Weekend Reading For Financial Planners (March 11-12)

Nerd's Eye View

MARCH 10, 2023

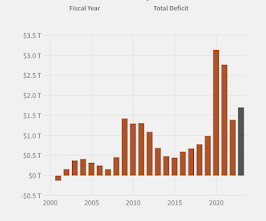

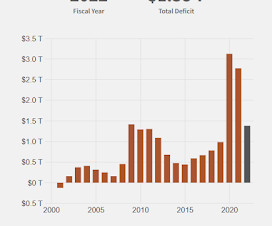

While the budget almost certainly will face stiff resistance in a divided Congress, proposals that could affect financial advisors and their clients include increasing the top income and capital gains tax rates, raising the Net Investment Income Tax rate and applying it to pass-through income, and increasing the amount of the child tax credit.

Let's personalize your content