Estate Planning 101

Integrity Financial Planning

AUGUST 28, 2022

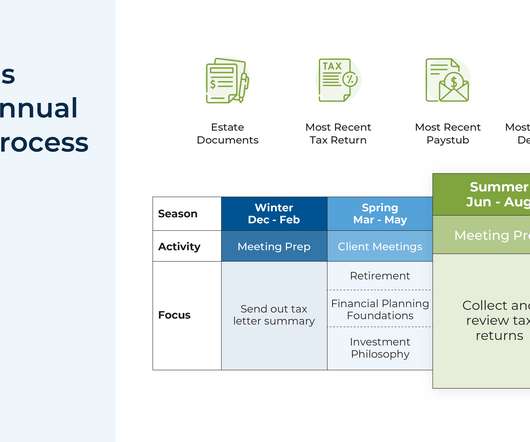

Understand the basics first, and then create an estate plan. Wills and trusts are both important estate planning tools with important differences. Communicate, Communicate, Communicate. Get in touch with us to find out how we can help you create a financial plan for your retirement and the future.

Let's personalize your content