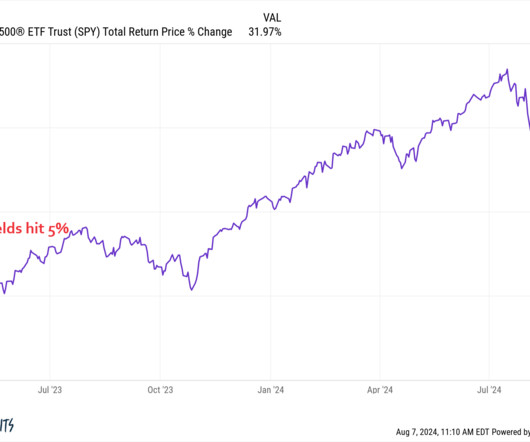

The Opportunity Cost of Market Timing in T-Bills

A Wealth of Common Sense

AUGUST 8, 2024

Roth IRA himself, Bill Sweet, joined me again to discuss questions about credit unions vs. banks, how the wash sale rule works, student loan forgiveness vs. tax filing status, tax implications from the sale of a rental property and index funds vs. financial advisors.

Let's personalize your content