Weekly Market Insights – November 20, 2023

Cornerstone Financial Advisory

NOVEMBER 20, 2023

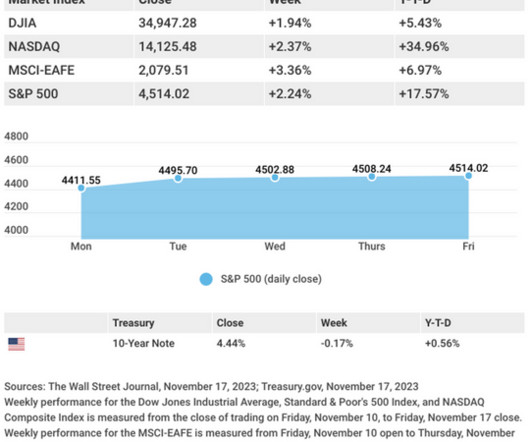

The rally paused in the final days of trading as stocks digested their gains and investors assessed weak retail sales and industrial production reports and a rise in continuing jobless claims. 6 This Week: Key Economic Data Tuesday: Existing Home Sales. Investment Advisor Representative, Cambridge Investment Research Advisors, Inc.,

Let's personalize your content