray Matters: A Biography of Brain Surgery,” by Dr. Theodore H. Schwartz. (wsj.com) An excerpt from "The Happiness of Dogs: Why the Unexamined Life Is Most Worth Living" by Mark Rowlands. (theguardian.com) A Q&A with Julie McFadden author of "Nothing to Fear: Demystifying Death to Live More Fully.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Advisor Perspectives

AUGUST 22, 2024

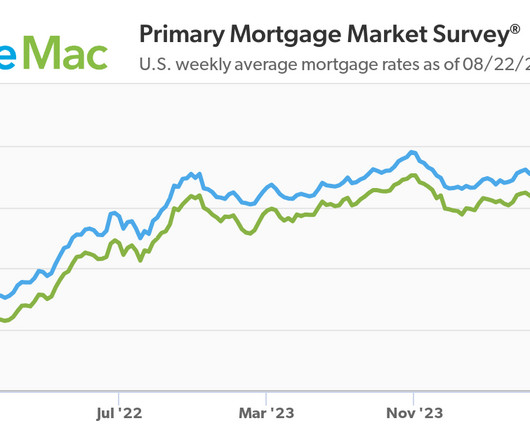

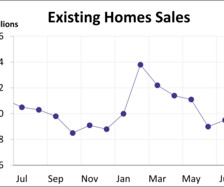

Existing home sales rose for the first time since February, ending a four-month skid. According to the data from the National Association of Realtors (NAR), existing home sales were up 1.3% from June, reaching a seasonally adjusted annual rate of 3.95 million units in July. This figure came in just above the expected 3.94 million. Existing home sales are down 2.5% compared to one year ago.

Discipline Funds

AUGUST 22, 2024

Here are some things I think I am thinking about this week: 1) That BIG Employment Revision. The biggest news of the week was the -818K employment revision for 2024. This was the biggest revision since 2009 and very large by any measure. For perspective, here are the most recent revisions: 2018: +43K 2019: -501K 2020 -173K 2021: -165K 2022: +462K 2023: -306K Oh boy, the tinfoil hat guys are gonna have a field day with this one.

Advisor Perspectives

AUGUST 22, 2024

Emerging-market stocks are trading at the steepest discount to US equities since the Covid-19 panic in March 2020 as skittish investors look elsewhere for growth opportunities.

Carson Wealth

AUGUST 22, 2024

Social Security spousal benefits can be a crucial component of the Social Security program, designed to provide financial support to spouses — whether they are currently married, divorced or widowed. Understanding these benefits can significantly impact retirement planning and financial security in your later years. Let’s take a closer look at Social Security spousal benefits, explain who qualifies and cover important aspects such as spousal benefits after divorce and what happens to your benefi

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Let's personalize your content