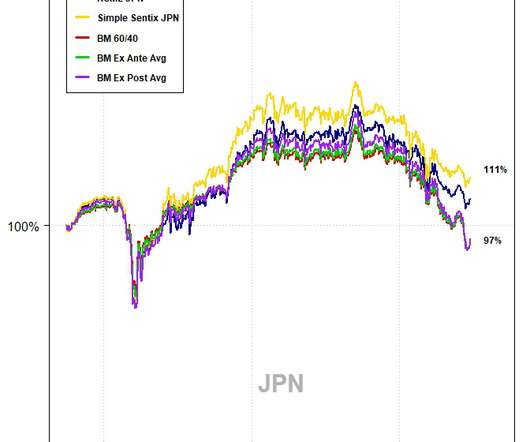

Relative Sentiment and Machine Learning for Tactical Asset Allocation: Out-of-Sample Results

Alpha Architect

JULY 19, 2022

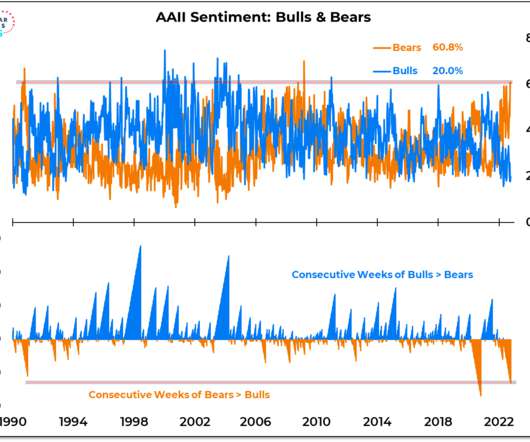

We examine Sentix sentiment indices for use in tactical asset allocation. Europe, Japan, and Asia ex-Japan by taking the difference in 6-month economic expectations between each region's institutional and individual investors. In particular, we construct monthly relative sentiment factors for the U.S.,

Let's personalize your content