Real Estate Newsletter Articles this Week: "House Price Battle Royale: Low Inventory vs Affordability"

Calculated Risk

MAY 13, 2023

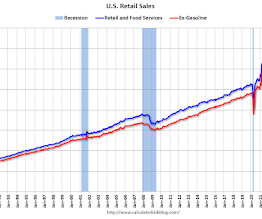

At the Calculated Risk Real Estate Newsletter this week: • Part 1: Current State of the Housing Market; Overview for mid-April • Part 2: Current State of the Housing Market; Overview for mid-April • House Price Battle Royale: Low Inventory vs Affordability • Lawler: American Homes 4 Rent Net Seller of Single-Family Homes Last Quarter • 2nd Look at Local Housing Markets in April This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Let's personalize your content