No, CLOs and CDOs Are Not the Same

Wealth Management

NOVEMBER 18, 2022

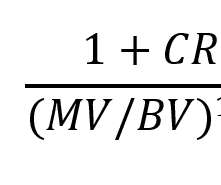

Unlike CDOs, which collapsed during the housing crisis, not a single AAA CLO has defaulted since the inception of the asset class 30 years ago

Wealth Management

NOVEMBER 18, 2022

Unlike CDOs, which collapsed during the housing crisis, not a single AAA CLO has defaulted since the inception of the asset class 30 years ago

The Reformed Broker

NOVEMBER 18, 2022

Welcome to the latest episode of The Compound & Friends. This week, Michael Batnick, Gregor Macdonald, and Downtown Josh Brown discuss the latest on the Sam Bankman-Fried saga, the inverted yield curve, electrification of the power grid, the growth of electric vehicles, peak oil, and much more! You can listen to the whole thing below, or find it wherever you like to listen to your favorite pods!

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

NOVEMBER 18, 2022

Bento addresses wealth transfer and financial literacy while Holistiplan joins LPL's Vendor Affinity Program and Addepar adds UBS as client.

Calculated Risk

NOVEMBER 18, 2022

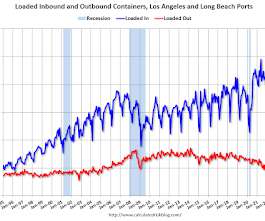

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago ), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast. Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

NOVEMBER 18, 2022

Retirement industry thought leaders answer three probing questions on critical issues, providing an open, honest and candid dialogue.

Calculated Risk

NOVEMBER 18, 2022

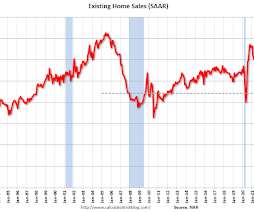

From the NAR: Existing-Home Sales Slumped 5.9% in October Existing-home sales retreated for the ninth straight month in October, according to the National Association of REALTORS®. All four major U.S. regions registered month-over-month and year-over-year declines. Total existing-home sales - completed transactions that include single-family homes, townhomes, condominiums and co-ops – decreased 5.9% from September to a seasonally adjusted annual rate of 4.43 million in October.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

NOVEMBER 18, 2022

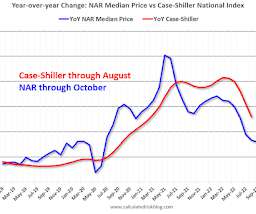

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 4.43 million SAAR in October Excerpt: On prices, the NAR reported: The median existing-home price for all housing types in October was $379,100, a gain of 6.6% from October 2021 ($355,700), as prices rose in all regions. This marks 128 consecutive months of year-over-year increases, the longest-running streak on record.

Wealth Management

NOVEMBER 18, 2022

Rich Cancro, founder and CEO of AdvisorEngine, explains how technology can help advisors improve client experience, increase revenue and enhance operational excellence.

Nerd's Eye View

NOVEMBER 18, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that AdvisorTech giant Envestnet has announced a partnership with New Zealand-based FNZ that will allow Envestnet to offer custodial services to advisors beginning in the second half of 2023. At a time of significant change in the RIA custodial space, epitomized by the ‘Schwabitrade’ integration (also in late 2023), Envestnet’s custodial offe

Wealth Management

NOVEMBER 18, 2022

FP Alpha's Andrew Altfest and TIFIN Wealth's Niharika Shah discuss how AI can help advisors run a better business, delight clients and streamline their operations.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Abnormal Returns

NOVEMBER 18, 2022

Bonds Bond investors are swapping mutual funds for ETFs. (advisorperspectives.com) Bonds vs. bond funds: people have strong feelings. (awealthofcommonsense.com) What lessons can we take away from the bond market this year? (monevator.com) FTX Why investors were so willing to overlook issues with FTX, and crypto in general. (wsj.com) Taking a tax loss due to FTX-related losses is harder than it looks.

Wealth Management

NOVEMBER 18, 2022

The agency says an army of new auditors could help raise as much as $1 trillion by forcing tax evaders to pay their fair share.

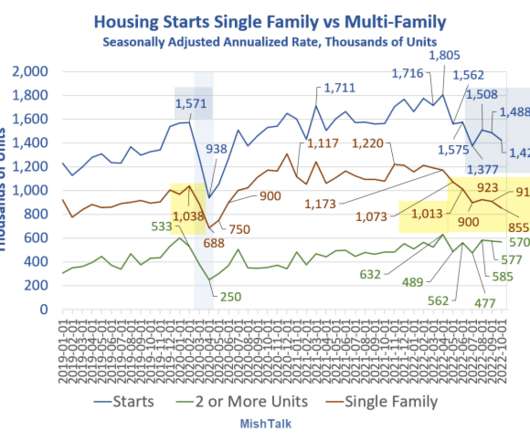

Mish Talk

NOVEMBER 18, 2022

Existing home sales from the National Association of Realtors via St. Louis Fed. The National Association of Realtors (NAR) reports Existing-Home Sales Slumped 5.9% in October Existing Home Sales Key Points Existing-home sales faded for the ninth month in a row to a seasonally adjusted annual rate of 4.43 million. Sales fell 5.9% from September and 28.4% from one year ago.

Wealth Management

NOVEMBER 18, 2022

Wednesday, December 07, 2022 | 2:00 PM ET

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Calculated Risk

NOVEMBER 18, 2022

From BofA: Existing home sales actually fell less than we expected, implying slightly stronger brokers’ commissions in 4Q. As a result, our tracking estimate for residential investment in 4Q edged up. That said, after rounding, our 4Q GDP tracking estimate was unchanged at 1.3% q/q saar. [Nov 18th estimate] emphasis added From Goldman: We lowered our Q4 GDP tracking estimate by 0.1pp to +0.9% (qoq ar).

Wealth Management

NOVEMBER 18, 2022

In about-face from September, ETFs focused on alternative investments, especially private credit, shine in October.

A Wealth of Common Sense

NOVEMBER 18, 2022

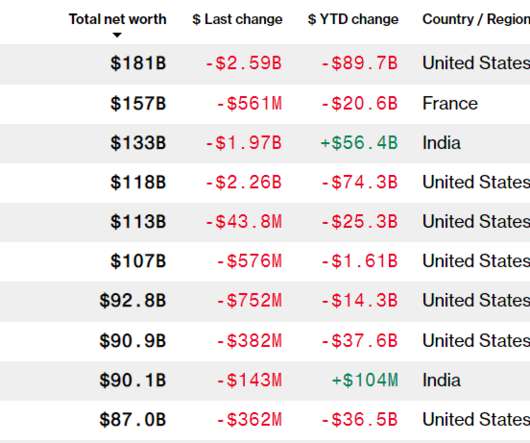

Scott Galloway once said, “It’s never been easier to become a billionaire, or harder to become a millionaire.” I’m not sure I agree but it does seem like more people want to become a billionaire these days. I honestly don’t think it’s worth it. More money in your life is obviously better than less money but only up to a certain point.

Alpha Architect

NOVEMBER 18, 2022

Are active managers victims of the same bias as individual investors? That is the question we’ll explore in this paper. Active Managers are Subject to the Same Biases as Individual Investors was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Wealth Management

NOVEMBER 18, 2022

Scott Leak, senior consultant with FP Transitions, discusses how advisors can transition ownership over time.

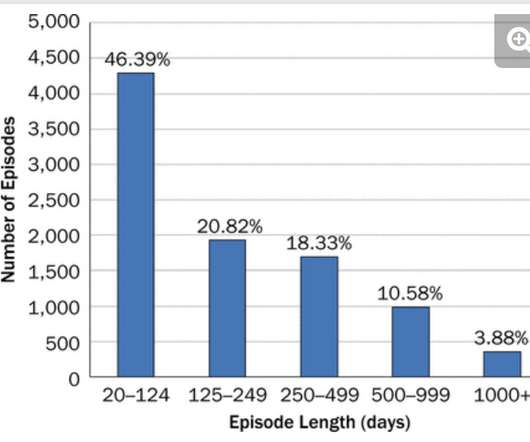

Abnormal Returns

NOVEMBER 18, 2022

The biz 1 in 5 Americans listen to a podcast on a daily basis. (theverge.com) Podcasting is growing its 'share of ear.' (edisonresearch.com) Companies Patrick O'Shaughnessy talks with Parker Conrad who is co-founder and CEO of Rippling. (joincolossus.com) Shane Parrish talks growth with Shopify ($SHOP) co-founder and CEO Tobi Lütke. (fs.blog) Benjamin Gilbert and David Rosenthal talk about the history of Qualcom ($QCOM).

Wealth Management

NOVEMBER 18, 2022

David Devoe, founder and CEO of Devoe & Company, explains why 2022 is looking like another record year for M&A activities.

Integrity Financial Planning

NOVEMBER 18, 2022

There has historically been a pay gap between men and women for comparable jobs which favors men. This phenomenon generally affects retirement funds as well – this is called the gender retirement gap. [1] On average, women earn 17% less than men, taking home $89 compared to the man’s $100. [2] The gender pay gap has lasted throughout history, affecting global economic potential, and has cost the US an annual $1.6 trillion [3] in potential economic activity.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Wealth Management

NOVEMBER 18, 2022

Shareholders may have to pay tax even if their fund lost money this year.

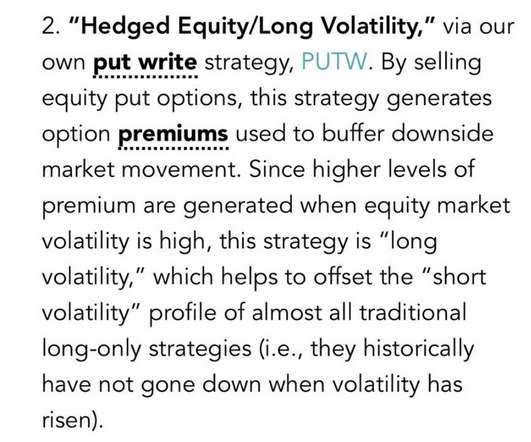

Random Roger's Retirement Planning

NOVEMBER 18, 2022

Corey Hoffstein Tweeted out the following snippet, presumably from WisdomTree about its PutWrite Strategy Fund (PUTW). There were a ton of replies jumping on WisdomTree, rightfully so, for the strangely worded commentary. Maybe they mean they've benefited from higher premiums when they sell puts? That seems reasonable if that was they mean but the actual wording could be confusing for anyone not confident in their understanding of options.

Advisor Perspectives

NOVEMBER 18, 2022

Financial crises are really about trust. They tend to occur when people lose trust in assets, institutions, or people they had thought trustworthy. Whether the lost trust was a consequence of the crisis, or its cause is a different question. But they do seem to go together.

Aleph

NOVEMBER 18, 2022

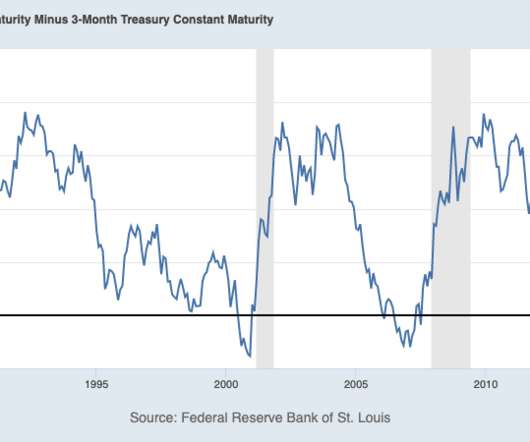

Picture Credit: Boston Public Library || When total systemic leverage is so high, you can’t tell what might go wrong. Because of the fall in interest rates since the last post , the risks have declined with Stable Value Funds. That said, the FOMC still sounds hawkish, even though the yield curve is inverted. The FOMC needs fewer macroeconomists, and more economic historians.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Advisor Perspectives

NOVEMBER 18, 2022

The latest Conference Board Leading Economic Index (LEI) for October was down 0.8% from the September final figure of 115.8.

Nationwide Financial

NOVEMBER 18, 2022

Hear more from Bryan Jordan, Nationwide’s Deputy Chief Economist, as he shares his outlook on the holiday shopping season. (12 min). Retail sales rose by 1.3 percent in October — its largest increase in eight months. What does this mean for the all-important holiday shopping in the weeks ahead? Will inflation keep shoppers away? Bryan Jordan, Nationwide’s Deputy Chief Economist, shares his outlook on the holiday shopping season.

Advisor Perspectives

NOVEMBER 18, 2022

Owning a mutual fund that’s down 20% or 30% is bad enough. Now, holders of many money-losing investments will be asked to pay capital gains taxes too.

NAIFA Advisor Today

NOVEMBER 18, 2022

Join NAIFA's Business Performance Center for a webinar on Tuesday, November 29 at 1 pm eastern. Sit down for a discussion with Harlan Accola of Fairway Independent Mortgage Corporation , and Caleb Guilliams , Founder of BetterWealth , to learn about the three products your clients must have to survive this intense financial storm.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content