The Two Flavors Of Direct Indexing

Wealth Management

MAY 19, 2023

Direct indexing is often applied as the name for two different things, it is time to clarify.

Wealth Management

MAY 19, 2023

Direct indexing is often applied as the name for two different things, it is time to clarify.

The Big Picture

MAY 19, 2023

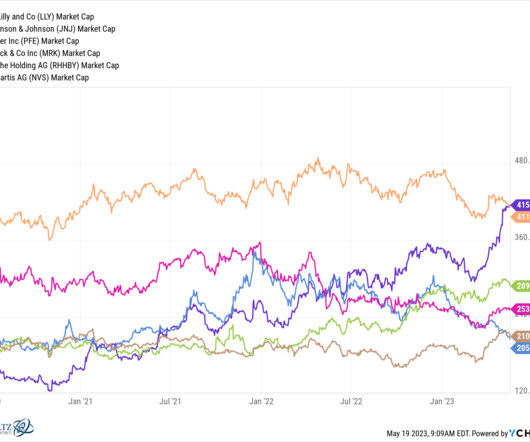

Let’s see if I can find something to counter and/or undercut each of these 10 items listed in this morning’s tweet above: 1. Only 5 stocks driving markets?! Then why are Equal-weighted indices doing so well? Equal-weighted Nasdaq100 up 17% since the June lows for the market because “it’s only 5 stocks”? How bad at math do you need to be to think that it’s only 5 stocks driving this market?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

MAY 19, 2023

Education on key asset allocation strategies is necessary to get clients ready for their golden years.

Nerd's Eye View

MAY 19, 2023

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news of a recent survey indicating that investors overwhelmingly believe that Artificial Intelligence (AI) will help financial advisors better serve their clients and would like to work with an advisor who leverages AI tools.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

MAY 19, 2023

We collected some of the best obituaries and tributes to real estate industry icon Sam Zell, who passed away at age 81 at his home. Sandeep Mathrani’s abrupt departure as CEO of WeWork came as a surprise to observers, reports Bisnow. These are among the must reads from around the real estate investment world to heading into the weekend.

Calculated Risk

MAY 19, 2023

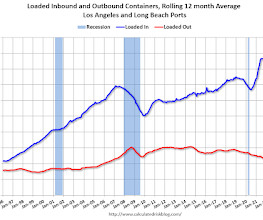

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted several years ago ), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast. Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

MAY 19, 2023

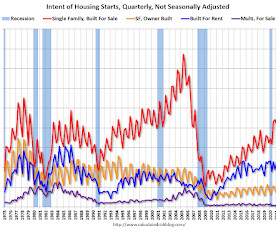

Today, in the Calculated Risk Real Estate Newsletter: Similar Number of Housing Units started in Q1 as 'Built-for-Rent' as 'Built-for-Sale' A brief excerpt: Along with the monthly housing starts report for January last week, the Census Bureau released Housing Units Started by Purpose and Design through Q1 2023. This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and

Wealth Management

MAY 19, 2023

There are three finalists in the running for CEO after Gorman leaves, including Andy Saperstein, the head of Morgan Stanley Wealth Management.

The Reformed Broker

MAY 19, 2023

RWM is coming to Austin, TX June 12th-14th @Downtown with more detailsEmail us at info@ritholtzwealth.com subject line “Austin” to reserve a meeting slot! pic.twitter.com/9iSdG4HFf3 — Ritholtz Wealth (@RitholtzWealth) May 19, 2023 Why did we open an office in Austin, Texas? Is it because the city is expected to add another 1.5 million residents by 2040, giving it a population of 4 million?

Wealth Management

MAY 19, 2023

Wednesday, June 14, 2023 | 2:00 PM ET

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

The Reformed Broker

MAY 19, 2023

Welcome to the latest episode of The Compound & Friends. This week, Michael Batnick, Morgan Housel, Chris Davis, and Downtown Josh Brown discuss the big wave of AI coming, the most important chart in the stock market, SVB insiders facing scrutiny, the worst startup investment ever, and much more! You can listen to the whole thing below, or find it wherever you like to listen to your favorite pods!

Calculated Risk

MAY 19, 2023

From BofA: Overall, this week’s data pushed up our 1Q US GDP tracking estimate up from 0.9% q/q saar to 1.1% q/q saar and kicked off our 2Q GDP tracking estimate at 1.2% q/q saar [May 19th estimate] emphasis added From Goldman: We left our Q2 GDP tracking estimate unchanged at +2.0% (qoq ar) and our past-quarter GDP tracking estimate for Q1 unchanged at +1.4%.

A Wealth of Common Sense

MAY 19, 2023

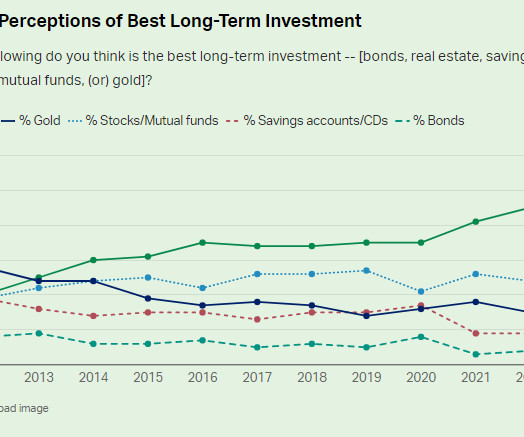

Each year Gallup performs a survey that asks a group of Americans what the best long-term investment is among the following options: Stocks Bonds Cash Gold Real estate These are the latest results: Real estate has been at the top of the charts for over a decade at this point but it saw a big drop from 2022 to 2023. Following the 2022 bear market stocks fell to third place behind gold.

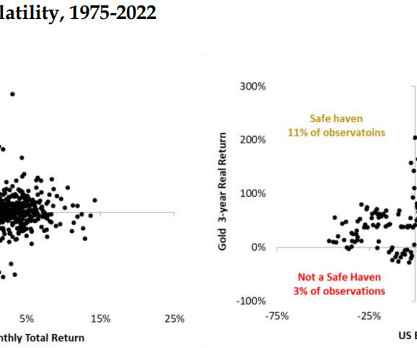

Alpha Architect

MAY 19, 2023

I’ve received calls from clients inquiring about moving assets to gold. When I asked them why, three reasons dominated. Gold as a Safe-Haven Asset was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Abnormal Returns

MAY 19, 2023

Markets Across the board, volatility is below average. (mrzepczynski.blogspot.com) Housing stocks are defying recession talk. (carsongroup.com) Finance The battle to be the biggest S&P 500 fund is on. (ft.com) There is a big problem with structured notes. (morningstar.com) Advertising YouTube really wants you want to watch more and (longer) ads.

Wealth Management

MAY 19, 2023

FP Alpha's Andrew Altfest discusses the disconnect between what investors want and what some advisors deliver.

Abnormal Returns

MAY 19, 2023

Economics Margaret Hoover talks with Felix Salmon author of "The Phoenix Economy: Work, Life, and Money in the New Not Normal." (youtube.com) Tyler Cowen talks with Simon Johnson, co-author of "Power and Progress: Our Thousand-Year Struggle Over Technology and Prosperity." (conversationswithtyler.com) Cardiff Garcia talks about the economics of innovation with Heidi Williams and Caleb Watney.

Wealth Management

MAY 19, 2023

JPMorgan Chase & Co., Goldman Sachs Group Inc. and Morgan Stanley are among those hawking "quantitative investment strategies.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Advisor Perspectives

MAY 19, 2023

Looming behind market fears over the prospect of a historic US default is the less-discussed risk of what would follow a deal to resolve the debt-ceiling impasse.

Wealth Management

MAY 19, 2023

The expansion comes amid ongoing concern about liquidity among US Treasuries.

NAIFA Advisor Today

MAY 19, 2023

Kathleen Owings makes her appearance on the Advisorist Virtual Advisor Power Hour this coming Wednesday, May 24 at 12 pm eastern. Kathleen will discuss critical lessons from her book, Put Your Money to Work: A Woman’s Guide to Financial Confidence , in order to help more women with their finances with advice that was never taught in school. Kathleen will also share the story of her non-traditional route into the financial services industry and how it has helped during times of high market volati

Wealth Management

MAY 19, 2023

The market dynamics exist for blank-check companies, but private businesses and investors are skeptical after the excess of the last few years.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

MarketWatch

MAY 19, 2023

Debt-ceiling negotiations are at a “pause,” said Republican Rep. Garret Graves of Louisiana, a key ally of House Speaker Kevin McCarthy, according to multiple reports. It wasn’t immediately clear how long the pause would last. Graves also said the White House’s team was being “unreasonable.” Market Pulse Stories are Rapid-fire, short news bursts on stocks and markets as they move.

Wealth Management

MAY 19, 2023

“The SEC will drag their feet,” Van Eck said.

MarketWatch

MAY 19, 2023

The KBW Regional Bank index XX:KRX slumped over 3%, after a report from CNN that Treasury Secretary Janet Yellen told bank chief executives than more mergers may be necessary. The CNN report, citing two people familiar with the matter, raises the prospect that more regional banks would have to be bought by larger too-big-to-fail firms. The Treasury Department confirmed the meeting on Thursday but its readout did not include the point about the possible need for further mergers.

Advisor Perspectives

MAY 19, 2023

Advisors are looking ahead to the policy and tax changes impacting their high-net-worth clients. Those include changes stemming from the passage of Secure 2.0 Act.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

MarketWatch

MAY 19, 2023

Morgan Stanley’s MS stock is down 0.8% early Friday as CEO James Gorman aired a plan at the bank’s annual general shareholder meeting to step down in the next 12 months. “The specific timing of the CEO transition has not been determined, but it is the board’s and my expectation that it will occur at some point in the next 12 months,” Gorman said, according to a transcript provided to MarketWatch.

Advisor Perspectives

MAY 19, 2023

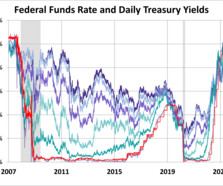

The yield on the 10-year note ended May 19, 2023 at 3.70%, the 2-year note ended at 4.28%, and the 30-year at 3.95%.

MarketWatch

MAY 19, 2023

Samsung Electronics Co. Ltd. KR:005930 ended an internal review that was looking into whether to swap out Alphabet Inc.’s GOOGGOOGL Google with Microsoft Corp.’s MSFT Bing as the default search engine for the Internet app on its mobile devices, The Wall Street Journal reported Friday. The New York Times had wrote in April that Samsung was exploring a potential switch, a report that weighed on Alphabet shares at the time.

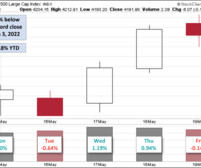

Advisor Perspectives

MAY 19, 2023

The S&P 500 fell slightly on Friday after finishing Thursday with the index's highest close of the year. The index is currently up 9.18% year to date and is 12.60% below its record close from January 3, 2022.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content