Financial Market Round-Up – Jul’23

Truemind Capital

AUGUST 12, 2023

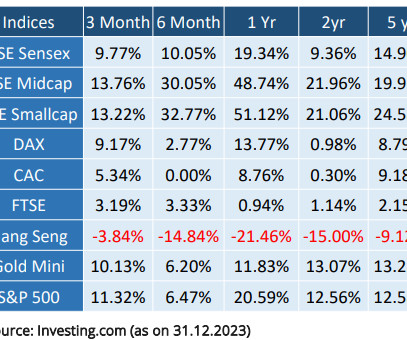

All the sectors went up with major sectoral growth seen in auto (up 22%), realty (up 33%), and consumer durables (up 13%) on the back of an improving economic outlook. The recent rally in the market has made the valuations more expensive compared to historical standards. Valuations across all sectors do not offer any margin of safety.

Let's personalize your content