Three Strategies to Help Clients Retain More Wealth From Their Businesses

Wealth Management

AUGUST 7, 2023

Some best practices to help fight the cash flow boogeyman.

Wealth Management

AUGUST 7, 2023

Some best practices to help fight the cash flow boogeyman.

Abnormal Returns

AUGUST 7, 2023

Crypto PayPal ($PYPL) has launched its own stablecoin. (theverge.com) Five questions about the PayPal stablecoin. (coindesk.com) Companies How Apple ($AAPL) saves money on new chips manufactured by Taiwan Semi ($TSM). (theinformation.com) Uber ($UBER) seems to have threaded the needle. (youngmoney.co) A closer look at Berkshire Hathaway's ($BRK.A) second quarter results.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

AUGUST 7, 2023

Wealth management is a relationship-driven business. It takes an experienced financial professional with a keen understanding of behavioral finance to be a successful advisor.

Nerd's Eye View

AUGUST 7, 2023

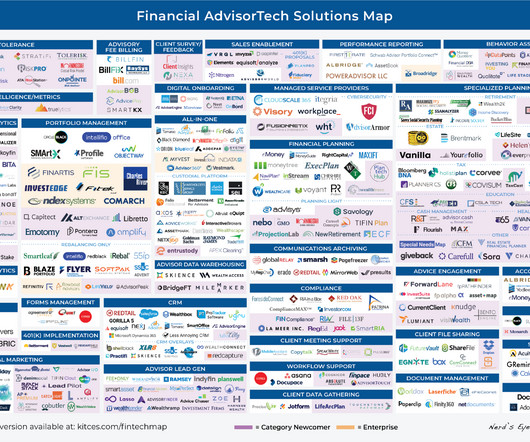

Welcome to the August 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, underlying trends, and developments that are emerging in the world of technology solutions for financial advisors! This month's edition kicks off with the news that estate planning platform Wealth.com has launched Ester, an AI-driven 'legal assistant' that uses machine learning to help advisors quickly review and extract the key information from clients' estate plan

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

AUGUST 7, 2023

Complacency is a funny thing: It’s easy to fall into and hard to get out of.

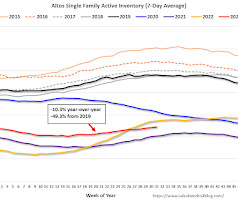

Calculated Risk

AUGUST 7, 2023

Altos reports that active single-family inventory was up 0.7% week-over-week. Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of August 4th, inventory was at 488 thousand (7-day average), compared to 485 thousand the prior week. Year-to-date, inventory is down 0.6%. And inventory is up 20.3% from the seasonal bottom 16 weeks ago.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

AUGUST 7, 2023

Today, in the Calculated Risk Real Estate Newsletter: Black Knight Mortgage Monitor: Home Prices Increased Month-to-month to New Record High in June A brief excerpt: Note: Although not in Mortgage Monitor, Black Knight told me: “ We haven’t yet calculated payment-to-income ratios given yesterday’s news of rates north of 7%, but it’s a pretty safe bet it’s pushed us past last October/November’s “worst affordable market” marker ".

Wealth Management

AUGUST 7, 2023

Private credit funds are queueing up to jump on opportunities in the real estate space, reports The Real Deal. Simon Property Group may become more active in sales and acquisitions, the firm said in its latest earnings call. These are among the must reads from around the real estate investment world to start the new week.

Calculated Risk

AUGUST 7, 2023

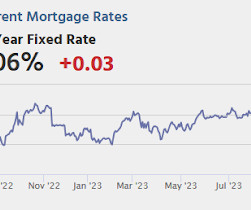

From Matthew Graham at Mortgage News Daily: Mortgage Rates Slightly Higher Over The Weekend Mortgage rates are starting out the new week at modestly higher levels compared to last Friday afternoon. The average change is very small. Many borrowers would see no difference in today's rate quotes. A few lenders are marginally improved from Friday, but they generally hadn't improved as much as other lenders on Friday itself.

Wealth Management

AUGUST 7, 2023

Looking beyond loan forgiveness.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

AUGUST 7, 2023

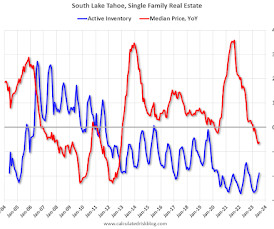

With the pandemic, there was a surge in 2nd home buying. I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from lending changes, rising mortgage rates or the easing of the pandemic. This graph is for South Lake Tahoe since 2004 through July 2023, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Wealth Management

AUGUST 7, 2023

Office REITs were up 13.3% in July, helping push the FTSE Nareit All Equity Index up 2.0% for the month.

Calculated Risk

AUGUST 7, 2023

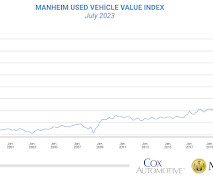

From Manheim Consulting today: Wholesale Used-Vehicle Prices See Large Decline in June Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) decreased 1.6% in July from June. The Manheim Used Vehicle Value Index (MUVVI) declined to 211.7, down 11.6% from a year ago. “The July drop of 1.6% is an indicator of slowing wholesale price declines, at least when compared to the month-over-month losses we’ve seen since April,” said Chris Frey, senior manager of Economic and Ind

Wealth Management

AUGUST 7, 2023

Carson Group's acquisition of Northwest Capital Management comes on the heels of Creative Planning's deal with Lockton.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Abnormal Returns

AUGUST 7, 2023

Podcasts Daniel Crosby talks adviser self-care with Neil Bage who is the co-Founder of Shaping Wealth. (standarddeviationspod.com) Brendan Frazier talks with Justin Castelli about helping clients better align money and purpose. (wiredplanning.com) Meb Faber talks Future Proof and stock market valuation with Ben Carlson and Michael Batnick. (mebfaber.com) 401(k) plans More companies are offering Roth 401(k) options.

Wealth Management

AUGUST 7, 2023

White-label technology lets advisors offer cash management services to clients, including access to high-yielding FDIC-insured depository accounts through a marketplace of banks and credit unions.

The Reformed Broker

AUGUST 7, 2023

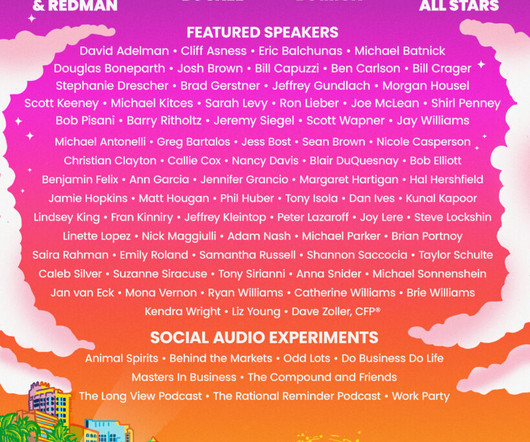

You have never been to an event like this before. This is the one. You’ll be telling your colleagues years from now that you were there. Why am I so sure of this? We built it that way. That’s the purpose. You can earn continuing education credits on the internet, who cares. This is for people who want more out of their careers. Who want to network with the best practitioners in the space and learn from them.

Wealth Management

AUGUST 7, 2023

A spot-Bitcoin ETF does not currently exist in the US and regulators have, in the past, been loath to approve one.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Advisor Perspectives

AUGUST 7, 2023

Is it possible for economic news to be a little too good? If many economic worries seem to be dwindling, is that reason to be scared? After periods of success, are economies due for a comeuppance — perhaps even for reasons stemming from their earlier achievements?

Wealth Management

AUGUST 7, 2023

"Just say less" is becoming the new approach of private fund managers.

Advisor Perspectives

AUGUST 7, 2023

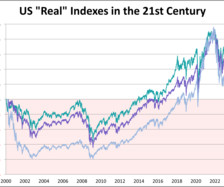

Here is a look at real (inflation-adjusted) charts of the S&P 500, Dow 30, and Nasdaq composite since their 2000 highs. We've updated this through the July 31, 2023 close.

A Wealth of Common Sense

AUGUST 7, 2023

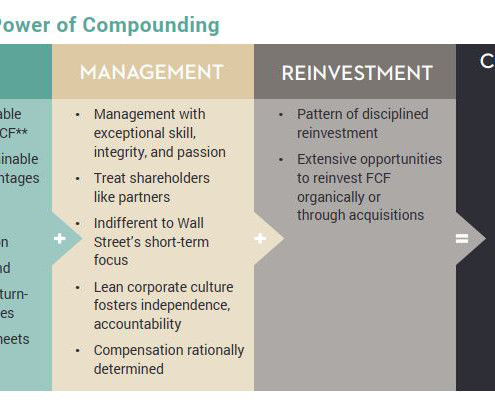

Today’s Talk Your Book is brought to you by AKRE Capital Management: We had John Neff, Partner and Portfolio Manager of AKRE Capital Management on to discuss their best-ideas Focus Fund. On today’s show, we discuss: Fundamental analysis in the early investing era John Neff’s favorite investing books and mantras AI and what’s driving today’s market The Three-Legged Stool Framework The compou.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Alpha Architect

AUGUST 7, 2023

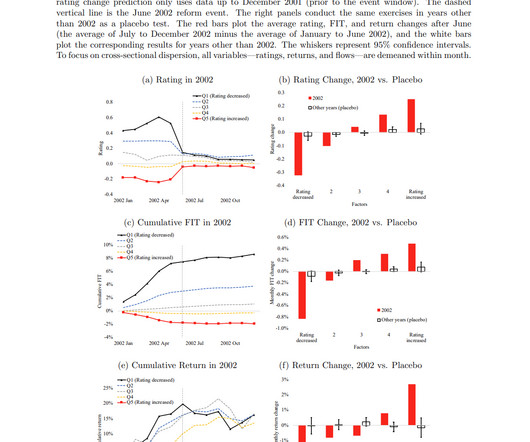

The traditional financial theory attributes security returns to market- or factor-based risk, with no role ascribed to other influences. In this research, the authors argue for including investor demand as an additional variable in explaining returns. Can changes in investor demand generate systematic changes in security returns? Investor demand, rating reform and equity returns was originally published at Alpha Architect.

Trade Brains

AUGUST 7, 2023

Best Tata Group Stocks Under Rs 500: Pratik Gandi starring as Harshad Mehta remarks in the famous ‘Scam 1992’ series, “Utha lo Tata ka koi bhi stock. Ek na ek din toh upar jana hi hai.” Not that it is investment advice, but it does highlight the strong faith Indian investors have in the Tata Group stocks. If you closely follow the house of Tatas, we have a gold mine for you.

Alpha Architect

AUGUST 7, 2023

The following factor performance modules have been updated on our Index website. Global Factor Performance: August 2023 was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Advisor Perspectives

AUGUST 7, 2023

What is the secret to digital marketing that drives website traffic and leads?

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Fortune Financial

AUGUST 7, 2023

Are Alternative Investments the Key to Diversifying Your Portfolio? Explore Types, Benefits and How to Get Started Are you tired of the traditional investment options that seem to be a rollercoaster ride and often offer limited downside protection? Do you find yourself longing for new opportunities that can potentially generate higher returns over market cycles?

Advisor Perspectives

AUGUST 7, 2023

Investors planning for retirement are facing seven significant challenges.

Don Connelly & Associates

AUGUST 7, 2023

All financial advisors start in the same place—with no clients. Getting that first client (who’s not a relative) is a significant hurdle but not insurmountable. And, as many successful advisors will tell you, once you clear that first hurdle, it’s off to the races. While getting your first client can be a challenge, you can succeed with the right skills, a solid game plan, and a hefty dose of persistence.

Discipline Funds

AUGUST 7, 2023

I recently joined Andrew Horowitz on the Disciplined Investor podcast to talk about…you guessed it – financial discipline. The interview starts at the 18:30 mark and we cover lots of ground in here including: What does investing discipline mean to me? How a good financial plan is like dieting – easy in theory, but difficult in implementation.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content