Advising Clients on Exit Planning: Part 1

Wealth Management

FEBRUARY 6, 2023

An introductory four-part guide for helping clients increase the value and net profit of their businesses.

Wealth Management

FEBRUARY 6, 2023

An introductory four-part guide for helping clients increase the value and net profit of their businesses.

The Big Picture

FEBRUARY 6, 2023

I am in Florida for the big ETF Exchange event. It’s a giant annual conference with 2000+ people attending in Miami to network, talk ETF’s, and discuss the future of the industry. It’s always a worthwhile hang. (Full agenda here ) My contribution to the event is a live Masters-in-Business with the Vanguard Group’s CEO Tim Buckley. We will be recording it for broadcast next week; even if you cannot make it to Miami tomorrow, you will be able to hear what the CEO of Vanguard Grou

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

FEBRUARY 6, 2023

Yes, your CRM can deliver the outcomes you need. Here’s how.

Nerd's Eye View

FEBRUARY 6, 2023

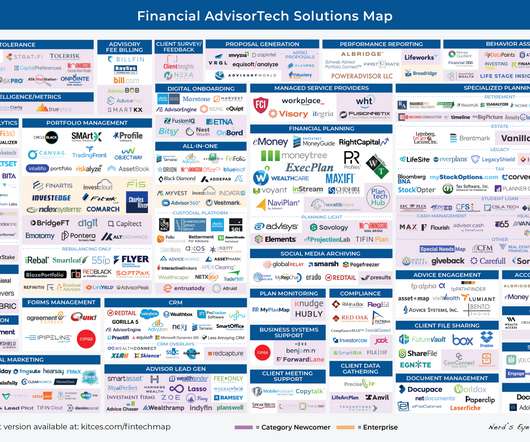

Welcome to the February 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors! This month's edition kicks off with the news that the “financial monitoring software” platform Elements has raised $5 million in a seed-extension funding round as it seeks to establish a foothold in the rapidly growing AdvisorTech categ

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

FEBRUARY 6, 2023

Multi-Housing News looks at whether manufactured housing remains a good investment option. A New Yorker article examines how explosive population growth in Austin, Texas has affected quality of life in the city. These are among today’s must reads from around the commercial real estate industry.

Calculated Risk

FEBRUARY 6, 2023

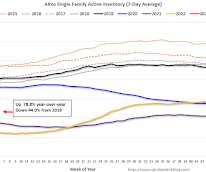

Altos reports inventory was down 1.9% week-over-week. Usually inventory bottoms in early February; however, in 2022, inventory bottomed in early March. Here are the same week inventory changes for the last five years: 2023: -8.7K 2022: -16.0K 2021: -13.4K 2020: -4.3K 2019: -10.9K Click on graph for larger image. This inventory graph is courtesy of Altos Research.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Abnormal Returns

FEBRUARY 6, 2023

Markets February has historically been the second worst month for the stock market. (allstarcharts.com) Finance We're all better off having a robust short selling community. (netinterest.co) Why Rothschild & Co is going private. (ft.com) Wall Street layoffs are nothing new. (npr.org) Companies Four big trends are causing the tech giants trouble.

Wealth Management

FEBRUARY 6, 2023

What would an advisor do differently?

Calculated Risk

FEBRUARY 6, 2023

Today, in the Calculated Risk Real Estate Newsletter: Black Knight Mortgage Monitor: Home Prices Declined in December; Down 5.3% since June A brief excerpt: Here is a graph of the Black Knight HPI. The index is still up 5.0% year-over-year but declined for the sixth straight month in December and is now 5.3% off the peak in June. • December’s 0.45% seasonally adjusted decline was roughly on par with the 0.48% average seen over the past 6 months, with an even sharper 0.89% decline on an unadjuste

Wealth Management

FEBRUARY 6, 2023

United Advisor Group, which launches with $750 million in AUM, wants Goldman's full suite of integrated wealth management services, including alternative investments and asset-backed lending.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

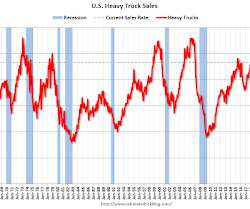

Calculated Risk

FEBRUARY 6, 2023

The BEA released their estimate of vehicle sales for January last week. This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the January 2023 seasonally adjusted annual sales rate (SAAR). Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new all-time high of 570 thousand SAAR in April 2019.

Wealth Management

FEBRUARY 6, 2023

Wealth Management IQ and Discovery Database have compiled a list of RIAs that are experiencing outsized growth while keeping sight of their first priority: the client.

Calculated Risk

FEBRUARY 6, 2023

From Matthew Graham at Mortgage News Daily: Mortgage Rates Jump to Highest Levels in a Month Mortgage rates were already under quite a bit of pressure on Friday following the stunningly strong jobs report in the morning. Strong economic data is generally bad for rates. One reason for that is the data's impact on decisions made by the Federal Reserve.

Wealth Management

FEBRUARY 6, 2023

Preparing to celebrate its 50th anniversary this year, MAI Capital Management has grown by at least 170% since 2017 while maintaining an impressive level of client service, adding capabilities and developing a strong acquisition model.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

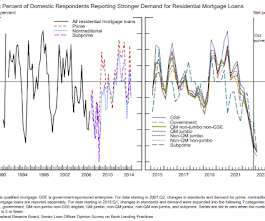

Calculated Risk

FEBRUARY 6, 2023

From the Federal Reserve: The January 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices The January 2023 Senior Loan Officer Opinion Survey (SLOOS) on Bank Lending Practices addressed changes in the standards and terms on, and demand for, bank loans to businesses and households over the past three months, which generally correspond to the fourth quarter of 2022.

Wealth Management

FEBRUARY 6, 2023

The White House's proposed Renters Bill of Rights is likely more talk than action, reports Propmodo. Commercial Property Executive takes another look at the $15 billion STORE Capital deal, now that the transaction has closed. These are among today’s must reads from around the commercial real estate industry.

Clever Girl Finance

FEBRUARY 6, 2023

If you are seeking jobs for stay at home moms, it is completely possible to find the right fit. As a mom, you are already juggling a wide range of responsibilities. The last thing that you want to do is commute to a job on top of everything else that's causing you mom struggles. That’s where finding the right job as a stay at home mom can help. The best part is that there are dozens of jobs to choose from.

Wealth Management

FEBRUARY 6, 2023

Creating financial plans isn’t easy. And while financial planning rules of thumb are obviously imperfect, they’re better than nothing.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

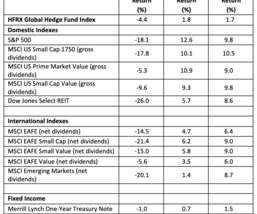

Advisor Perspectives

FEBRUARY 6, 2023

The greatest anomaly is that despite decades of poor performance and the failure to effectively hedge exposure to conventional security classes, assets under management among hedge funds have grown from about $300 billion 25 years ago to about $5 trillion today.

Wealth Management

FEBRUARY 6, 2023

Mario Rivero pleaded guilty in New Jersey federal court to charges of wire fraud and securities fraud.

Clever Girl Finance

FEBRUARY 6, 2023

The term personal finance ratios might be giving you flashbacks to math class. Back then, if students looked like they were zoning out, your teacher might have told you “pay attention, this will be useful to you later.” Well, this time you don’t have to wait—a lot of the ratios below will be useful to you right now! They are essentially quick equations that can help you make helpful financial calculations.

Wealth Management

FEBRUARY 6, 2023

The FTSE All Equity REIT Index total returns rose more than 10 percent in January.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

XY Planning Network

FEBRUARY 6, 2023

6.5 MIN READ Admit it: Do you have a shoebox full of “important” papers that you *think* might be needed for your taxes? Do you know what’s in there? Are they in your junk drawer? The kitchen counter? The dining room table? In some online account that you don’t have the password for? Some combination of the above? We get it. “Preparing” for tax preparation can be daunting.

Wealth Management

FEBRUARY 6, 2023

Metro Loft Developers LLC, headed by Nathan Berman, is partnering with Silverstein Properties to raise $1.5 billion in equity to start SilverLoft, an engine for years of conversions, beginning with 55 Broad. Metro Loft and Silverstein have identified more than 200 candidates. If they were to purchase just 10 percent of those properties over the next decade, it could result in as many as 15,000 units, according to Silverstein.

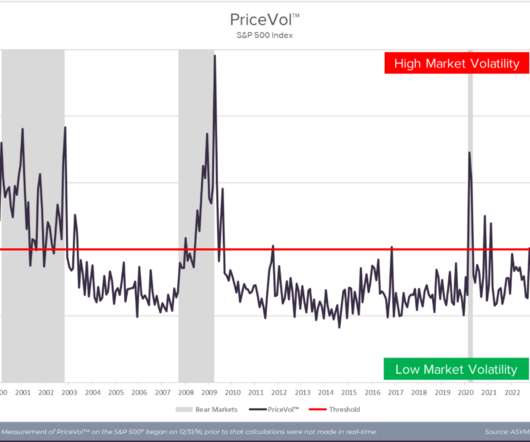

A Wealth of Common Sense

FEBRUARY 6, 2023

Today’s show is brought to you by ASYMmetric ETFs: We had Darren Schuringa, Founder and CEO of ASYMmetric ETFs on the show to discuss Asymetric’s latest Smart Income and Smart Alpha ETFs. On today’s show, we discuss: Darren’s background prior to ASYMmetric ETFs How ASYMmetric structures their strategies Looking at market volatility Rules-based strategies v emotions What makes Smart ETFs smart How ASYMmet.

Wealth Management

FEBRUARY 6, 2023

Dave Dase, head of franchise relationships, will take over for Duran, who will still work with the firm on a new coordinated effort to bring Goldman’s capabilities across divisions to the RIA community.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Abnormal Returns

FEBRUARY 6, 2023

Podcasts Brendan Frasier talks with Jordan Hutchison of Shaping Wealth about finding flow with clients. (wiredplanning.com) Michael Kitces talks with Ali Swart who is a Partner and the Managing Director for Waldron Private Wealth about the business of a multi-family office. (kitces.com) Rick Ferri talks taxes and withdrawal rates with Christine Benz of Morningstar.

Wealth Management

FEBRUARY 6, 2023

The winners of tomorrow are not the winners of yesterday. So why hold a fund that mostly tracks the latter?

MarketWatch

FEBRUARY 6, 2023

Tyson Foods Inc. stock TSN slid 5.9% in premarket trade Monday, after the meat supplier missed consensus estimates for its fiscal first quarter by a wide margin. “We faced some challenges in the first quarter,” Chief Executive Donnie King said in a statement. “Market dynamics and some operational inefficiencies impacted our profitability. We expect to improve our performance through the back half of fiscal 2023 and into the future, as we strive to execute with excellence and work to become best

Wealth Management

FEBRUARY 6, 2023

Historically, companies ramp up restructuring after large economic shocks with an eye toward labor-saving technologies.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content