Happy Holidays

Bell Investment Advisors

JANUARY 4, 2024

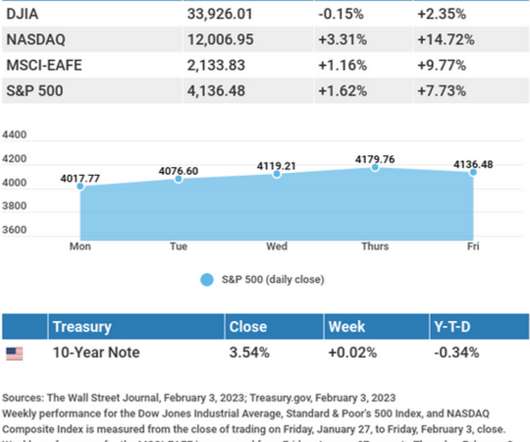

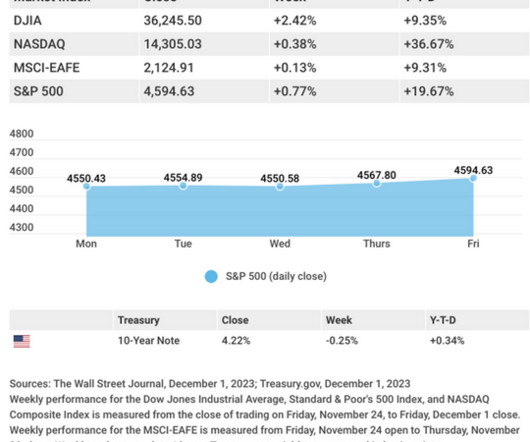

Not to be left out, the bond market rose by 9% from its October low. Why did financial markets deliver such favorable results in December? Investors now expect a loosening of monetary policy and a soft economic landing with no immediate recession. bond market returns to nearly match those of the U.S.

Let's personalize your content