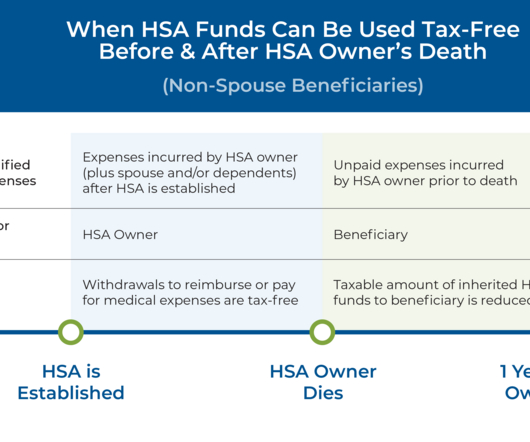

The HSA ‘Deathbed Drawdown’: Making Tax-Efficient Distributions Of Large Balances (When There Isn’t Much Time)

Nerd's Eye View

FEBRUARY 15, 2023

Health Savings Accounts (HSAs) feature useful tax advantages that make them a popular savings vehicle. One possible outcome of ‘superfunding’ an HSA, however, is that the account owner may not actually use up all of their HSA funds over their lifetime, which can have significant tax consequences. Read More.

Let's personalize your content