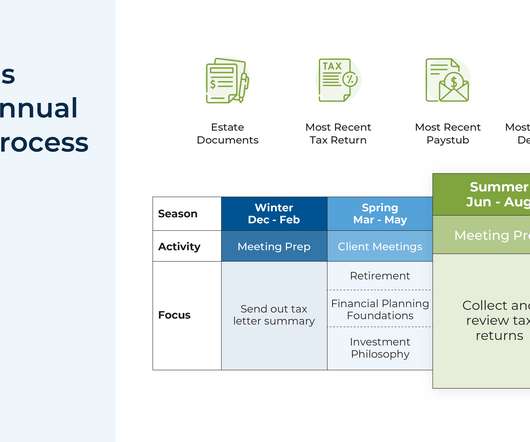

Increasing Financial Planning Efficiency With A Systematized Annual Process

Nerd's Eye View

NOVEMBER 21, 2022

A common service model for many financial advisory firms is to schedule annual client meetings throughout the year where the advisor meets with each client in the month they started working with the firm, and conducts a comprehensive review of all planning topics for the client.

Let's personalize your content