Core or 16% Trimmed-Mean CPI?

The Big Picture

AUGUST 10, 2023

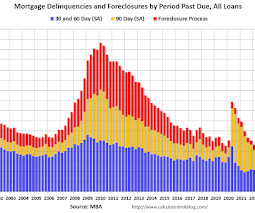

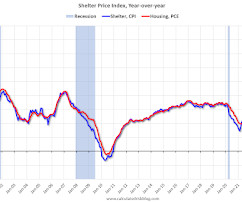

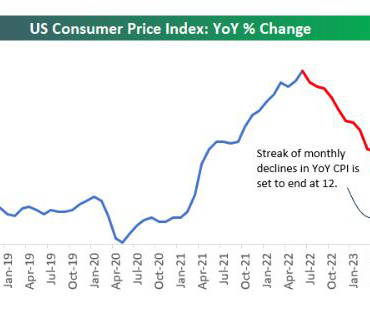

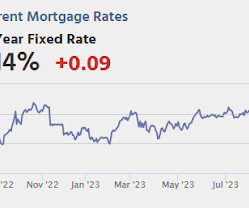

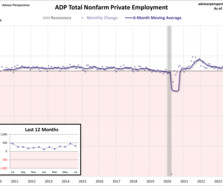

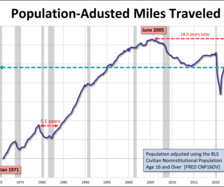

A quick note on today’s BLS report on the Consumer Price Index (CPI), which rose 0.2% in July on a seasonally adjusted basis, Over the last 12 months, the CPI has increased 3.2%. Once again, the biggest part of the gains was for shelter. As I have noted before, the entity primarily responsible for rising home prices higher is the Fed. There are numerous ways to measure price increases, and I wanted to highlight a specific approach the BLS occasionally references: “The 16% trimmed-mea

Let's personalize your content