“Legacy IRA” Rollover To A Charitable Gift Annuity: Using This New Tax-Advantaged Opportunity To Help Clients Achieve Charitable And Retirement Goals

Nerd's Eye View

AUGUST 23, 2023

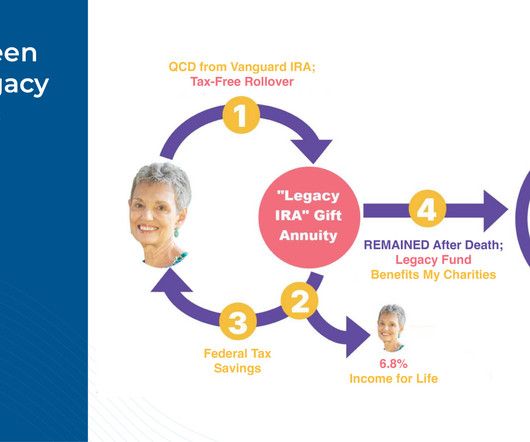

Act, passed in December 2022, created the ability for individuals over age 70 1/2 to make a one-time Qualified Charitable Distribution (QCD) of up to $50,000 of IRA funds into a CGA, with the amount distributed to the CGA being excludable from the donor's taxable income. But the SECURE 2.0 legislation at the end of 2022. Read More.

Let's personalize your content