Financial Market Round-Up – Jan’24

Truemind Capital

JANUARY 16, 2024

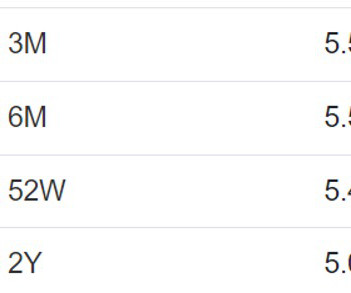

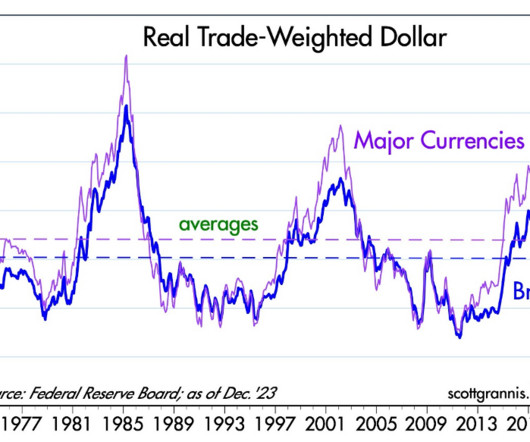

Global growth exceeded projections, primarily propelled by the resilient performance of the US economy. We maintain our underweight position to equity (check the 3rd page for asset allocation) due to an unfavorable risk-reward ratio. The debt yields have declined across the yield curve maturities in the developed economies.

Let's personalize your content