Alternatives Fundraising from Retail Investors on Track to Reach $115B in 2024

Wealth Management

JULY 24, 2024

Robert A. Stanger & Co. raised its forecast for the year after strong inflows during the first half of 2024.

Wealth Management

JULY 24, 2024

Robert A. Stanger & Co. raised its forecast for the year after strong inflows during the first half of 2024.

Calculated Risk

JULY 24, 2024

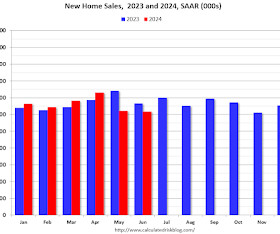

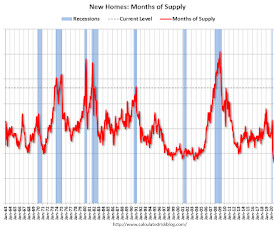

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales Decrease to 617,000 Annual Rate in June Brief excerpt: The Census Bureau reports New Home Sales in June were at a seasonally adjusted annual rate (SAAR) of 617 thousand. The previous three months were revised up sharply, combined. The next graph shows new home sales for 2023 and 2024 by month (Seasonally Adjusted Annual Rate).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JULY 24, 2024

The agency continues to ramp up its enforcement efforts.

The Big Picture

JULY 24, 2024

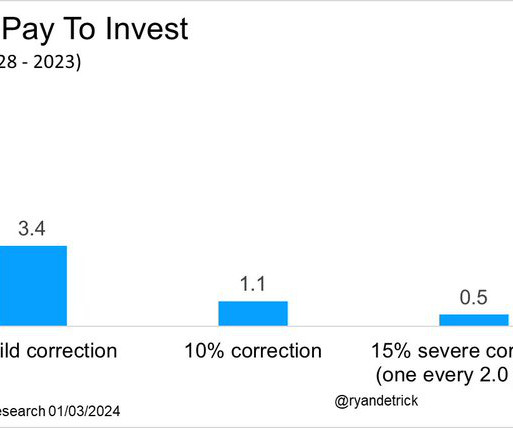

At The Money: Behavior Beats Intelligence (July 24, 2024) We focus most of our investing efforts on information and knowledge. But is that where we generate the highest ROI? As it turns out, managing your behavior has a much greater impact on your returns than does any single data point. Full transcript below : ~~~ About this week’s guest: Morgan Housel is a partner at the Collaborative Fund and author of “ The Psychology of Money: Timeless lessons on wealth, greed, and happiness.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

JULY 24, 2024

Emigrant Partners' Liz Nesvold details the three areas firms need to focus on to ensure future success.

Abnormal Returns

JULY 24, 2024

Strategy For investors, inflation is the enemy. (disciplinefunds.com) Three investment myths, debunked. (morningstar.com) Crypto A big opening day for spot Ethereum ETFs. (theblock.co) An option for those who still want to custody their own Bitcoin. (theblock.co) AI Charlie Warzel, "Whether you believe that AI executives are delusional or genuinely on the verge of constructing a superintelligence, you should be concerned about how much power they’ve amassed.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

JULY 24, 2024

The Census Bureau reports New Home Sales in June were at a seasonally adjusted annual rate (SAAR) of 617 thousand. The previous three months were revised up sharply, combined. Sales of new single-family houses in June 2024 were at a seasonally adjusted annual rate of 617,000 , according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.

Wealth Management

JULY 24, 2024

Certain 10-year designated and successor beneficiaries get no extension.

Calculated Risk

JULY 24, 2024

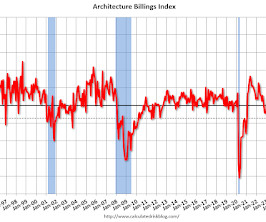

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment. From the AIA: ABI June 2024: Business conditions remain soft at architecture firms Billings at firms decreased for the seventeenth consecutive month , with an AIA/Deltek Architecture Billings Index (ABI) score of 46.4 (any score below 50 means that billings declined).

Wealth Management

JULY 24, 2024

Open, honest and candid discussion about Human Interest, advisor use of AI, more 401(k) plan haters and the top stories so far this year.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Calculated Risk

JULY 24, 2024

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey Mortgage applications decreased 2.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending July 19, 2024. The Market Composite Index, a measure of mortgage loan application volume, decreased 2.2 percent on a seasonally adjusted basis from one week earlier.

Wealth Management

JULY 24, 2024

How this decision affects insurance product suitability.

Calculated Risk

JULY 24, 2024

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Thursday: • At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 238 thousand initial claims, down from 243 thousand last week. • Also at 8:30 AM, Gross Domestic Product, 2nd quarter (advance estimate), and annual update.

Wealth Management

JULY 24, 2024

Discover unique benefits and dedicated support with Wells Fargo Advisors' teaming program.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

A Wealth of Common Sense

JULY 24, 2024

Today’s Animal Spirits is brought to you by Global X and Fabric: See here to learn more about Global X’s suite of ETFs Go to meetfabric.com/spirits for more information on life insurance from Fabric by Gerber Life On today’s show, we discuss: The Biggest Winners in the Stock Market Household Wealth Gains Are a Tailwind to Consumer Spending American Borrowers Are on Shakier Ground.

Wealth Management

JULY 24, 2024

Thursday, August 22, 2024 | 2:00 PM ET

Advisor Perspectives

JULY 24, 2024

Here’s how to conduct yourself as an advisor if you want to demonstrate that you care about your clients.

Wealth Management

JULY 24, 2024

Over $1 billion worth of shares traded across the nine spot Ethereum ETFs during their debut on Tuesday.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Steve Sanduski

JULY 24, 2024

Guests: Scott Hanson and Pat McClain , founding principals of Allworth Financial. In a Nutshell: There’s an old bit of sage business advice about getting a partner: Don’t! My guests today are an exception to the rule (err, joke). Over their 30-year partnership, Scott Hanson and Pat McClain built Allworth Financial from $10 million to $20 billion in AUM.

Wealth Management

JULY 24, 2024

Transcript of Episode 115 of 401(k) Real Talk.

Advisor Perspectives

JULY 24, 2024

While it's too early to declare small caps' recent outperformance as a meaningful trend shift, we continue to think high-quality companies and industries will likely perform well.

Random Roger's Retirement Planning

JULY 24, 2024

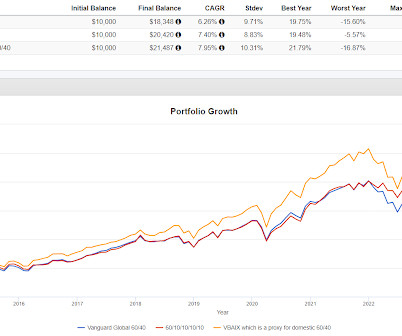

A few days ago I bagged on a strategist from Vanguard for telling investors to stick with bonds in a 60/40 portfolio allocation. In that post we put together a 60/10/10/10/10 portfolio with just 10% to bonds and the other 10% sleeves into different alts that each represented uncorrelated return streams. I modeled the strategist's idea for mixing domestic and foreign equities and bonds and also incorporated his idea into our comparison portfolio.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

SEI

JULY 24, 2024

As the 2024 Paris Olympics draw near, in the digital arena, a different kind of competition unfolds—the race to secure the Games against cyberthreats.

Advisor Perspectives

JULY 24, 2024

Whether the discussion is about training, coaching, or consulting on roles and responsibilities, the topic of behavioral style – that is, sameness and differences – often gets missed.

Norman Marks

JULY 24, 2024

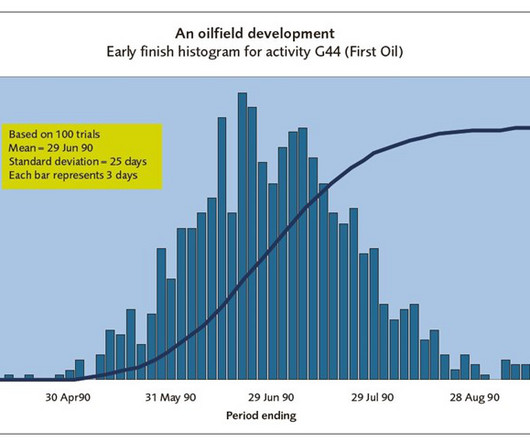

One of the errors that many make is thinking that the level of risk from an event (such as an earthquake, fire, supply chain disruption, interest rate change, currency fluctuation, etc.) is a single point. A single effect or consequence with a single likelihood. Nope.

Advisor Perspectives

JULY 24, 2024

US exchange-traded funds investing directly in Ether achieved overall net inflows of $107 million on their first day of trading in launches that will provide a window onto mainstream crypto demand outside of Bitcoin.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Abnormal Returns

JULY 24, 2024

Podcasts Peter Lazaroff talks with Darius Foroux, author of "The Stoic Path to Wealth: Ancient Wisdom for Enduring Prosperity." (peterlazaroff.com) Larry Wilmore talks with Scott Galloway author of "The Algebra of Wealth." (theringer.com) Noah Kagan talks with Bill Perkins author of "Die With Zero." (noahkagan.com) Dan Haylett talks about repurposing your life in retirement with Suzanne Campi.

Advisor Perspectives

JULY 24, 2024

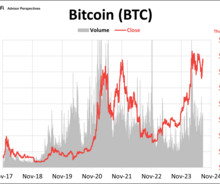

Bitcoin's price reached their highest level in over a month this past week. BTC is currently up ~49% year to date. Here's the latest charts on three of the largest cryptocurrencies by market share through 7/23/24.

Nerd's Eye View

JULY 24, 2024

When the original SECURE Act was passed in December 2019, it brought sweeping changes to the post-death tax treatment of qualified retirement accounts. One of the biggest changes was to eliminate the prior "stretch" treatment of post-death distributions for most non-spouse beneficiaries, who are now subject to the so-called 10-Year Rule requiring beneficiaries to fully distribute inherited retirement accounts by the end of the 10th year following the original account owner's death.

Advisor Perspectives

JULY 24, 2024

Investors flocked to the US Treasury’s monthly sale of two-year notes in a powerful demonstration of faith in Federal Reserve interest-rate cuts beginning this year.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Let's personalize your content