Caught Between Privacy Laws And Contracts: The Compliance Dilemma Of Taking Clients To A New Firm

Nerd's Eye View

JUNE 4, 2025

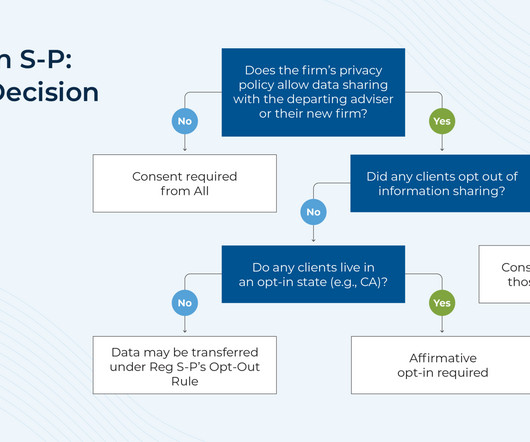

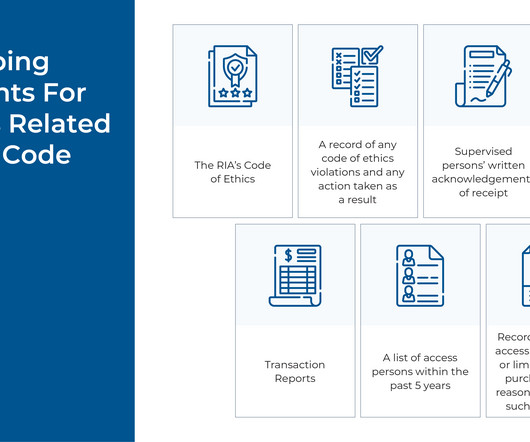

From a privacy standpoint, client data held by an RIA or broker-dealer is considered Nonpublic Personal Information (NPI) under Regulation S-P and generally cannot be shared with an unaffiliated third party without the client's consent – unless the firm's privacy policy explicitly allows it and the client has not opted out.

Let's personalize your content