Air Bags Deployed to Cushion Bank Crashes

Investing Caffeine

APRIL 3, 2023

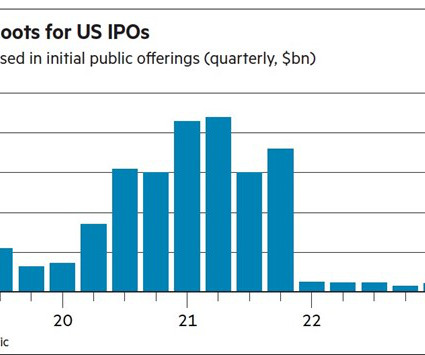

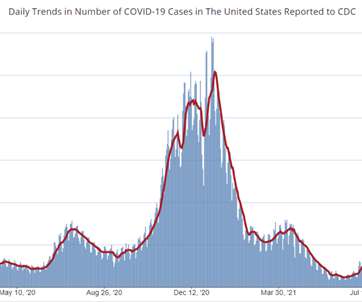

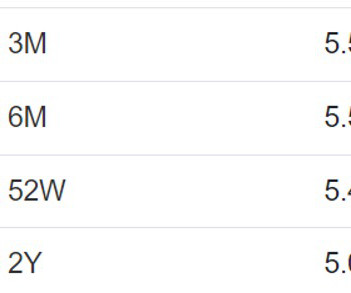

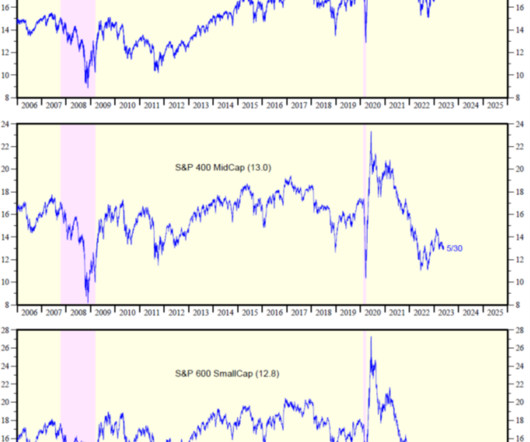

In recent years, COVID and a ZIRP (Zero Interest Rate Policy) caused out-of-control inflation to swerve the economy in the wrong direction. Source: Trading Economics Unfortunately, this unparalleled spike in interest rates contributed to the 2nd and 3rd largest bank failures in American history, both occurring in March.

Let's personalize your content