Asset Allocation: Caution Toward High Dividend Yielding Stocks

Brown Advisory

OCTOBER 28, 2016

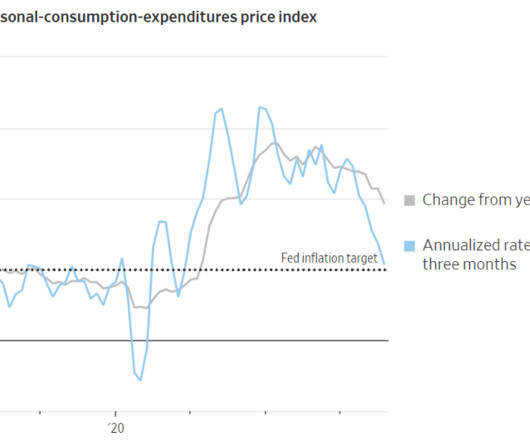

Asset Allocation: Caution Toward High Dividend Yielding Stocks achen Fri, 10/28/2016 - 11:25 Why Have High Dividend Yielding Sectors Done Well This Year? investment grade, fixed rate bond market securities, including government, government agency, corporate, asset-backed, and mortgage-backed securities between one and ten years.

Let's personalize your content