Financial Market Round-Up – Jan’24

Truemind Capital

JANUARY 16, 2024

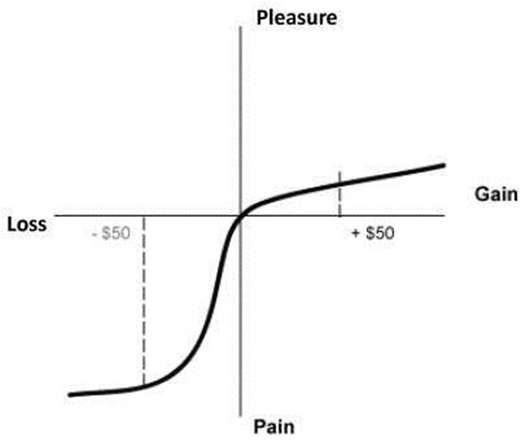

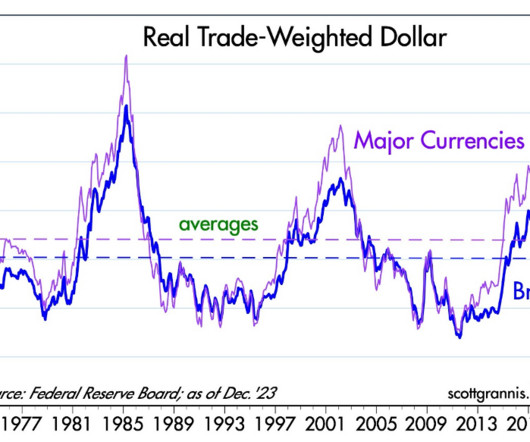

Contrary to the expectation of an economic slowdown in 2023, the year turned out to be full of surprises, mostly positive ones. We maintain our underweight position to equity (check the 3rd page for asset allocation) due to an unfavorable risk-reward ratio.

Let's personalize your content