Bank CDs Are an Insult to America’s Savers

Wealth Management

MARCH 1, 2023

Big financial institutions don’t feel the need to offer competitive rates on certificates of deposit, which are universally below the world’s safest asset: Treasury bills.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

MARCH 1, 2023

Big financial institutions don’t feel the need to offer competitive rates on certificates of deposit, which are universally below the world’s safest asset: Treasury bills.

Nerd's Eye View

MAY 7, 2024

Hannah is a partner and financial advisor at Lomanto Provost Financial Advisors, a hybrid advisory firm based in Plattsburgh, New York, that oversees approximately $150 million in assets under management for about 380 client households.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Good Financial Cents

MARCH 22, 2023

O ne of the issues that many people have been concerned with during this recession is what happens when a bank is seized by the FDIC. This is a matter of concern because the recession saw quite a few bank closings, and there are still hundreds of banks still on the FDIC watch list for potential failures.

MarketWatch

MARCH 10, 2023

Silicon Valley Bank has been closed by the California Department of Financial Protection and Innovation, and the Federal Deposit Insurance Corporation (FDIC) has been appointed receiver, becoming the first FDIC-backed institution to fail this year. The bank had 13 branches in California and Massachusetts, which will reopen on Monday.

Ballast Advisors

MARCH 15, 2023

.” This refers to a partnership between the RIA and a financial institution that acts as the custodian of the client’s investment assets. For example, Ballast Advisors uses Charles Schwab as custodian for client investment assets. Are my CDs invested at specific banks and are they protected by FDIC insurance?

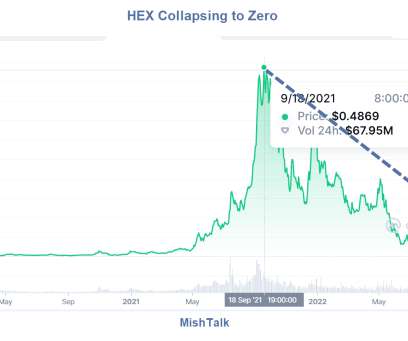

Mish Talk

NOVEMBER 28, 2022

HEX issues " Certificates of Deposit " that yield as much as 40 percent interest paid in HEX of course, not dollars. The APY for HEX Stakes of average length is around 40%, while traditional bank CDs average less than 2%. Abandon ship while you still can! " HEX Price History. HEX is down to 2.4 cents from a high of 48.7

Good Financial Cents

JANUARY 11, 2023

A career in a major bank can be both rewarding and well-paying, with top positions garnering income of hundreds of thousands or even millions of dollars annually. For example, investment bankers are near the top of the list, often working for large investment banks like Goldman Sachs or Morgan Stanley. About the Banking Industry.

International College of Financial Planning

APRIL 25, 2024

This certification is recognized globally and showcases a deep, systematic understanding of personal financial management, including investment planning, risk management, tax planning, and retirement planning. Individuals who earn this certification are thoroughly prepared to offer expert financial advice.

International College of Financial Planning

FEBRUARY 23, 2024

At the heart of this profession lies the financial planner certification, a credential that not only signifies expertise but also opens doors to significant career opportunities. This certification is recognized globally and is considered a benchmark for competence and professionalism in financial planning.

Financial Symmetry

APRIL 14, 2025

Custodial Bank Checking or Savings This is probably the simplest option to open and manage for your child. In fact, you can probably open it through your bank or credit unions mobile app instead of having to physically go to a branch, depending on the size of it.

Clever Girl Finance

AUGUST 15, 2022

Liquidity means you have a sufficient amount of accessible liquid assets that you can easily convert into cash. Liquid investments are assets that can easily be converted into cash in a short amount of time with little to no decrease in their value. The asset must maintain a large number of readily-available, interested buyers.

International College of Financial Planning

OCTOBER 26, 2023

While many financial advisors find their niche in investment firms, banks, and insurance sanctuaries, some trailblazers opt for independence, establishing their advisory havens. Investment Mastery: Financial advisors are adept at channelling their clients’ resources into various asset classes, ensuring growth and security.

WiserAdvisor

MAY 29, 2025

Time is another valuable asset in wealth building that allows you to benefit from the magic of compounding. Best 1,000-dollar investment instruments High-yield savings accounts or certificates of deposit (CDs) : High-yield savings accounts and CDs are excellent entry points for those who prioritize safety and stability.

Good Financial Cents

DECEMBER 9, 2022

1) Certificates of Deposit (CDs). For those of you who like to see the numbers, here’s an example of compound interest at work: Suppose you invest $1,000 in a five-year certificate of deposit, paying 5% and compounded annually. Banks Savings Accounts. 1) Certificates of Deposit (CDs). . What Is the “Rule of 72”?

The Big Picture

JANUARY 16, 2024

I like as a real estate person, you walk through your assets, you can touch and feel things. Essentially you buy assets. It could be all kinds of assets. And, and it was a way for individual investors to a own assets in a small slice, they could never access themselves. It just wasn’t doing it for me.

MarketWatch

MARCH 24, 2023

Schwab could borrow from the Federal Home Loan Bank, issue certificates of deposit, or collect interest paid on its bond portfolio, he said. The comments came as investors study reduced values of long-term holdings and other assets held by financial firms that may not be sufficient to cover a sharp drop in deposits.

MainStreet Financial Planning

MARCH 15, 2023

Many are worried about the security of their money following the collapse of Silicon Valley Bank (SVB) last week. Even though the federal government has rescued SVB and guaranteed all deposits over the FDIC insurance limit of $250,000 per account, that doesn’t mean they will be doing it again for other banks.

Clever Girl Finance

SEPTEMBER 11, 2023

Liquidity means you have a sufficient amount of accessible liquid assets that you can easily convert into cash. E.g., your liquid net worth, when you add all of your liquid assets together and subtract your liabilities. The asset must maintain a large number of readily-available, interested buyers.

International College of Financial Planning

DECEMBER 9, 2024

The financial planning industry has witnessed remarkable growth, making the Certified Financial Planner (CFP) certification increasingly valuable for professionals seeking to advance their careers. Why Choose CFP Certification? This accelerated program enables qualified candidates to obtain their certification within just 4 months.

Good Financial Cents

SEPTEMBER 29, 2022

That will give you an opportunity to invest in crypto on the same platform where you hold other assets. Crypto is considered to be an alternative asset that represents a diversification away from more traditional financial assets like stocks and bonds. Unlike most other assets, crypto is not backed by anything.

Good Financial Cents

DECEMBER 22, 2022

Certificates of Deposit . Certificates of Deposit. Note that Fundrise requires a 0.15% annual advisory fee and an annual asset management fee of up to 0.85%. Certificates of Deposit. Like certificates of deposit (CDs), these accounts are FDIC-insured in amounts up to $250,000 per deposit per account. Index Funds.

International College of Financial Planning

SEPTEMBER 7, 2024

The CFP® Fast Track course offers a quick, efficient pathway to certification, allowing you to accelerate your career in the financial planning industry. The CFP® Fast Track is designed for professionals with prior qualifications in the finance and banking sector. What Is the CFP® Fast Track Course?

International College of Financial Planning

DECEMBER 29, 2024

The CFP certification stands as the gold standard in financial planning, offering professionals a comprehensive pathway to excellence in this dynamic field. The CFP certification prepares professionals for these challenges through rigorous training and practical application.

Good Financial Cents

AUGUST 11, 2022

After all, the people in that case study actually had other assets in their favor. According to a Global Wealth Report from Credit Suisse, around 8% of American adults had enough assets to be considered millionaires at last count. Certificates of Deposit (CDs). Well, I wrote that case study too. Investing with a Plan.

International College of Financial Planning

OCTOBER 10, 2024

The CFP® Fast Track offers a time-efficient and cost-effective solution for becoming a Certified Financial Planner, especially for those in India where the cost and time associated with traditional certification methods can be daunting. Why is CFP® Certification Important for Financial Planners?

Good Financial Cents

JANUARY 23, 2023

Many investors were burned by ‘can’t miss’ tech stocks and could only watch as the value of digital assets, like cryptocurrencies and NFTs , evaporated in minutes and couldn’t sustain the promised high returns. Raisin works with over 400 banks in more than 30 countries worldwide. No Penalty CD.

Nationwide Financial

FEBRUARY 14, 2023

Members include Advisor Group , Capital Group/American Funds , Franklin Templeton , Huntington Bank , Miami Life , Morgan Stanley , M Financial Group , NFP , RBC Wealth Management , Swiss Re , and Nationwide.

Trade Brains

SEPTEMBER 11, 2023

Its 35 international product certifications help it to maintain trust with its distributors and customers. R R Kabel IPO Review – Financials If we look at the financials of R R Kabel IPO we find out that their assets have increased from ₹1,715.11 crores in March 2021 to ₹2,633.62 crores in March 2023. crores in March 2021 to ₹5,633.64

International College of Financial Planning

SEPTEMBER 23, 2024

This program offers a streamlined route to earning the prestigious Certified Financial Planner (CFP®) certification, especially for experienced professionals or those with advanced qualifications in finance. b) Increased Earning Potential Obtaining a CFP® certification significantly enhances your earning potential.

International College of Financial Planning

APRIL 20, 2022

This article will discuss the basics of financial planning , the education and certifications required to become a financial planner, and how to develop your financial planning skills and network. The next step is to analyze your current financial situation is looking at your income, expenses, assets, and liabilities.

Clever Girl Finance

JANUARY 22, 2023

We’ve broken down the numbers below based on data from the Federal Reserve about the mean financial asset balances by age group. These numbers reflect the total amount of liquid assets for savings based on age brackets. These financial assets include bank accounts and investment portfolios.

International College of Financial Planning

JULY 10, 2023

Credit Manager: Credit managers are professionals responsible for overseeing and supervising credit assets within an organization. Qualifying Certification Exams for Investment Advisors Individuals must clear the necessary qualifying exams to become certified investment advisors in India.

International College of Financial Planning

JUNE 14, 2023

Experience Personal investment advisors or non-individual investment advisors’ chief officers should have at least five years of experience in financial product guidance, securities, funds, assets, or portfolio management. For individual investment advisors, the net worth should be a minimum of INR 5 lakhs in tangible assets.

Validea

JUNE 9, 2023

Over the last 15 years, cash has fallen out of favor as it didn’t earn much and was a drag on portfolios while other assets soared. But now, cash is a valuable asset, not just as a defense but as an offense too, contends Jason Zweig in an article in The Wall Street Journal.

Validea

JUNE 9, 2023

Over the last 15 years, cash has fallen out of favor as it didn’t earn much and was a drag on portfolios while other assets soared. But now, cash is a valuable asset, not just as a defense but as an offense too, contends Jason Zweig in an article in The Wall Street Journal.

Trade Brains

SEPTEMBER 26, 2024

It offers various services across various asset classes, including equity, fixed-income, and derivative securities. The exchange operates an “anywhere, any asset” trading platform. The exchange also received the CII EXIM Bank Excellence Prize in 2014 and 2016. However, financial asset allocation increased recently.

Harness Wealth

APRIL 5, 2023

The Federal Deposit Insurance Corporation (FDIC), a US Government agency, insures bank deposits up to $250,000 per person , depositor, bank, and ownership category. In other words, if you have more than $250,000 in a single bank, and that bank were to fail , you would not be insured for any cash exceeding the insurance limit.

Good Financial Cents

FEBRUARY 15, 2023

Tweet “They have come a long way since inception and now allow you to invest in alternative assets like artwork and cryptocurrencies. But the company also provides banking services, including a checking account and high-interest savings, as well as credit cards, personal loans, and mortgages. per contract fee); $9.95

Clever Girl Finance

NOVEMBER 22, 2022

Restricting access to funds or assets. This could look like this: The abuser decides when the victim gets cash or more money deposited into their bank account. Demanding that all assets and accounts be in the abuser’s name only. Stealing or destroying the victim’s belongings or assets. Birth certificate.

Good Financial Cents

SEPTEMBER 2, 2022

While you can keep your emergency fund in any account you want, it’s smart to look for online banks that pay high rates on savings, money markets, and certificates of deposit (CDs). Some examples of banks that fit the bill include: CIT Bank Synchrony Bank BBVA (formerly BBVA Compass). 88 cents on your behalf.

Good Financial Cents

JULY 6, 2023

Having $100 in the bank might not seem like a lot, but it may be all you need to change your future for the better. The key to winning at this game is investing in assets that can provide a fairly steady return you can count on, and making sure your contributions are consistent and automatic.

Nationwide Financial

OCTOBER 18, 2022

For this type of plan, your client can choose from a range of investment options, such as mutual funds, ETF portfolios or principal protected bank products. Maximum contributions vary depending on the state, as well as asset-fee ratios, account maintenance fees, and if they offer more rare features like contribution matching.

Clever Girl Finance

NOVEMBER 21, 2023

Having money in the bank is a unique opportunity. And no matter how you have come to have $50,000 in your bank, you need to know how to use it. Boost your retirement savings Now that you have excess money in the bank, it may be a smart time to increase your retirement savings. What to do with $50k before you invest it!

Trade Brains

SEPTEMBER 16, 2023

Meaning Diversification of an investment portfolio refers to investing money into different asset classes like shares, bonds, mutual funds, etc. Hence the main purpose of diversification is always to earn maximum returns on investments by compensating the weakness of one asset class with the other. To know more, keep reading!

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content