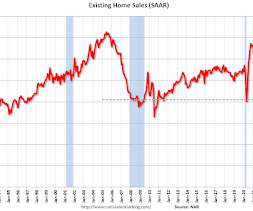

NAR: Existing-Home Sales Decreased to 4.09 million SAAR in November

Calculated Risk

DECEMBER 21, 2022

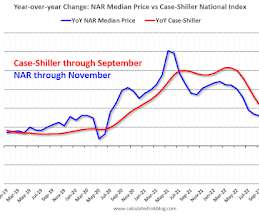

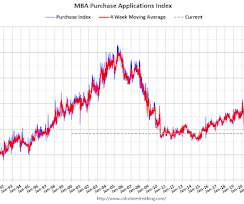

From the NAR: Existing-Home Sales Dipped 7.7% in November Existing-home sales declined for the tenth month in a row in November, according to the National Association of REALTORS®. All four major U.S. regions recorded month-over-month and year-over-year declines. Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – waned 7.7% from October to a seasonally adjusted annual rate of 4.09 million in November.

Let's personalize your content