Financial Market Round-Up – Apr’24

Truemind Capital

APRIL 19, 2024

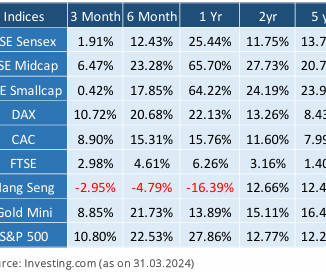

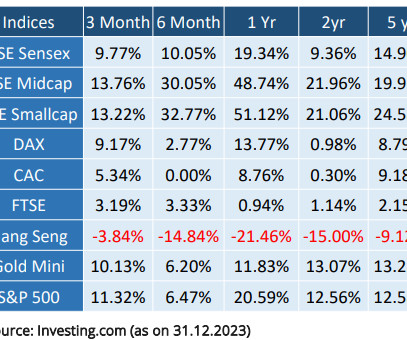

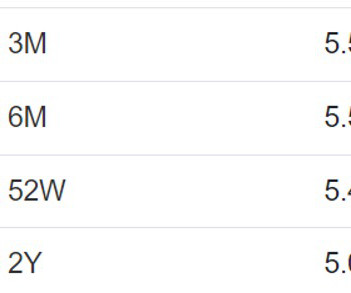

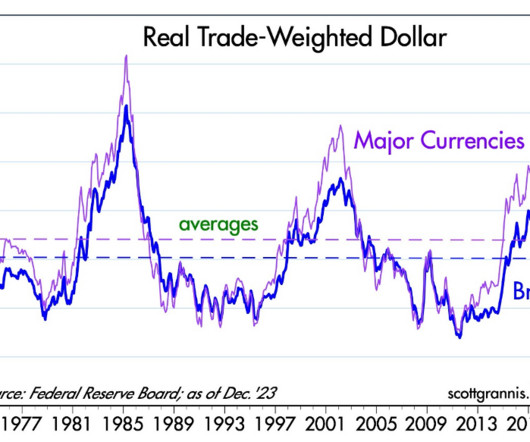

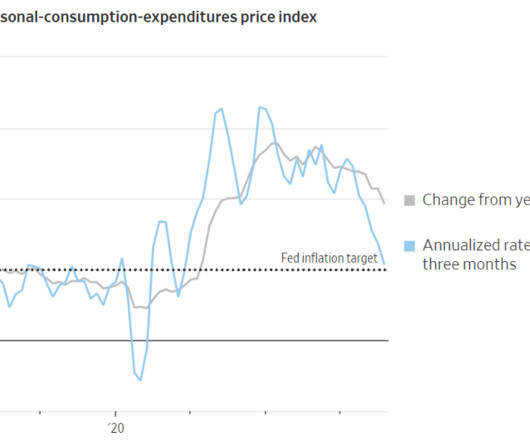

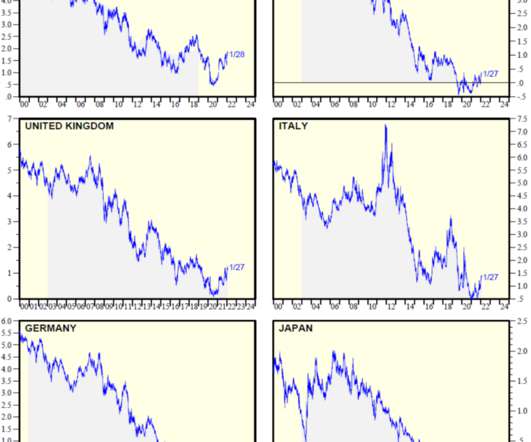

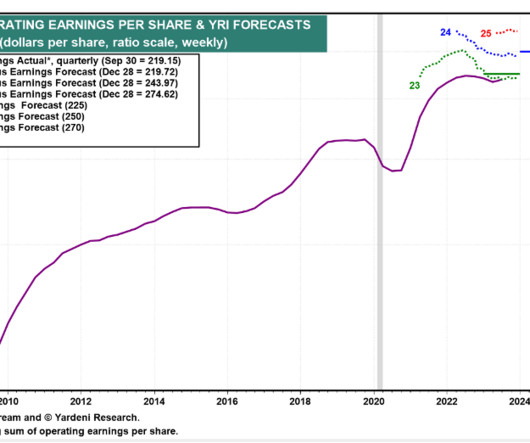

RBI also goes in tandem with the other central banks regarding rate cuts to maintain stability in the exchange rate and avoid the risk of loosening too early. Consequently, the portfolio allocation should reflect these probabilities depending on the risk profiles. Other Asset Classes: Gold sparkled in the last quarter, going up by 9%.

Let's personalize your content