Orion Acquires Summit Wealth Systems To Become Its Next-Generation All-In-One Portal (And More Of The Latest In Financial #AdvisorTech – January 2025)

Nerd's Eye View

JANUARY 6, 2025

FINNY AI, an AI-powered prospecting tool, has raised $4.2

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JANUARY 6, 2025

FINNY AI, an AI-powered prospecting tool, has raised $4.2

Darrow Wealth Management

FEBRUARY 9, 2025

If you’re not working with a financial advisor , seriously consider your appetite for ongoing portfolio management, fund analysis, rebalancing, etc. Hypothetical simulation uses current yields and assumes 60% of the account is invested in SPY and 40% AGG. No other cash flows in the account.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Wealth Management

JULY 2, 2025

From Point Solutions to Seamless Intelligence For decades, our industry has relied on integrations—APIs painstakingly connected across custodians, CRMs, planning tools and portfolio management systems. But those connections are brittle, proprietary and sometimes dependent on manual intervention. It’s about trust, time and scale.

WiserAdvisor

JUNE 16, 2025

Privacy protection through offshore accounts: Many high-net-worth individuals maintain offshore accounts in other countries. These accounts typically offer stronger privacy protections as well as favorable tax regimes that can enhance your wealth preservation strategy. Use Separately Managed Accounts (SMAs).

Harness Wealth

JANUARY 29, 2025

It should be noted, however, that tax-loss harvesting is only applicable to taxable accounts and doesnt apply to tax-advantaged accounts like IRAs or 401(k)s. Does tax-loss harvesting apply to retirement accounts? It is only relevant for taxable investment accounts where capital gains taxes are incurred.

Steve Sanduski

DECEMBER 11, 2024

By bringing in [Advisor Name] and having [him/her] work closely with me on your account, we’re diversifying the expertise and perspective you benefit from. It’s a way to manage risk and ensure continuity in your financial care. He/She] has been involved in the management of your investments alongside me.

WiserAdvisor

JULY 9, 2025

There are so many products out there – 401(k)s, mutual funds, Individual Retirement Accounts (IRAs), Exchange-Traded Funds (ETFs), bonds, Real Estate Investment Trusts (REITs), etc. You can also use a robo-advisor for basic portfolio management at relatively low fees. Understanding all of this can be overwhelming.

The Big Picture

MAY 20, 2025

I’m assuming you’re running other stuff as a either separately managed accounts or a separate what have you. First of all, my, some of my co-portfolio managers will bristle if you refer to us as a factor based firm. 00:29:23 [Speaker Changed] And the firm’s culture also emphasizes accountability.

Trade Brains

JULY 3, 2025

The shares of Motilal Oswal Financial Services Ltd have seen bullish movement after its subsidiary achieved a significant milestone, as its Assets Under Management (AUM) crossed Rs 1.5 Its team includes 2,500+ Relationship Managers and 100+ research professionals. lakh crore in assets under advice, it manages 7.8

Carson Wealth

DECEMBER 23, 2024

For one thing, PCE inflation is elevated right now because of lagging shelter data and financial services (thanks to portfolio management services inflation driven by higher stock prices). Its baffling that Fed members are accounting for this already. (We This is quite confounding.

The Big Picture

JANUARY 21, 2025

You just needed a brokerage account. But today, you know, a lot of brokers, you know, whether they’re with the big full service brokerage firms now have advisory accounts that they flog to clients where they can buy ETFs. 01:04:39 [Speaker Changed] I think it was the Journal of Portfolio Management.

Trade Brains

JULY 25, 2025

Additionally, management noted that the decline in consolidated PAT was partially due to forex translation losses stemming from the depreciation of the US dollar against SGD and GBP on a QoQ basis. Gains from GBP appreciation were captured in reserves as per accounting standards, not in reported earnings. lakh crore, registering a 13.28

Carson Wealth

APRIL 4, 2025

My colleague, Associate Portfolio Manager, Blake Anderson, who manages equity portfolios and focuses especially on the technology sector, says that Apple runs about 97% gross margins on its products, and 85-90% of production costs are Asia based. We just dont know how large and for how long. It exactly balances out.

The Big Picture

APRIL 8, 2025

So now we’re everywhere and we’re serving every type of wealth client internationally, domestic self-directed through a brokerage account all the way through complete discretionary. Can we give every single one of your employees a account or advice, you know, to their first, you know, purchase in a 5 29 account?

The Big Picture

APRIL 29, 2025

And, and I saw that the, what were in those days, the big eight accounting firms were coming up to hire and they had this program where they would hire liberal arts graduates, have them work, and as part of the arrangement would pay for you to go to grad school. So our analysts and our firm are as important as our portfolio managers.

The Big Picture

FEBRUARY 14, 2025

But it needs to improve tech and service as it pushes into wealth management and cash accounts.( ESPN ) Be sure to check out our Masters in Business interview this weekend with Christine Phillpotts , Portfolio Manager at Ariel Investments. She manages Ariels Emerging Markets Value strategies.

The Big Picture

MAY 13, 2025

What we’ve been talking about is really that direct relationship when a, a client, you know, opens a, a mutual fund account directly with Vanguard. I mean, I would acknowledge that the RIA channel for sure is, it’s a totally different division at Vanguard, but it is absolutely critical to our success and growth over time.

The Big Picture

MARCH 25, 2025

As you note, when we spun out, we kept all of our Bear Stearns accounts, continued to work with all their private client service people over there. It was, we wanted to have the absolute best software for the way we managed money. And so we put on a pretty significant developer team that had background in portfolio management.

Carson Wealth

APRIL 14, 2025

In reality, the federal government always has a lot of debt to refinance because it issues a lot of short-term debt (which all of us happily purchase, including in money market accounts). A Dash for Cash Instead, the rise in rates is likely due to portfolio managers at hedge funds liquidating positions.

The Big Picture

FEBRUARY 17, 2025

million American women have created an OnlyFans account, equivalent to 2% of all American women aged 18-45. Washington Post ) How Lorne Michaels manages creative people after 50 years of Saturday Night Live Susan Morrison, author of a new biography on Michaels, reveals management lessons from the SNL creator.(

The Big Picture

FEBRUARY 17, 2025

And ultimately we’re looking for the 60 stocks that we think have the best upside potential take into account liquidity and other parameters of risk. And ultimately we’re looking to build a 60 stock portfolio across 20 plus different markets so we don’t have to be in all countries. So that’s a big pool Yeah.

The Big Picture

MAY 6, 2025

So at the time, well, I left the floor beginning of 95 and started deploying just the money I’d earned on the floor in off floor trading account. And as I was having other people manage basically my trading account, I realized I had to scale my risk profile that I developed on the floor over multiple risk takers.

Abnormal Returns

DECEMBER 6, 2022

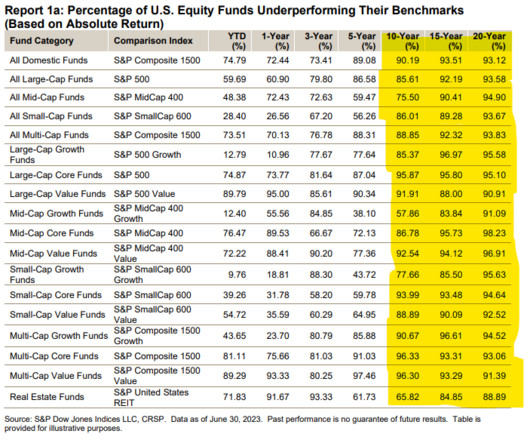

Retirement Automatic retirement account enrollment helps to boost participation. papers.ssrn.com) Research A lot of anomalies disappear once you account for the costs of short sales. papers.ssrn.com) How bad weather affects portfolio manager activity. nber.org) Financial regrets in old age. papers.ssrn.com).

A Wealth of Common Sense

FEBRUARY 16, 2024

Early on in my savings journey I prioritized tax-deferred retirement accounts over all else. I like the ease and simplicity of 401k contributions coming out of my paycheck before it ever even touches my checking account. It’s easy to automate. Plus, I like the fact that it’s difficult to get the money out of these ac.

Abnormal Returns

DECEMBER 12, 2023

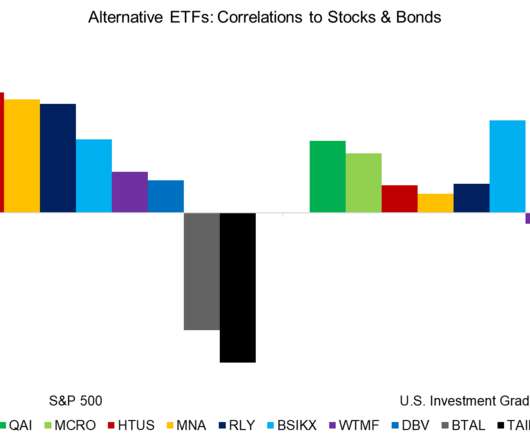

riabiz.com) Fund management Diseconomies of scale in fund management are real. alphaarchitect.com) Why portfolio managers shift styles. papers.ssrn.com) When do you need to take into account 'key person' risk? (insights.finominal.com) The factor ETF space has gotten crowded. aswathdamodaran.blogspot.com)

Nerd's Eye View

SEPTEMBER 27, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a recent study by Cerulli has shown a sharp increase in the number of affluent investors willing to pay for advice, which on the one hand reflects the increasing financial complexity in peoples' lives (while they've also gotten (..)

Abnormal Returns

AUGUST 3, 2023

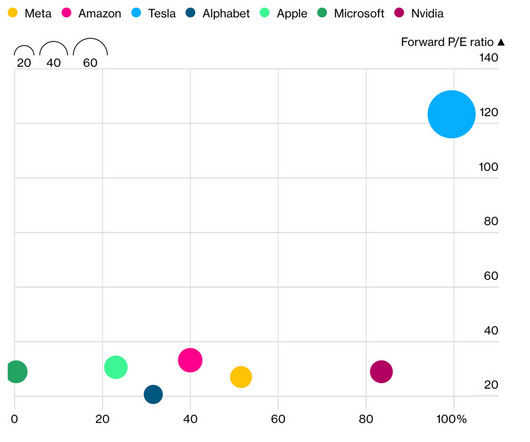

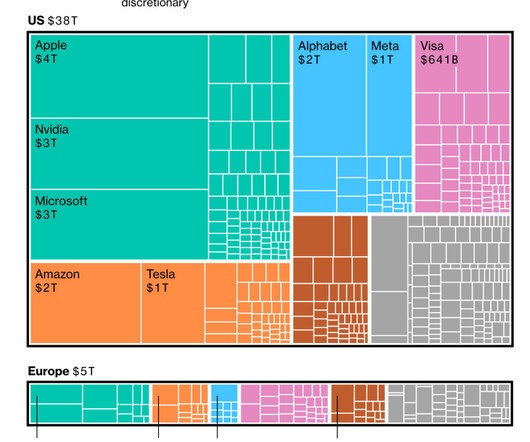

etf.com) Portfolio managers won't outperform if they get it wrong about the biggest seven stocks. wggtb.substack.com) Finance The Apple ($AAPL) Card savings account now has more than $10 billion in assets. (rcmalternatives.com) The Big Seven It's not surprising that a handful of stocks are driving the market.

The Big Picture

APRIL 8, 2023

He “ always wonders about these accounting firms that reappraise price but not value; they reappraise price because they lack the tools to re-appraise value.” Damdoran loves “untangling the puzzles of corporate finance and valuation.” A list of his books is here ; A transcript of our conversation is available here Tuesday.

Nerd's Eye View

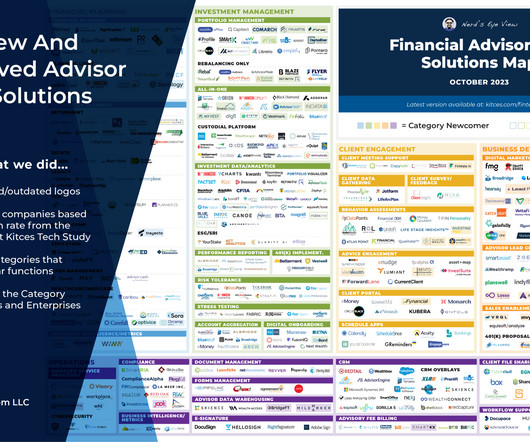

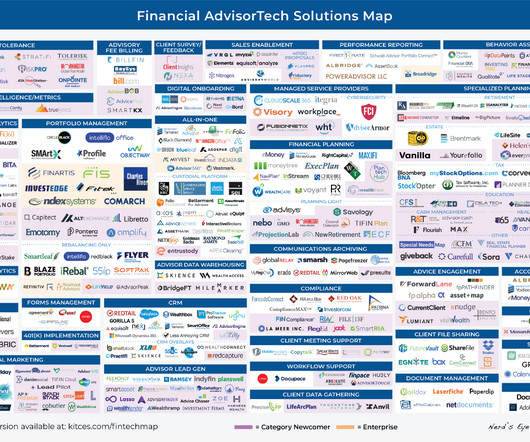

OCTOBER 2, 2023

Welcome to the October 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

The Big Picture

JULY 14, 2023

By his own account, he’s in great shape, owing to a fondness for mixed martial arts and a propensity for doing calisthenics while wearing a camo-print weighted vest. Wagner began his career doing hedge fund accounting at Ernst & Young. million or about $100 million, depending on whom you ask—is nowhere to be found.

The Big Picture

JULY 13, 2023

New York Times ) Be sure to check out our Masters in Business next week with Tom Wagner, Co-Portfolio Manager at Knighthead Capital. Wagner began his career doing hedge fund accounting at Ernst & Young. .” ( CBS News ) • Making Them Laugh, and Swoon : A year ago, Matt Rife was just another struggling road comedian.

The Big Picture

APRIL 6, 2023

We do not think, “Hey, it’s time to increase our position in Sony by 23.9% ,” but rather, that reflects capital being put to work by either new clients or existing clients adding to their accounts. Active portfolio management strategy? ” First, I am unfamiliar with the company, which at barely $2B is hardly a giant.

Nerd's Eye View

JULY 3, 2023

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including: All-in-one software platform Blueleaf has launched a new “aggregation-as-a-service” solution, promising better client data aggregation capabilities than existing solutions by automating the process of weaving multiple (..)

A Wealth of Common Sense

APRIL 17, 2023

Today’s Talk Your Book is brought to you by Madison Investments: See here to learn more about investing in Madison Investments strategies and managed account solutions and here for Haruki’s year-end letter to investors.

The Big Picture

FEBRUARY 16, 2024

He was executive vice president of the Markets Group at the New York Fed, where he also managed the System Open Market Account. Previously, he was chief US economist at Goldman Sachs (the firm’s first) as well as a partner and managing director.

A Wealth of Common Sense

NOVEMBER 28, 2022

Today’s Talk Your Book is brought to you by Madison Investments: See here to learn more about investing in Madison Investments strategies and managed account solutions and here for disclosure information On today’s show, we are joined by Ray Di Bernardo, VP and Portfolio Manager of Madison Investments to discuss covered call strategies in today’s (..)

Abnormal Returns

MAY 22, 2023

advisorperspectives.com) Direct indexing involves two parts: index construction and portfolio management. investmentnews.com) Why auto-portability of 401(k) accounts will help. wealthmanagement.com) Going solo Three questions to ask before launching a new advisory practice. financial-planning.com)

The Big Picture

JULY 8, 2023

Be sure to check out our Masters in Business next week with Tom Wagner, Co-Portfolio Manager at Knighthead Capital. Wagner began his career doing hedge fund accounting at Ernst & Young. All of our earlier podcasts on your favorite pod hosts can be found here.

XY Planning Network

OCTOBER 10, 2022

When it comes to being a financial advisor and running your practice, you must wear multiple hats – finance, business development, portfolio management, client relations, marketing, accounting – the list goes on and on. Marketing is just one piece of the puzzle, but it’s an important one.

Brown Advisory

SEPTEMBER 20, 2017

Conversation with the Portfolio Manager: Mid-Cap Growth Strategy achen Wed, 09/20/2017 - 16:43 Over time, the Brown Advisory small-cap growth team, led by Christopher Berrier and George Sakellaris, watched numerous successful investments compound and grow out of their investible universe. Universe performance rankings from eVestment.

Brown Advisory

SEPTEMBER 20, 2017

Conversation with the Portfolio Manager: Mid-Cap Growth Strategy. While both mid-cap portfolio managers believe their experience gives them an advantage, other factors set them apart as well. Wed, 09/20/2017 - 16:43. Universe performance rankings from eVestment.

The Irrelevant Investor

APRIL 16, 2023

Today’s Talk Your Book is brought to you by Madison Investments: See here to learn more about investing in Madison Investments strategies and managed account solutions and here for Haruki’s year-end letter to investors.

Good Financial Cents

FEBRUARY 15, 2023

Investment management companies – firms that provide individual portfolio management and may work with other investment companies. Robo-advisors, in particular, have democratized investment management. Schwab can also accommodate nearly any type of account, including an extensive list of retirement accounts.

The Irrelevant Investor

NOVEMBER 27, 2022

Today’s Talk Your Book is brought to you by Madison Investments: See here to learn more about investing in Madison Investments strategies and managed account solutions and here for disclosure information On today’s show, we are joined by Ray Di Bernardo, VP and Portfolio Manager of Madison Investments to discuss covered call strategies in today’s (..)

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content