This Baby Bull Has Time to Grow

Investing Caffeine

JANUARY 2, 2024

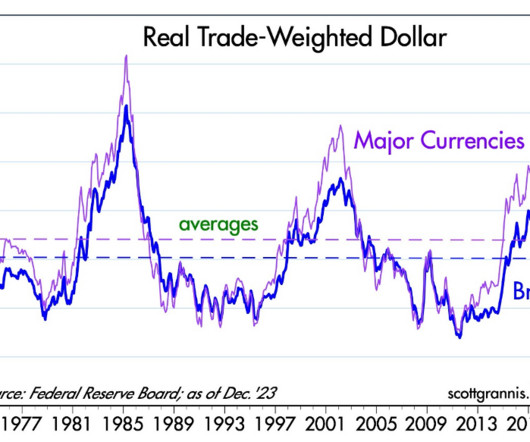

With China’s stagnating economy, it has helped our inflationary cause by exporting deflationary goods to our country. Source: Visual Capitalist Why So Bullish? What has investors so jazzed up in recent months? For starters, inflation has been on a steady decline for many months. a few months ago to 3.9% today (see chart below).

Let's personalize your content