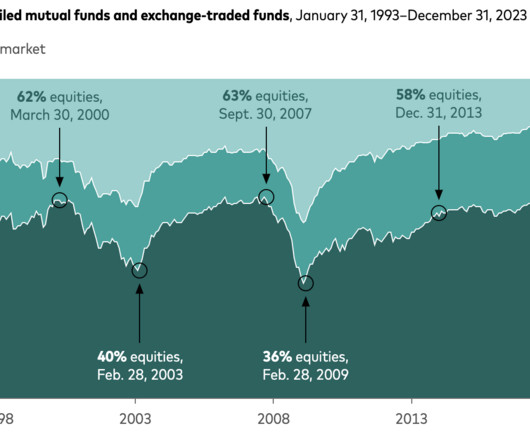

Importance of Sticking to Asset Allocation

Truemind Capital

JANUARY 22, 2024

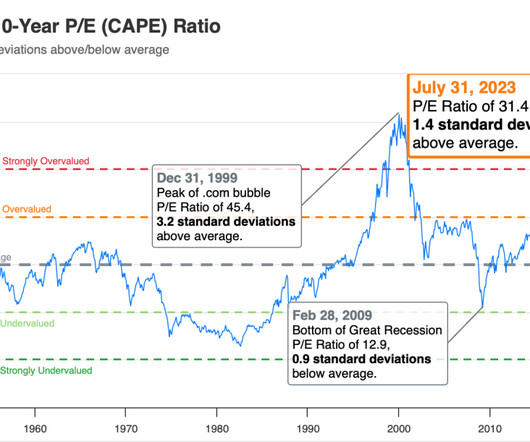

Not exactly for the Russia-Ukraine event, but for all the possible events that can puncture the bubble in various asset classes that were created on the back of unlimited and cheap liquidity. The runup in any asset class creates a delusion that the rally will be permanent. Well, we were at Truemind Capital.

Let's personalize your content