SEC Reiterates Warnings on Marketing Rule

Wealth Management

JUNE 9, 2023

The SEC's new risk alert reiterates that the commission is "not kidding" about marketing rule violations, according to the head of one vendor.

Wealth Management

JUNE 9, 2023

The SEC's new risk alert reiterates that the commission is "not kidding" about marketing rule violations, according to the head of one vendor.

Nerd's Eye View

JUNE 9, 2023

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that the House has passed legislation that would expand the definition of who qualifies as an accredited investor eligible to invest in certain private investments to include those who pass an exam designed by the SEC, and those with certain licenses or educational backgrounds, including financial advisors.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JUNE 9, 2023

A new board has been created which is independent from the parent company.

Calculated Risk

JUNE 9, 2023

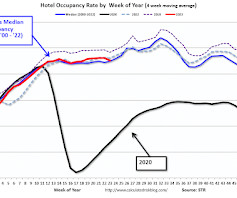

From STR: STR: U.S. hotel results for week ending 3 June As expected with the Memorial Day holiday, U.S. hotel performance decreased from the previous week, according to STR‘s latest data through 3 June. 28 May through 3 June 2023 (percentage change from comparable week in 2022): • Occupancy: 61.6% (-2.3%) • Average daily rate (ADR): US$150.28 (+1.3%) • Revenue per available room (RevPAR): US$92.55 (-1.0%) emphasis added The following graph shows the seasonal pattern for the hotel occupancy rate

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

JUNE 9, 2023

Women RIAs have the opportunity to create thriving, flexible workplaces that provide essential support for working moms and caregivers.

The Reformed Broker

JUNE 9, 2023

Welcome to the latest episode of The Compound & Friends. This week, Michael Batnick, Jill Schlesinger, and Downtown Josh Brown discuss whether or not the bear market is over, the chances of Jamie Dimon running for president, Apple’s WWDC product unveil, the accredited investor rule, Artificial Intelligence, the state of the economy, and much more!

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

A Wealth of Common Sense

JUNE 9, 2023

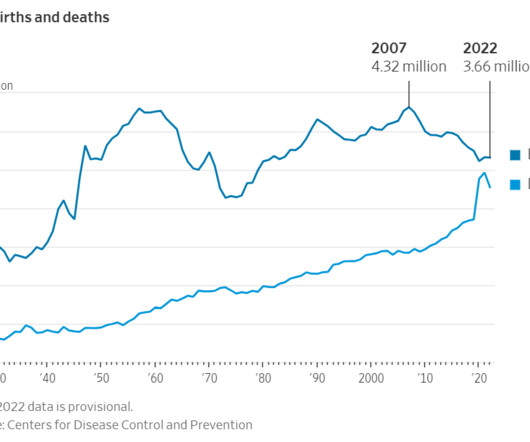

Agriculture was invented approximately 10,000 years ago. It’s estimated there were roughly 5 million people on Earth at the time. This shift completely changed our species from nomadic hunter-gathers which allowed humans to live in larger and larger groups of people. The population grew slowly but steadily from there reaching 1 billion people by the year 1800.

Wealth Management

JUNE 9, 2023

Colin Falls, the president and CEO of GeoWealth, details why RIAs are desiring more flexibility and control with their technology solutions.

Calculated Risk

JUNE 9, 2023

From BofA: Overall, the data pushed up our 1Q GDP tracking estimate three-tenths to 1.9% q/q saar and our 2Q GDP tracking moved up a tenth to 1.2%. [June 9th estimate] emphasis added From Goldman: [W]e lowered our Q2 GDP tracking estimate by 0.5pp to +1.7% (qoq ar). Our Q2 domestic final sales forecast stands at +2.1%. [June 7th estimate] And from the Altanta Fed: GDPNow The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2023 is 2.2 percent o

Wealth Management

JUNE 9, 2023

More than $1 billion has flooded into the $35 billion Invesco S&P 500 Equal Weight ETF (ticker RSP).

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Abnormal Returns

JUNE 9, 2023

Strategy Periodic rebalancing is a part of any comprehensive investment plan. (awealthofcommonsense.com) Thematic investing appeals to investors' worst instincts. (morningstar.com) Crypto The Three Arrows Capital founders are doing just fine, thank you very much. (nytimes.com) Robinhood ($HOOD) is ending support for Solana, Polygon and Cardano. (theblock.co) Crypto.com will shut down its institutional exchange service for US customers.

Wealth Management

JUNE 9, 2023

ETFs aren’t supposed to move the market, just trade in line with the underlying asset.

Abnormal Returns

JUNE 9, 2023

The biz 20 years on, how has podcasting changed the world? (theguardian.com) Spotify ($SPOT) is reorganizing its podcasting unit. (variety.com) And is trying to expand the audience for its exclusive podcasts. (bloomberg.com) How to use Descript to edit audio. (fastcompany.com) Companies Benjamin Gilbert and David Rosenthal do a deep live into the history of Lockheed Martin.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

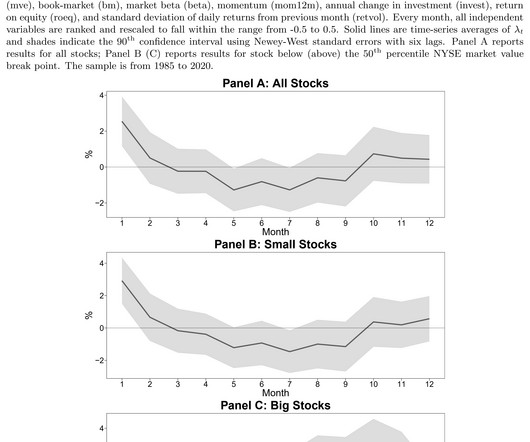

Alpha Architect

JUNE 9, 2023

In this article we examine the research about how artificial intelligence influences stock returns by analyzing a measurement of firm-level AI exposures called Alness. Novel Measure of Firm-Level AI exposures was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Wealth Management

JUNE 9, 2023

Available On Demand

Advisor Perspectives

JUNE 9, 2023

Pop Quiz! Without recourse to your text, your notes, or a Google search, what line item is the largest asset in Uncle Sam's financial accounts? A) U.S.

Nationwide Financial

JUNE 9, 2023

Key Takeaways: The last two years have been marked by the highest inflation rates in decades; your clients saving for retirement can use this to their advantage through short-term investments, tax deferral, and insurance products offering better benefits. Fixed annuities can help your clients maximize those higher rates while also deferring taxes, allowing them to take advantage of potentially lower retirement tax rates in the future.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Advisor Perspectives

JUNE 9, 2023

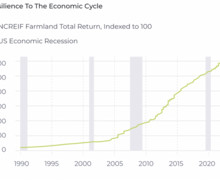

Despite market headwinds, investors remain bullish on real estate. As traditional sectors, like office and retail, continue to underperform, farmland presents an opportunity for investors seeking capital preservation and downside protection.

Integrity Financial Planning

JUNE 9, 2023

As the world becomes more digitized, many people may believe that libraries are becoming a thing of the past. However, this couldn’t be further from the truth. Libraries are still essential for providing access to information, learning, and community building. In fact, libraries are particularly important for retirees who seek to enrich their lives through reading and learning.

Advisor Perspectives

JUNE 9, 2023

I wrote this article in 2030 after I interviewed several retirees whose income plans were designed by ChatRET.

NAIFA Advisor Today

JUNE 9, 2023

Do you know any college students interested in the insurance and financial services industry? NAIFA's Future Leaders Program is a unique opportunity for college students and recent graduates to get a glimpse into careers in insurance and financial services. Future Leaders was created to raise awareness about opportunities in the industry and invite more students into the profession.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

MarketWatch

JUNE 9, 2023

Biogen Inc. BIIB shares rallied in the extended session late Friday following a full-day halt after the biotech company received a recommendation from a Food and Drug Administration advisory committee to approve an Alzheimer’s treatment it makes with Eisai Co. ESALF Biogen shares rallied as much as 9% after hours, after spending the regular session halted at $308.88.

Advisor Perspectives

JUNE 9, 2023

Spare a thought for the other AT1 crowd — not investors in Additional Tier 1 securities extinguished in Credit Suisse Group AG’s rescue, but shareholders in Aroundtown SA, the Frankfurt-listed property firm with the same stock-market ticker.

MarketWatch

JUNE 9, 2023

Shares of some electric-vehicle charging companies were moving lower in Friday’s premarket trading after Tesla Inc. TSLA said it would open its charging network to General Motors Co. GM ChargePoint Holdings Inc. shares CHPT were down more than 3% premarket, while EVgo Inc. shares EVGO were down more than 4%. Blink Charging Co.’s stock BLNK was down 0.5%.

The Irrelevant Investor

JUNE 9, 2023

Today’s Compound and Friends is brought to you by Wisdom Tree: Thanks to Wisdom Tree for sponsoring this episode. For important information including objectives, risks, and performance visit wisdomtree.com/dgr On today’s show, we discuss: Is the Bear Market Over? It Depends. BMO’s Brian Belski explains why his firm raised S&P 500 price target to 4,550 Goldman Sachs: Stocks Cheap because of AI Jamie Dimon F.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

MarketWatch

JUNE 9, 2023

Carvana Co.’s stock CVNA is up 1% Friday, and is one of the most heavily traded in the premarket, after the stock jumped 56% in its previous session on a hiked outlook from the car seller. William Blair analyst Sharon Zackfia on Friday reiterated a market perform rating on Carvana and said the company’s progress is encouraging, but she’s seeking improved visibility on liquidity and free cash flow generation before any potential stock upgrade.

Norman Marks

JUNE 9, 2023

I was privileged to be a member a few years ago of the IIA’s Relook Task Force.

MarketWatch

JUNE 9, 2023

BMO Capital Markets analyst Keith Bachman lifted his price target on shares of Microsoft Corp. MSFT to $385 from $347 Friday, writing that he was “increasingly confident” that the technology giant was cementing itself as a leader in artificial intelligence. “While we believe that MSFT remains in the early innings of its AI journey, we are encouraged by the company’s pace of development,” he wrote in a note to clients.

Advisor Perspectives

JUNE 9, 2023

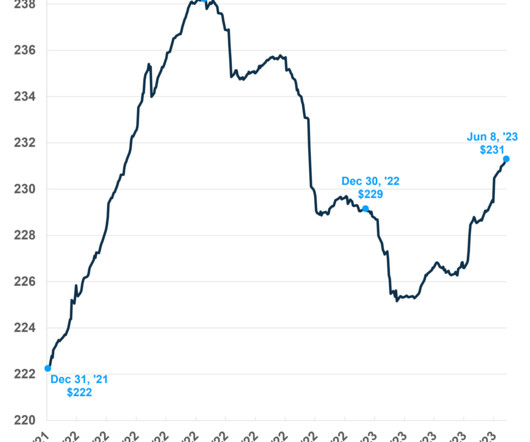

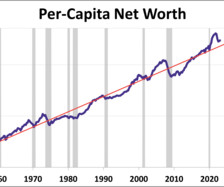

This is a couple months past its release, but the latest Fed balance sheet shows that total household and nonprofit organizations net worth is 151% above the 2009 trough. The nominal Q1 2023 net worth is up 2.1% from the previous quarter and down 2.5% year-over-year.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content