Weekly Market Insights – January 8, 2024

Cornerstone Financial Advisory

JANUARY 8, 2024

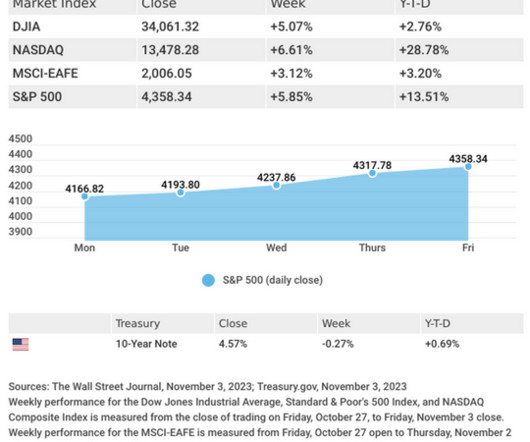

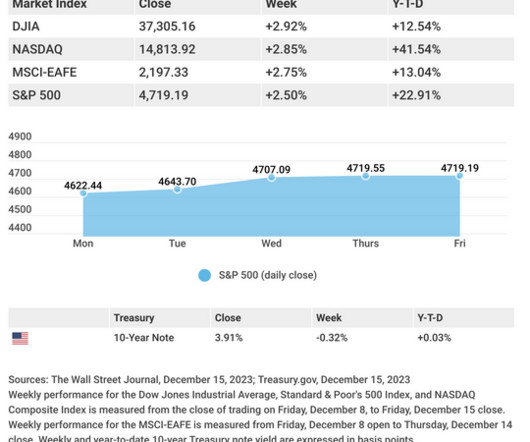

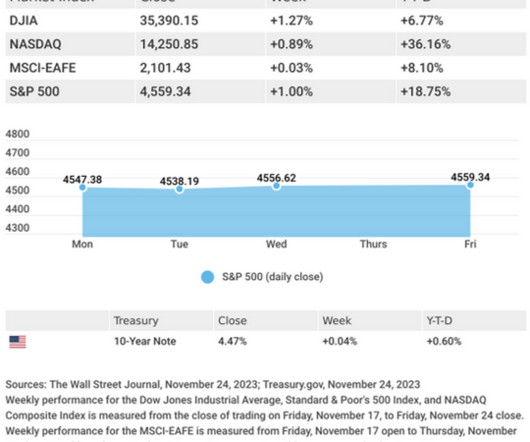

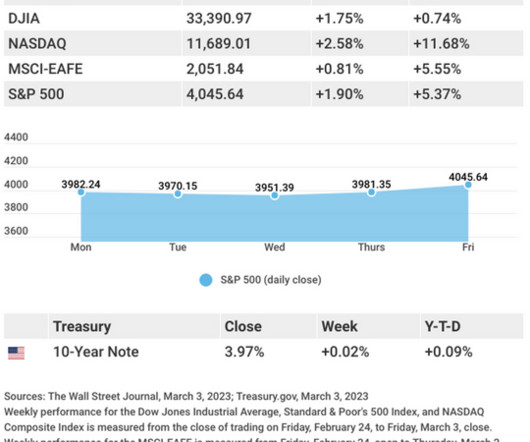

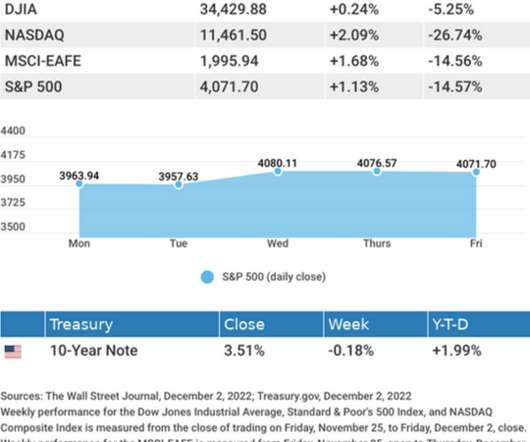

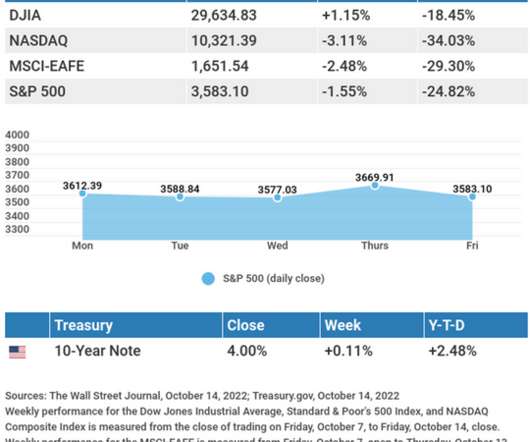

1,2 All About The Fed On Wednesday, manufacturing news came in better than expected, lifting markets until the December Federal Open Market Committee meeting minutes were released, revealing that the Fed members had discussed rate cuts for 2024 but in no specific terms. 3,4 This Week: Key Economic Data Tuesday: International Trade in Goods.

Let's personalize your content