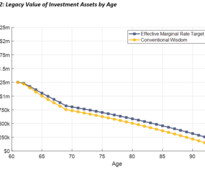

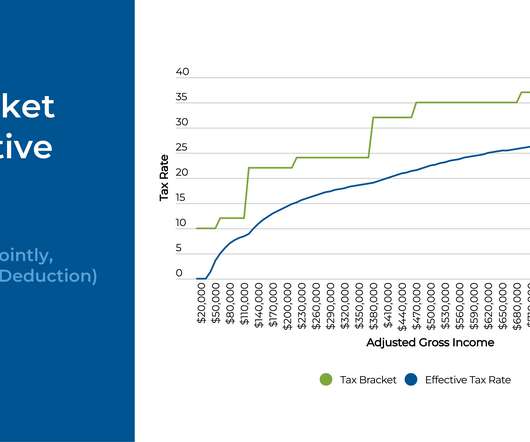

Managing Taxes in Retirement using the Effective Marginal Tax Rate

Advisor Perspectives

NOVEMBER 13, 2023

Research on tax-efficient retirement distribution strategies aims to sequence withdrawals from taxable, tax-deferred, and tax-exempt accounts to maximize after-tax spending.

Let's personalize your content