Weekend Reading For Financial Planners (January 25–26)

Nerd's Eye View

JANUARY 24, 2025

Read More.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Abnormal Returns

MARCH 14, 2025

fasterplease.substack.com) Policy Stephen Dubner talks tax myths with Jessica Riedl, a senior fellow in budget, tax, and economic policy at the Manhattan Institute. (podcasts.apple.com) Jim Pethokoukis talks the business of space with Matt Weinzierl, co-author of "Space to Grow: Unlocking the Final Economic Frontier."

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Big Picture

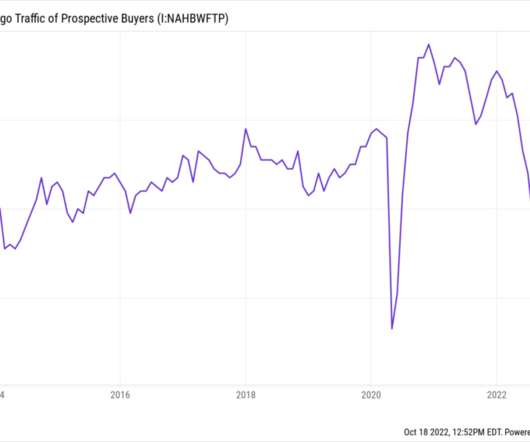

OCTOBER 18, 2022

We have discussed in the past why the actual purchase price of a home matters less than the monthly carrying costs: The sale price is somewhat abstract while homeowners must pay their monthly mortgage, utilities, HOA, and taxes. The post Collapse in Prospective Home Buyer Traffic appeared first on The Big Picture.

Clever Girl Finance

JULY 3, 2023

Love it or hate it, if you want to be financially successful, you need to budget your money and understand budget categories. Getting your finances in order and building wealth takes planning, and your budget can help you do just that. Determine which budgeting methods will work for you 2. Table of contents 1.

Clever Girl Finance

FEBRUARY 10, 2023

Like many, you might shudder at the word budget. But the 50-30-20 budget and the 50-30-20 budget template prove it doesn't have to be difficult. A budget plans out exactly how you'll use your money and this can be tailored to suit your specific lifestyle and situation. What is a 50-30-20 budget?

Clever Girl Finance

JULY 16, 2023

Budgeting as a couple is critical in managing your household finances. Your budget not only allows you to plan and track where the money will be spent, but it enables you to direct the course of your finances together. Table of contents 5 Steps to get started budgeting as a couple Expert tip What is the best way to budget as a couple?

Clever Girl Finance

JULY 13, 2024

The 60/30/10 budget turns the traditional rules of budgeting upside down. Instead of focusing on discretionary spending, this budgeting rule emphasizes sprinting toward our financial goals. And although the 60/30/10 rule budget won’t work for everyone, many could use it to take their finances to the next level.

Nerd's Eye View

OCTOBER 4, 2023

People often talk about "the economy" as a single entity whose parts move in unison, with a small number of key indicators (such as GDP, the unemployment rate, and inflation) moving reliably in relation to each other. And even though U.S.

Clever Girl Finance

NOVEMBER 4, 2023

Love it or hate it, if you want to be financially successful, you need to budget your money and success with budgeting means understanding budget categories. So, let’s talk about the various categories that you might need, including a budget categories list! How many categories should I have for a budget?

Clever Girl Finance

SEPTEMBER 11, 2023

Like many, you might shudder at the word budget, or perhaps it sounds too boring or challenging to figure out. But the 50-30-20 rule and the 50 30 20 budget template prove it doesn’t have to be difficult. If you’re looking to simplify your budgeting process or are new to budgeting, then this might be the perfect match!

Clever Girl Finance

DECEMBER 16, 2023

If you don’t feel like you truly have a strong handle on your finances, one possible cause for that is using a budgeting method that doesn’t work. While not everyone needs a to-the-penny balanced budget, some type of budgeting strategy or template is really important if you want to know where your money is going month after month.

Nerd's Eye View

DECEMBER 23, 2022

A review of financial planning actions, from tax-loss harvesting to charitable giving, that have a December 31 deadline.

Good Financial Cents

MARCH 17, 2023

This information is critical if you want to create a budget and manage your money correctly. I’ll also share some budgeting and side hustle tips so you can get the most out of the money you earn. Paid Time Off for Hourly Employees Earning $25 per Hour How Much Is $25 An Hour After Taxes?

Clever Girl Finance

JANUARY 16, 2024

There are many different ways to come up with your perfect budgeting strategy. Alongside your monthly budget, you should also have a bare bones budget waiting in the wings. Table of contents What is a bare bones budget? Who needs a bare bones budget? It’s a budget that only covers the necessities.

Clever Girl Finance

SEPTEMBER 7, 2023

In personal finance, where income, expenses, dreams, and aspirations converge, the budget emerges as a crucial tool. It’s not just a set of numbers, rather, it’s a strategic plan that empowers you to navigate the complexities of financial decisions. Table of contents What is a family budget? What is a family budget?

Nerd's Eye View

OCTOBER 30, 2023

Most notable is the fact that industry associations are not the drivers of advisor conferences that they once were; while a decade ago, 75%+ of this "Best Conferences" list consisted of various events run by industry associations, now it numbers less than 25%. Read More.

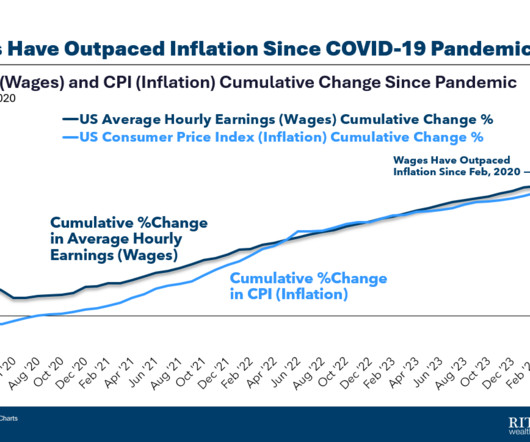

The Big Picture

JUNE 27, 2024

If they get a 7% increase in wages, they see a modest increase in their direct deposit of after FICA, federal and state withholding taxes, 401K, etc. and energy as a percentage of your household budget is less than it ever was. For most of us who are not regularly crunching the numbers in spreadsheets, it may not feel that way.

Nationwide Financial

AUGUST 29, 2022

Key Takeaways: Even without new legislation, the prospect of higher taxes in the future is still looming. The impact of higher taxes on retirees could be substantial, so staying up to date on the current tax landscape is vital. But even without new legislation, the prospect of higher taxes in the future is still looming.

The Big Picture

MARCH 10, 2025

” A : Money is NOT a store of value to be useful, a dollar must maintain its value long enough for me to pay my rent or mortgage, buy food and energy, fund my entertainment and travel, pay my taxes, and get invested. It does that splendidly. Q :“ Your book discusses emotional decision-making extensively.

Your Richest Life

JUNE 3, 2024

Some people start to feel like they’re behind on their goals anyway, so what’s the point of looking at the numbers to face the reality? Find some tax savings While your taxes are fresh on your mind, you can use this time to organize your paperwork, checking your withholdings and evaluating your tax-savings strategies.

Carson Wealth

SEPTEMBER 5, 2024

Whether you’re enrolling for the first time or considering a change, these tips will help you choose a plan that fits your healthcare needs and budget. Here are some tips to protect yourself: Guard your Medicare number: Treat your Medicare number like you would a credit card number.

Clever Girl Finance

SEPTEMBER 28, 2022

There are many different ways to come up with your perfect budgeting strategy. Alongside your monthly budget, you should also have a bare bones budget waiting in the wings. What is a bare bones budget? It's a budget that only covers the necessities. That's why this is not a sustainable long-term budget.

MainStreet Financial Planning

JUNE 13, 2023

Make a new baby budget. Stay on track with this New Baby Budget Guide. Get a social security number for your child. You can request a social security number along with your baby’s birth certificate. Take advantage of tax breaks. If you need some guidance creating your New Baby Budget we can help!

Carson Wealth

OCTOBER 24, 2024

Taxes One of the biggest financial considerations for Americans retiring abroad is understanding how taxes will work. is one of the few countries that taxes its citizens on worldwide income, regardless of where they reside. tax return every year. To avoid double taxation — paying taxes both in the U.S.

Getting Your Financial Ducks In A Row

JUNE 12, 2023

If you’re having trouble balancing your budget (your income is less than your expenses) you’ll need to look at the “nice” expenses and determine what you can do without. My preference is to use the most Efficient methods, in terms of placement of funds, taxes, expenses, and risks, in order to take you toward those goals.

Carson Wealth

DECEMBER 10, 2024

With careful planning, you may be able to reduce your tax bill or optimize the impact of your estate. Establish a Budget and Schedule for Giving One of your first tasks is to determine how much you are comfortable giving. Or maybe boost their publicity budget to attract more donors? What do you want to do for that organization?

Harness Wealth

MARCH 27, 2025

Pass-Through Entity Tax (PTET) is a state-level tax mechanism designed to sidestep the federal State and Local Tax (SALT) deduction limit. Allowing a pass-through entity to pay state income taxes directly, PTET effectively shifts the tax burden from individual owners to the business itself.

Harness Wealth

MAY 12, 2025

The tax arena may be in a constant state of flux, however, 2025 is proving to be a year of major upheavals. Alongside the widely anticipated sunset of the Tax Cuts and Jobs Act (TCJA), 39 states have implemented notable tax changes this year. These reductions aimed at enhancing business competitiveness and attracting investment.

MainStreet Financial Planning

DECEMBER 20, 2023

Review your budget – Are there any new expenses that you need to add or anything that can be taken out such as any unused subscriptions? Factors to consider would include – job changes, a change in the number of dependents, or a change in the number of breadwinners.

The Big Picture

MAY 20, 2025

In addition, they’ve put up some really impressive numbers over the past 30 years, which has given them the opportunity to donate tens of millions of dollars to their favorite organizations. We don’t give exact numbers. Number one, it means our transaction costs are less, which based on your career, you know exactly.

Harness Wealth

MAY 18, 2025

Filing taxes in Utah requires a clear understanding of the specific forms and regulations that apply to residents and non-residents alike. Navigating the tax landscape can be complex, but having a comprehensive guide to Utah tax forms simplifies the process significantly. Obtaining Utah tax forms is straightforward.

Clever Girl Finance

MARCH 28, 2023

The importance of understanding financial literacy basics Financial literacy covers several topics , including budgeting, banking, investing, handling debt, and planning for the future. And budgeting isn’t as tricky as it sounds. A monthly budget (or biweekly or weekly) gives you an overview of your personal finances.

MazumaBusinessAccounting

JULY 15, 2021

Strategizing around how to pay yourself, your taxes, and other expenses. Tax Planning. Calculating tax rates can be tricky for small business owners. In addition to paying taxes on their income, many small business owners need to pay a 15% self-employment tax—which covers Social Security and Medicare taxes.

Carson Wealth

AUGUST 4, 2022

Of course, there are always the everyday household expenses to account for in your post-retirement budget. But one budget line that doesn’t always get enough attention? 1 It’s a number that just keeps rising, too. However, depending on how contributions were treated, distributions may still be taxed on the way out. .

Good Financial Cents

APRIL 19, 2023

This amount is based on gross income, which is before taxes and other deductions are taken out. per month Keep in mind that after taxes, the amount you receive will be reduced to a five-figure sum. How Much Is 6 Figures After Taxes? Your gross income determines the number of figures you earn. How Can I Earn 6 Figures?

Harness Wealth

AUGUST 31, 2023

In this guide, we explore the strategic and financial considerations of building a team for your tax firm, from understanding the hiring process to outlining the unique solutions that Harness Wealth can provide. Deciding Between an Accountant and a Tax Assistant The first hire you might consider adding to your team is another accountant.

MazumaBusinessAccounting

APRIL 10, 2021

Unpaid invoices can collect interest or be found at a time where the budget it tighter than usual. . Underestimate Tax Bill: When it comes to paying taxes, no one likes to be surprised by a larger number than what they were expecting. Incorrect books can cause a miscalculation and underestimation of your tax bill.

Clever Girl Finance

FEBRUARY 6, 2023

In mathematical terms, a ratio is essentially a way to compare two numbers to each other. Since personal finance is all about numbers, that can come in handy in many ways! A traditional ratio is expressed as a divisible number, but some of the financial ratios below use multiplication or subtractions instead.

Random Roger's Retirement Planning

APRIL 2, 2024

Northwestern Mutual published a report about the state of retirement and of course all the numbers are grim. million, do you think that number is close to what you need? I've been pushing back on the idea of have a number, a retirement number, for a very long time. Arizona is a low tax state. Do you need more?

Clever Girl Finance

JANUARY 29, 2023

Any medical debt, personal loans, or back taxes are also considered liabilities. Staying away from debt is also encouraged so you can keep your net worth number positive. Many things can make your net worth higher, but keeping low liabilities (debt) and growing your assets will determine your net worth number.

Good Financial Cents

JULY 3, 2023

Multiply the number of hours in a workweek (40) by the number of weeks in a year (52) to calculate the total number of working hours in a year: 40 hours x 52 weeks = 2,080 hours. Multiply the $30 hourly rate by the total number of working hours (2,080) to determine the gross annual salary: $30 x 2,080 hours = $62,400.

Clever Girl Finance

MARCH 19, 2024

Is a financial plan the same as a budget? You should also go over the numbers. Make a budget Budgeting is a key part of how to create a financial plan that works. A budget must work for you, which means finding a method that suits your circumstances. A pen and paper or a budget planner will work just as well!

Clever Girl Finance

AUGUST 14, 2022

Do you cut down on the rest of your budget? Without a doubt, in the coming months, an expense will likely come up that is outside of your usual budget. Surely it's a no-brainer to use your savings to cover some of your off-budget expenses , right? Self-employment tax. How will you pay for it? Pay it off by credit card ?

WiserAdvisor

SEPTEMBER 1, 2022

If you wish to have a firm grip on your finances and want to learn about different strategies related to investing, tax-saving, or retirement planning, consult with a professional financial advisor who can advise you on the same. You need help creating a budget. Budgeting is one of the most important aspects of financial planning.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content