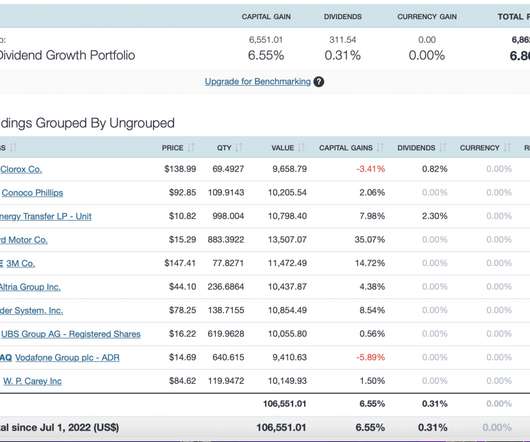

Top 10 Dividend Growth Portfolio

Dear Mr. Market

AUGUST 5, 2022

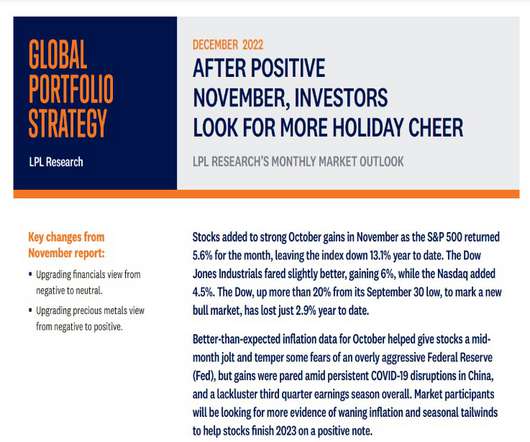

Inflation is currently at 40 year highs with increasing signs of slowing economic growth. While everyone is bantering about the official definitions of what a recession is, we’re very likely to see a period of stagflation. The Top 10 Dividend Growth Portfolio strategy is a concentrated portfolio.

Let's personalize your content