Trends In Financial Advice Fees: What Financial Advisors Are Actually Charging For Their Services

Nerd's Eye View

JUNE 16, 2025

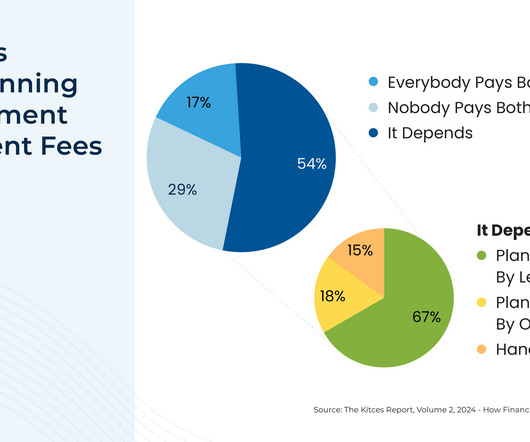

While many firms have historically relied on commission-based compensation methods – reflecting a sales-driven approach – financial advice has evolved with technological advancements and a greater focus on financial planning, with the Assets Under Management (AUM) fee emerging as the primary compensation model.

Let's personalize your content